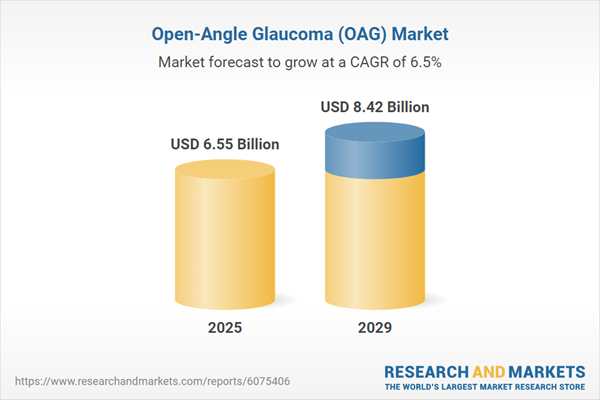

The open-angle glaucoma (OAG) market size has grown strongly in recent years. It will grow from $6.13 billion in 2024 to $6.55 billion in 2025 at a compound annual growth rate (CAGR) of 6.8%. The growth during the historic period can be attributed to factors such as the rising prevalence of glaucoma in aging populations, increasing awareness about the early detection of eye diseases, higher healthcare expenditure, government initiatives supporting vision care programs, and the global expansion of ophthalmology practices.

The open-angle glaucoma (OAG) market size is expected to see strong growth in the next few years. It will grow to $8.42 billion in 2029 at a compound annual growth rate (CAGR) of 6.5%. The growth during the forecast period can be attributed to factors such as the increasing demand for combination therapies, a growing emphasis on personalized medicine, improved reimbursement policies for glaucoma treatments, a rise in lifestyle-induced ocular conditions, and a growing preference for non-invasive diagnostic methods. Key trends expected to shape the forecast period include the growing adoption of AI in glaucoma diagnostics, a shift toward outpatient surgical procedures for glaucoma, an increased use of sustained-release glaucoma implants, greater integration of wearable technology for monitoring intraocular pressure, and a heightened focus on sustainability in the manufacturing of medical devices.

The increasing awareness of eye diseases is expected to drive the growth of the open-angle glaucoma (OAG) market in the future. Eye illnesses refer to conditions that affect the eyes' structure, function, or vision, ranging from minor issues such as dry eye to more severe conditions such as glaucoma and macular degeneration. The rising prevalence of these conditions is influenced by factors such as aging populations, extended screen time, higher rates of diabetes, environmental pollution, and lifestyle choices that negatively affect eye health. Open-angle glaucoma (OAG), which is a leading cause of blindness, particularly in older adults, highlights the importance of regular eye exams, early detection, and timely treatment to prevent irreversible vision loss. For example, in October 2023, the Royal National Institute of Blind People (RNIB), a UK-based charity for sight loss, reported that eye care outpatient appointments in the UK surpassed eight million in 2021/22, making it the most requested medical specialty. Furthermore, the number of people experiencing sight loss, which currently exceeds two million, is expected to double to over four million by 2050. As a result, the rising awareness of eye illnesses is fueling the growth of the open-angle glaucoma (OAG) market.

Leading companies in the open-angle glaucoma (OAG) market are focusing on the development of innovative solutions, such as minimally invasive glaucoma devices (MIGDs), to offer advanced, less invasive options for managing primary open-angle glaucoma while reducing dependence on traditional treatments. A minimally invasive glaucoma device (MIGD) includes various surgical implants and techniques aimed at lowering intraocular pressure in glaucoma patients through small incisions and minimal disturbance to ocular tissues. For example, in December 2023, iSTAR Medical, a medtech company based in Belgium, introduced MINIject in the Netherlands. This bio-integrating treatment for primary open-angle glaucoma uses a unique porous STAR material to improve fluid outflow and lower intraocular pressure. By reducing the need for traditional therapies, MINIject marks a significant advancement in glaucoma treatment, providing a safer and more effective management option for this major cause of irreversible blindness.

In July 2024, Alcon Inc., an ophthalmology company based in Switzerland, acquired BELKIN Vision Ltd. for $81 million. This acquisition is intended to strengthen Alcon's glaucoma portfolio by incorporating the direct selective laser trabeculoplasty (DSLT) device, an advanced first-line laser treatment for managing open-angle glaucoma. The acquisition supports Alcon’s strategy to expand global access to innovative and minimally invasive glaucoma treatments. BELKIN Vision Ltd., based in Israel, is a medical device company that specializes in providing devices for the treatment of open-angle glaucoma.

Major players in the open-angle glaucoma (OAG) market are Pfizer Inc., Merck & Co. Inc., AbbVie Inc, Novartis AG, Amgen Inc., Teva Pharmaceutical Industries Ltd., Boston Scientific, Alcon Inc., Bausch Health Companies Inc., Hoya Corporation, Sun Pharmaceutical Industries Ltd., Santen Pharmaceuticals, Mallinckrodt Pharmaceuticals, Théa Pharma, Glaukos Corporation, Quantel Medical, EyePoint Pharmaceuticals Inc., iSTAR Medical, Nicox Ophthalmics, Visus Therapeutics, Peregrine Eye Laser and Institute, and Inotek Pharmaceuticals.

North America was the largest region in the open-angle glaucoma (OAG) market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in open-angle glaucoma (OAG) report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the open-angle glaucoma (OAG) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Open-angle glaucoma (OAG) is a chronic and progressive eye condition in which the drainage canals in the eye gradually become blocked, causing an increase in intraocular pressure that damages the optic nerve. This damage typically occurs without noticeable symptoms until significant vision loss has occurred. Treatment focuses on lowering intraocular pressure to prevent further optic nerve damage and preserve vision through medications, laser therapies, or surgical procedures.

The main types of open-angle glaucoma (OAG) include open-angle glaucoma, angle-closure glaucoma, and other variants. Open-angle glaucoma is characterized by increased intraocular pressure, which leads to slow optic nerve damage and potential vision loss, often without early warning signs. The medications used to treat this condition include prostaglandin analogs, beta blockers, adrenergic agonists, carbonic anhydrase inhibitors, and others. The primary end users of these treatments include hospitals, homecare settings, specialty clinics, and more. These treatments are distributed through various channels such as hospital pharmacies, online pharmacies, and retail pharmacies.

The open-angle glaucoma (OAG) market research report is one of a series of new reports that provides open-angle glaucoma (OAG) market statistics, including open-angle glaucoma (OAG) industry global market size, regional shares, competitors with open-angle glaucoma (OAG) market share, detailed open-angle glaucoma (OAG) market segments, market trends and opportunities, and any further data you may need to thrive in the open-angle glaucoma (OAG) industry. This open-angle glaucoma (OAG) market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The open-angle glaucoma (OAG) market consists of revenues earned by entities by providing services such as optometric services, surgical interventions, medication management, and patient education and support services. The market value includes the value of related goods sold by the service provider or included within the service offering. The open-angle glaucoma (OAG) market also includes sales of tonometers, visual field analyzers, and lubricating eye drops. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values and are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Open-Angle Glaucoma (OAG) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on open-angle glaucoma (oag) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for open-angle glaucoma (oag)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The open-angle glaucoma (oag) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Disease Type: Open Angle Glaucoma; Angle Closure Glaucoma; Other Disease Type2) by Drug Class: Prostaglandin Analog; Beta Blockers; Adrenergic Agonist; Carbonic Anhydrase Inhibitors; Others Drug Class

3) by End User: Hospitals; Homecare; Specialty Clinics; Other End Users

4) by Distribution Channel: Hospital Pharmacy; Online Pharmacy; Retail Pharmacy

Subsegments:

1) by Open Angle Glaucoma (OAG): Primary Open-Angle Glaucoma (POAG); Secondary Open-Angle Glaucoma2) by Angle Closure Glaucoma: Acute Angle-Closure Glaucoma; Chronic Angle-Closure Glaucoma

3) by Other Disease Type: Normal-Tension Glaucoma; Congenital Glaucoma; Secondary Glaucoma

Key Companies Profiled: Pfizer Inc.; Merck & Co. Inc.; AbbVie Inc; Novartis AG; Amgen Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Open-Angle Glaucoma (OAG) market report include:- Pfizer Inc.

- Merck & Co. Inc.

- AbbVie Inc

- Novartis AG

- Amgen Inc.

- Teva Pharmaceutical Industries Ltd.

- Boston Scientific

- Alcon Inc.

- Bausch Health Companies Inc.

- Hoya Corporation

- Sun Pharmaceutical Industries Ltd.

- Santen Pharmaceuticals

- Mallinckrodt Pharmaceuticals

- Théa Pharma

- Glaukos Corporation

- Quantel Medical

- EyePoint Pharmaceuticals Inc.

- iSTAR Medical

- Nicox Ophthalmics

- Visus Therapeutics

- Peregrine Eye Laser and Institute

- Inotek Pharmaceuticals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.55 Billion |

| Forecasted Market Value ( USD | $ 8.42 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |