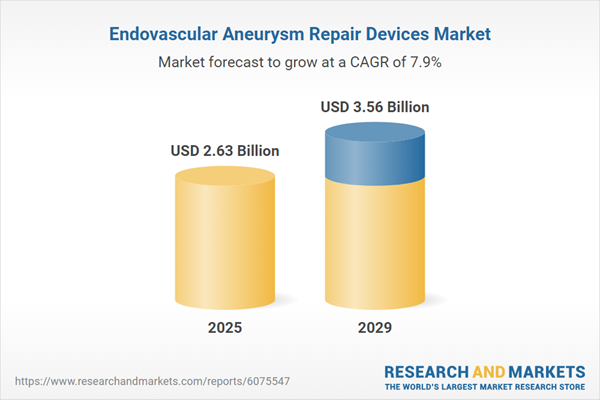

The endovascular aneurysm repair devices market size has grown strongly in recent years. It will grow from $2.43 billion in 2024 to $2.63 billion in 2025 at a compound annual growth rate (CAGR) of 8.2%. The growth observed during the historic period can be attributed to several factors, including improved patient outcomes with EVAR procedures, enhanced precision and safety in EVAR technology, favorable reimbursement policies, positive results from clinical trials, and regulatory approvals.

The endovascular aneurysm repair devices market size is expected to see strong growth in the next few years. It will grow to $3.56 billion in 2029 at a compound annual growth rate (CAGR) of 7.9%. The anticipated growth during the forecast period can be attributed to the rising demand for minimally invasive procedures, the development of safer and more effective devices, the shift from open surgery to minimally invasive techniques, advancements in imaging and diagnostic methods, and improved surgical outcomes. Key trends during this period include advancements in stent graft technology, better patient outcomes with reduced recovery times, the integration of imaging and navigation technologies into EVAR procedures, the development of hybrid EVAR devices, and regulatory advancements and approvals for new EVAR devices.

The increasing demand for minimally invasive surgical procedures is expected to drive growth in the endovascular aneurysm repair devices market. Minimally invasive surgeries involve procedures that use specialized tools and techniques with minimal incisions, reducing bodily disruption. The rise in demand for these procedures is due to factors such as faster recovery times, fewer complications, smaller incisions causing less pain, and improved surgical outcomes. Endovascular Aneurysm Repair (EVAR) devices help in these minimally invasive procedures by strengthening blood vessel walls and redirecting blood flow, thereby lowering the risk of aneurysm rupture. For example, in January 2024, Intuitive Surgical Inc., a U.S.-based producer of robotic surgical systems, announced the placement of 415 da Vinci systems in the fourth quarter of 2023, a 12% increase from the previous year. As a result, the growing trend toward minimally invasive surgeries is contributing to the expansion of the endovascular aneurysm repair devices market.

Leading companies in the endovascular aneurysm repair devices market are focusing on developing advanced solutions, such as abdominal stent-graft systems, to improve patient outcomes by enhancing device durability, increasing procedural success rates, and simplifying deployment. An abdominal stent-graft system is a medical device used during endovascular aneurysm repair (EVAR) to treat abdominal aortic aneurysms (AAA). For example, in August 2024, Terumo India, a medical technology company based in India, introduced the TREO Abdominal Stent-Graft System. This innovative solution is designed for treating abdominal aortic aneurysms (AAAs) in adults with suitable anatomies. It features a unique three-piece design that provides both suprarenal and infrarenal active fixation, improving stability and performance during EVAR procedures. Notable features include in situ limb adjustability for accurate deployment, enhanced proximal sealing to prevent leaks, and advanced lock stent technology to reduce the risk of migration.

Stryker Strengthens Neurovascular Portfolio With Acquisition Of Cerus Endovascular.

In May 2023, Stryker Corporation, a US-based medical technology company, acquired Cerus Endovascular Ltd. for an undisclosed sum. This acquisition allows Stryker to expand its aneurysm treatment portfolio by incorporating advanced neurointerventional devices, which will help physicians address a wider variety of intracranial aneurysms more effectively. Cerus Endovascular Ltd., a US-based medical device company, specializes in neurovascular products, with a strong focus on treating intracranial aneurysms.

Major players in the endovascular aneurysm repair devices market are Cardinal Health Inc., Johnson & Johnson, Abbott Laboratories, Medtronic Plc, Royal Philips, Boston Scientific, Terumo Corporation, Biotronik, L. Gore & Associates Inc., AorTech International, Teleflex Incorporated, Getinge AB, Cook Medical Group, Lombard Medical Technologies plc, Merit Medical Systems, Penumbra Inc., Volcano Corporation, Endologix Inc., Scranton Gillette Communications, and Medico S.p.A.

Endovascular aneurysm repair (EVAR) devices are sophisticated medical instruments used for the minimally invasive treatment of aneurysms, particularly in the aorta. An aneurysm occurs when a part of a blood vessel wall weakens and bulges, creating a risk of rupture. EVAR devices are designed to prevent rupture by reinforcing the blood vessel and rerouting blood flow away from the weakened area.

The primary types of aneurysms addressed by EVAR devices are abdominal aortic aneurysms (AAA), thoracic aortic aneurysms (TAA), and peripheral aneurysms. An abdominal aortic aneurysm (AAA) refers to an abnormal bulge or dilation in the lower section of the aorta, the body's largest blood vessel that runs through the abdomen. EVAR devices are used with endovascular grafts, stent-grafts, catheters, delivery systems, and imaging systems, and are intended for various end users, including hospitals, ambulatory surgical centers, and specialty clinics.

The endovascular aneurysm repair devices market research report is one of a series of new reports that provides endovascular aneurysm repair devices market statistics, including endovascular aneurysm repair devices industry global market size, regional shares, competitors with an endovascular aneurysm repair devices market share, detailed endovascular aneurysm repair devices market segments, market trends and opportunities, and any further data you may need to thrive in the endovascular aneurysm repair devices industry. This endovascular aneurysm repair devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the endovascular aneurysm repair devices market in 2024. The regions covered in endovascular aneurysm repair devices report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the endovascular aneurysm repair devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The endovascular aneurysm repair devices market consists of sales of stent grafts, delivery systems, guidewires, anchoring devices, and endograft components. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Endovascular Aneurysm Repair Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on endovascular aneurysm repair devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for endovascular aneurysm repair devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The endovascular aneurysm repair devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Aneurysm Type: Abdominal Aortic Aneurysms (AAA); Thoracic Aortic Aneurysms (TAA); Peripheral Aneurysms2) by Application: Endovascular Grafts; Stent-Grafts; Catheters; Delivery Systems; Imaging Systems

3) by End User: Hospitals; Ambulatory Surgical Centers; Specialty Clinics

Subsegments:

1) by Abdominal Aortic Aneurysms (AAA): Infrarenal AAA; Juxtarenal AAA; Pararenal AAA2) by Thoracic Aortic Aneurysms (TAA): Ascending Aortic Aneurysms; Aortic Arch Aneurysms; Descending Aortic Aneurysms

3) by Peripheral Aneurysms: Femoral Aneurysms; Popliteal Aneurysms; Iliac Aneurysms; Renal Aneurysms

Key Companies Profiled: Cardinal Health Inc.; Johnson & Johnson; Abbott Laboratories; Medtronic Plc; Royal Philips

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Endovascular Aneurysm Repair Devices market report include:- Cardinal Health Inc.

- Johnson & Johnson

- Abbott Laboratories

- Medtronic Plc

- Royal Philips

- Boston Scientific

- Terumo Corporation

- Biotronik

- L. Gore & Associates Inc.

- AorTech International

- Teleflex Incorporated

- Getinge AB

- Cook Medical Group

- Lombard Medical Technologies plc

- Merit Medical Systems

- Penumbra Inc.

- Volcano Corporation

- Endologix Inc.

- Scranton Gillette Communications

- Medico S.p.A

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.63 Billion |

| Forecasted Market Value ( USD | $ 3.56 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |