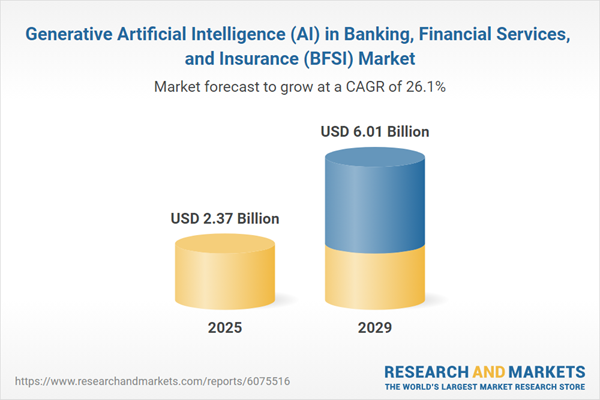

The generative artificial intelligence (AI) in banking, financial services, and insurance (bfsi) market size has grown exponentially in recent years. It will grow from $1.88 billion in 2024 to $2.37 billion in 2025 at a compound annual growth rate (CAGR) of 26.3%. The growth in the historic period can be attributed to increasing utilization of generative artificial intelligence (AI) in fraud detection, rise in personalized customer experiences, increasing focus on adoption of chatbots and virtual assistants in banks, regulatory compliance, and risk management, and operational efficiency and cost reduction.

The generative artificial intelligence (AI) in banking, financial services, and insurance (bfsi) market size is expected to see exponential growth in the next few years. It will grow to $6.01 billion in 2029 at a compound annual growth rate (CAGR) of 26.1%. The growth in the forecast period can be attributed to growing demand for enhanced customer service, generative models to provide personalized customer interactions, artificial intelligence (AI) being used to design personalized financial products, growing need for real-time fraud detection in the banking sector, and rising investments in artificial intelligence (AI). Major trends in the forecast period include advanced artificial intelligence techniques, developing new products, integrating machine learning, blockchain technologies, and predictive analysis.

The increase in financial fraud is expected to drive the growth of generative artificial intelligence (AI) in the banking, financial services, and insurance (BFSI) market in the future. Financial fraud involves intentional deception or misrepresentation to unlawfully obtain money, assets, or other financial benefits. This rise in fraud is attributed to the surge in digital transactions, sophisticated cybercrime techniques, the increasing complexity of the financial system, and insufficient security measures. AI plays a critical role in improving financial fraud management within the BFSI sector by offering advanced tools and techniques to detect, prevent, and mitigate fraudulent activities. For example, in May 2023, UK Finance reported that authorized fraud losses in the UK totaled £485.2 million ($616 million) in 2022, with 207,372 cases, marking a 6% increase from 2021. Thus, the growth of financial fraud is a key driver for the expansion of generative AI in the BFSI market.

Leading companies in the generative artificial intelligence (AI) sector for banking, financial services, and insurance (BFSI) are concentrating on technological innovations such as GenAI-powered virtual relationship managers (VRMs) to enhance customer experience and optimize banking operations. These advanced digital assistants utilize generative AI technology to interact with customers and manage relationships, handling tasks such as account management, financial advice, transaction support, and customer service to boost efficiency and improve the customer experience. For example, in July 2024, the Bank of Baroda (BoB), a banking institution based in India, introduced its Generative AI-powered Virtual Relationship Managers (VRMs). These VRMs offer real-time information about BoB's products and services and assist with everyday banking needs such as account statements, checkbook requests, and debit card requests. The multilingual VRM is available through video, audio, and chat interfaces.

In July 2024, Nubank, a neobank based in Brazil, acquired Hyperplane for an undisclosed sum. This acquisition is intended to enhance the personalization of financial products and improve decision-making in areas such as risk assessment and marketing. Hyperplane, a US-based data intelligence company, provides advancements in banking and financial services through its cutting-edge generative AI technologies.

Major companies operating in the generative artificial intelligence (AI) in banking, financial services, and insurance (BFSI) market are Amazon Web Services Inc., Alphabet Inc., Microsoft Corporation, Accenture PLC, IBM Corporation, The Allstate Corporation, Salesforce Inc., NVIDIA Corporation, Intuit Inc., SAS Institute Inc., DeepMind Technologies Limited, DataRobot Inc., C3.ai Inc., AlphaSense Inc., Marqeta Inc., Upstart Holdings Inc., Hugging Face Inc., Kensho Technologies Inc., ZestFinance Inc., TrueLayer Limited, Numerai Inc.

North America was the largest region in the generative artificial intelligence (AI) in banking, financial services, and insurance (BFSI) market in 2024. Asia-Pacific is expected to be the fastest growing region in the market going forward. The regions covered in the generative artificial intelligence (AI) in banking, financial services, and insurance (BFSI) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the generative artificial intelligence (AI) in banking, financial services, and insurance (BFSI) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Generative artificial intelligence (AI) in the banking, financial services, and insurance (BFSI) sector involves utilizing advanced AI models that create new content such as text, images, audio, or synthetic data rather than solely analyzing or recognizing patterns in existing data. This type of AI employs techniques such as deep learning and natural language processing (NLP) to generate realistic and valuable outputs, which can improve various functions within the BFSI industry.

The primary deployment methods for generative AI in the BFSI sector include on-premise and cloud-based solutions. On-premise deployment involves installing and running software or systems on the organization's own servers and infrastructure at their physical location. These AI systems are applied in areas such as fraud detection, risk assessment, customer experience enhancement, and algorithmic trading. They are utilized by various end-users, including banks, insurance companies, and financial service providers.

The generative AI in banking, finance, and insurance (BFSI) market research report is one of a series of new reports that provides generative AI in banking, finance, and insurance (BFSI) market statistics, including generative AI in banking, finance, and insurance (BFSI) industry global market size, regional shares, competitors with a generative AI in banking, finance, and insurance (BFSI) market share, detailed generative AI in banking, finance, and insurance (BFSI) market segments, market trends, and opportunities, and any further data you may need to thrive in the generative AI in banking, finance, and insurance (BFSI) industry. This generative AI in banking, finance, and insurance (BFSI) research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The generative artificial intelligence (AI) in banking, financial services, and insurance (BFSI) market consists of revenue earned by entities by providing fraud detection and prevention, predictive analysis, and anomaly detection services and risk management tools, chatbots, and virtual assistant tools. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Generative Artificial Intelligence (AI) in Banking, Financial Services, and Insurance (BFSI) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on generative artificial intelligence (ai) in banking, financial services, and insurance (bfsi) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for generative artificial intelligence (ai) in banking, financial services, and insurance (bfsi)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The generative artificial intelligence (ai) in banking, financial services, and insurance (bfsi) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Deployment Mode: on-Premise; Cloud-Based2) by Application: Fraud Detection; Risk Assessment; Customer Experience; Algorithmic Trading; Other Applications

3) by End-User: Banks; Insurance Companies; Financial Service Providers

Subsegments:

1) by on-Premise: Small and Medium Enterprises (SMEs); Large Enterprises2) by Cloud-Based: Public Cloud; Private Cloud; Hybrid Cloud

Key Companies Profiled: Amazon Web Services Inc.; Alphabet Inc.; Microsoft Corporation; Accenture PLC; IBM Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Generative Artificial Intelligence (AI) in Banking, Financial Services, and Insurance (BFSI) market report include:- Amazon Web Services Inc.

- Alphabet Inc.

- Microsoft Corporation

- Accenture PLC

- IBM Corporation

- The Allstate Corporation

- Salesforce Inc.

- NVIDIA Corporation

- Intuit Inc.

- SAS Institute Inc.

- DeepMind Technologies Limited

- DataRobot Inc.

- C3.ai Inc.

- AlphaSense Inc.

- Marqeta Inc.

- Upstart Holdings Inc.

- Hugging Face Inc.

- Kensho Technologies Inc.

- ZestFinance Inc.

- TrueLayer Limited

- Numerai Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.37 Billion |

| Forecasted Market Value ( USD | $ 6.01 Billion |

| Compound Annual Growth Rate | 26.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |