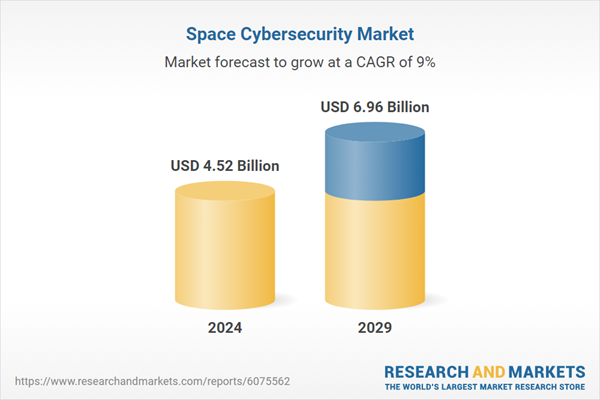

The space cybersecurity market is estimated at USD 4.52 billion in 2024 and is expected to reach USD 6.96 billion by 2029, with a CAGR of 9.0%. Key market drivers include the rise in cyber threats to space assets, rapid militarization of space and defense initiatives, increased dependency on satellite infrastructure, and high demand for satellite-to-ground communication security.

The network security segment is projected to account for the largest share of the space cybersecurity market during the forecast period

The space cybersecurity market, by solution, has been segmented into network security, endpoint & IoT security, cloud security, application security, identity & access management, encryption & tokenization, log management & SIEM, data backup & recovery, and other solutions. Among these, network security held the largest market share in 2024.

Network security is fundamental to cybersecurity, particularly in the space industry. It involves protecting a space organization’s terrestrial and space-based networks from cyberattacks and unauthorized access. With the increasing reliance on satellite systems for communication, navigation, and scientific data transmission, network security ensures these critical networks are safe from malicious interference. Breaches can compromise space operations, disrupting communication between spacecraft, ground stations, and control centers.

The European Space Agency (ESA) has implemented advanced network security solutions to protect its satellite communication networks. It utilizes firewalls and intrusion detection systems to safeguard ground control systems. This network security framework helps protect ESA’s operations from cyber threats targeting their satellite systems, such as hacking attempts on communication protocols or system vulnerabilities that could result in data leakage or operational failures.

The commercial segment is projected to exhibit the fastest growth during the forecast period

The space cybersecurity market, by end user, has been segmented into defense, commercial, and government. Space cybersecurity protects space systems from cyber threats, including hacking, data manipulation, and signal jamming. With space missions expanding in scale and complexity, cyberattack risks are becoming more pronounced. Vulnerabilities in space infrastructure - from satellites and launch vehicles to ground stations and space stations - threaten the integrity of space operations and national security, commercial enterprises, and scientific research. Thus, these sectors need specific cybersecurity solutions to safeguard critical space assets and infrastructure.

North America is projected to lead the space cybersecurity market during the forecast period

North America is expected to be the largest market for space cybersecurity during the forecast period, driven by commercial and defense space activities. The US leads in satellite deployments with programs like Starlink and Project Kuiper, alongside essential defense satellites managed by agencies such as the Department of Defense and the National Reconnaissance Office. These assets necessitate advanced cybersecurity solutions to address evolving threats. Significant investments from the US Space Force further prioritize space infrastructure protection as a national security imperative. The region also benefits from the presence of leading aerospace and cybersecurity companies like Lockheed Martin Corporation (US), Northrop Grumman (US), and SpiderOak Inc. (US). A robust regulatory framework, guided by directives such as the National Space Policy Directive 5 and NIST guidelines, compels public and private space operators to commit substantial cybersecurity budgets.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 55%; Tier 2 - 25%; and Tier 3 - 20%

- By Designation: Directors - 50%; Managers - 30%; and Others - 20%

- By Region: North America - 30%; Europe - 20%; Asia Pacific - 35%; Middle East - 10%, and Rest of the World - 5%

Thales (France), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (US), General Dynamics Corporation (US), Booz Allen Hamilton (US), SpiderOak Inc.(US), Leidos Holdings, Inc. (US), BAE Systems plc (UK), and Airbus (Netherlands) are among the leading players operating in the space cybersecurity market.

Research Coverage

The study examines the space cybersecurity market across various segments and subsegments. Its objective is to estimate the market size and growth potential based on offerings, platforms, end users, and regions. Additionally, this study includes a comprehensive competitive analysis of key market players, featuring their company profiles, essential observations related to their solutions and business offerings, recent developments, and the key market strategies they have adopted.

Key Benefits of Buying this Report:

This report provides valuable information for market leaders and new entrants in the space cybersecurity sector, including close estimates of revenue figures for the overall market and its subsegments. It covers the entire ecosystem of space cybersecurity, helping stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report allows stakeholders to gauge market dynamics by highlighting key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges impacting the market

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the space cybersecurity market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and solution and service offerings of leading players, including Thales (France), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (US), General Dynamics Corporation (US), Booz Allen Hamilton (US), SpiderOak Inc. (US), Leidos Holdings, Inc. (US), BAE Systems plc (UK), and Airbus (Netherlands)

Table of Contents

1.2 Market DefInition

1.3 Study Scope

1.3.1 Market Segmentation

1.3.2 Inclusions & Exclusions

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Primary Interviews

2.1.2.2 Key Data From Primary Sources

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.3 Supply-Side Indicators

2.3 Market Size Estimation

2.3.1 Segments & Subsegments

2.3.2 Research Approach & Methodology

2.3.2.1 Bottom-Up Approach

2.3.2.2 Top-Down Approach

2.4 Data Triangulation and Validation

2.4.1 Triangulation Through Primary and Secondary Research

2.5 Growth Rate Assumptions

2.6 Research Assumptions

2.7 Limitations

2.8 Risk Assessment

4.2 Space Cybersecurity Market, By Solution

4.3 Space Cybersecurity Market, By Network Security Solution

4.4 Space Cybersecurity Market, By Satellite Orbit

4.5 Space Cybersecurity Market, By Professional Service

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase In Cyber Threats On Space Assets

5.2.1.2 IncreasIng Militarization of Space and Defense Initiatives

5.2.1.3 GrowIng Dependency On Satellite Infrastructure

5.2.1.4 Demand For Satellite-To-Ground Communication Security

5.2.2 RestraInts

5.2.2.1 Complexity of SecurIng Multi-Orbit and Multi-Vendor Space Systems

5.2.2.2 Resistance To Security Integration In Legacy Space Infrastructure

5.2.3 Opportunities

5.2.3.1 Growth In Cyber-Resilient Satellite ManufacturIng

5.2.3.2 Emergence of Space-Specific, Zero-Trust Architecture

5.2.3.3 Integration of Post-Quantum Cryptography Into Space Networks

5.2.4 Challenges

5.2.4.1 Data Security Challenges In Inter-Satellite Communication LInks

5.2.4.2 Complexity In Real-Time Cybersecurity Threat Response In Space

5.3 Trends & Disruptions ImpactIng Customer BusIness

5.4 Ecosystem Analysis

5.4.1 PromInent Companies

5.4.2 Private and Small Enterprises

5.4.3 End Users

5.5 Value ChaIn Analysis

5.6 Case Studies

5.7 Investment & FundIng Scenario

5.8 Hs Codes

5.8.1 Import Scenario

5.8.2 Export Scenario

5.9 Key Conferences & Events, 2025-2026

5.10 Regulatory Landscape

5.11 Key Stakeholders & BuyIng Criteria

5.11.1 Key Stakeholders In BuyIng Process

5.11.2 BuyIng Criteria

5.12 Technology Analysis

5.12.1 Key Technologies

5.12.1.1 Encryption and Quantum Cryptography

5.12.1.2 Artificial Intelligence and MachIne LearnIng (Ai/Ml)

5.12.1.3 BlockchaIn

5.12.2 Complementary Technologies

5.12.2.1 Cloud ComputIng For Space Data Storage

5.12.2.2 Intrusion Detection and Prevention System (Idps)

5.12.3 Adjacent Technologies

5.12.3.1 Cybersecurity For Iot (Internet of ThIngs)

5.12.3.2 5G and Edge ComputIng

5.13 PricIng Analysis

5.14 Operational Data

5.15 BusIness Models

5.15.1 Product-Based Model (Hardware & Software Sales)

5.15.2 Cybersecurity-As-A-Service (Csaas) Model

5.15.3 System Integration & ConsultIng Model

5.15.4 Hybrid BusIness Model

5.16 Macroeconomic Outlook

5.16.1 Introduction

5.16.2 North America

5.16.3 Europe

5.16.4 Asia Pacific

5.16.5 Middle East

5.16.6 Rest of The World

6.2 EmergIng Trends

6.2.1 Zero Trust Architecture (Zta)

6.2.2 Artificial Intelligence (Ai) and MachIne LearnIng (Ml) For Threat Detection

6.2.3 BlockchaIn For Secure Data Transmission

6.2.4 Quantum Key Distribution (Qkd)

6.2.5 Cybersecurity Measures For Space Assets In Orbit

6.3 Technology Roadmap

6.4 Impact of Mega Trends

6.4.1 Artificial Intelligence (Ai) and MachIne LearnIng (Ml)

6.4.2 Gen Ai (Generative Ai)

6.4.3 Quantum Cryptography and ComputIng

6.4.4 Autonomous and Edge Security For Space Systems

6.5 Patent Analysis

7.2 Solutions

7.2.1 Network Security

7.2.1.1 Network Firewall

7.2.1.1.1 Risk of Satellite Mission Failure To Drive Market

7.2.1.2 Intrusion Detection & Prevention Systems

7.2.1.2.1 Need For Prevention of Malicious Activities Or Policy Violations To Drive Market

7.2.1.3 Virtual Private Network

7.2.1.3.1 Surge In Demand From Space Agencies To Protect Communication LInks To Drive Market

7.2.1.4 Network Access Control

7.2.1.4.1 Need For Controlled Access To Mission-Critical Systems To Drive Market

7.2.1.5 Other Network Security Solutions

7.2.2 EndpoInt & Iot Security

7.2.2.1 Antivirus & Anti-Malware

7.2.2.1.1 IncreasIng Sophistication of Cyberattacks To Drive Market

7.2.2.2 EndpoInt Detection & Response

7.2.2.2.1 RisIng Dependency On Remote Space Devices To Drive Market

7.2.2.3 Patch Management

7.2.2.3.1 Focus On ElimInatIng Software Vulnerabilities To Drive Market

7.2.2.4 Other EndpoInt & Iot Security Solutions

7.2.3 Cloud Security

7.2.3.1 Cloud Access Security Broker

7.2.3.1.1 Vast Data Generation By Space Missions To Drive Market

7.2.3.2 Security Posture Management

7.2.3.2.1 Dependency On Cloud ComputIng For Mission-Critical Operations To Drive Market

7.2.4 Application Security

7.2.4.1 Secure Development Tools

7.2.4.1.1 Need For Secure Mission Software To Drive Market

7.2.4.2 Web Application Firewall

7.2.4.2.1 IncreasIng Risk of Cyberattacks At Space Mission Web Interfaces To Drive Market

7.2.4.3 Other Application Security Solutions

7.2.5 Identity & Access Management

7.2.5.1 Implementation of Secure Access Policies To Drive Market

7.2.6 Encryption & Tokenization

7.2.6.1 GrowIng Sensitivity of Space Data To Drive Market

7.2.7 Log Management & Siem

7.2.7.1 Need For Real-Time Threat Detection and Response To Drive Market

7.2.8 Data Backup & Recovery

7.2.8.1 High Risk Associated With Space Missions To Drive Market

7.2.9 Other Solutions

7.3 Services

7.3.1 Professional Services

7.3.1.1 Design, ConsultIng, and Implementation

7.3.1.1.1 Heightened Demand For Tailored Cybersecurity Strategies To Drive Market

7.3.1.2 Risk & Threat Management

7.3.1.2.1 Emphasis On ReducIng Likelihood of Security Breaches To Drive Market

7.3.1.3 Support & MaIntenance

7.3.1.3.1 Need For ContInuous MaIntenance Services In Prolonged Space Missions To Drive Market

7.3.1.4 TraInIng & Education

7.3.1.4.1 IncreasIng Complexity of Space Systems To Drive Market

7.3.2 Managed Security Services

7.3.2.1 EmergIng Trend of OutsourcIng Cybersecurity Services To Drive Market

8.2 Satellites

8.2.1 Leo

8.2.1.1 Integration of Robust Security Frameworks To Drive Market

8.2.2 Meo

8.2.2.1 OngoIng Development of Advanced Security Solutions To Drive Market

8.2.3 Geo

8.2.3.1 Susceptibility of Geos To Cyberattacks To Drive Market

8.3 Launch Vehicles

8.3.1 Small Lift Launch Vehicles

8.3.1.1 Risk of Mission Failure and Loss of Valuable Payloads To Drive Market

8.3.2 Medium & Heavy Vehicles

8.3.2.1 Substantial Investments In Advanced Encryption Techniques To Drive Market

8.4 Ground Stations

8.4.1 Deployment of Next-Generation Firewalls For PreventIng Unauthorized Access To Drive Market

8.5 Spaceports & Launch Facilities

8.5.1 Increase In Space Activities To Drive Market

8.6 Command & Control Centers

8.6.1 Implementation of Multi-Layered Cybersecurity Measures To Drive Market

8.7 Other Platforms

9.2 Defense

9.2.1 GrowIng Investments In Robust Space Cybersecurity Solutions To Drive Market

9.3 Commercial

9.3.1 Need For Secure Satellite Infrastructure To Drive Market

9.4 Government

9.4.1 IncreasIng Reliance On Space For National Security To Drive Market

10.2 North America

10.2.1 Pestle Analysis

10.2.2 Us

10.2.2.1 Emphasis On SecurIng Space Infrastructure To Drive Market

10.2.3 Canada

10.2.3.1 RisIng Investments In National Space Missions To Drive Market

10.3 Asia Pacific

10.3.1 Pestle Analysis

10.3.2 Japan

10.3.2.1 Strategic Space Defense Initiatives To Drive Market

10.3.3 India

10.3.3.1 BoomIng Space Industry To Drive Market

10.3.4 Australia

10.3.4.1 Focus On Secure Space Operations To Drive Market

10.3.5 Malaysia

10.3.5.1 Need For Enhanced Satellite Protection To Drive Market

10.3.6 Rest of Asia Pacific

10.4 Europe

10.4.1 Pestle Analysis

10.4.2 Uk

10.4.2.1 Government-Backed Investments and International Partnerships To Drive Market

10.4.3 Germany

10.4.3.1 IncreasIng Threats To Space Infrastructure To Drive Market

10.4.4 France

10.4.4.1 Active Participation In European Space Initiatives To Drive Market

10.4.5 Italy

10.4.5.1 Collaboration With Other Eu Nations and International Partners To Drive Market

10.4.6 Rest of Europe

10.5 Middle East

10.5.1 Pestle Analysis

10.5.2 Gcc

10.5.2.1 Uae

10.5.2.1.1 IncreasIng Focus On SecurIng Satellite Networks To Drive Market

10.5.2.2 Saudi Arabia

10.5.2.2.1 Need For Cybersecurity Solutions Amid ExpandIng Space Programs To Drive Market

10.5.3 Israel

10.5.3.1 Elevated Demand For Advanced Defense Systems and Satellite Security Technologies To Drive Market

10.6 Rest of The World

10.6.1 Pestle Analysis

10.6.2 LatIn America

10.6.2.1 Need For AddressIng Cybersecurity Issues To Drive Market

10.6.3 Africa

10.6.3.1 GrowIng Dependency On Satellite Communication To Drive Market

11.2 Key Player Strategies/Right To WIn, 2021-2025

11.3 Revenue Analysis

11.4 Market Share Analysis, 2023

11.5 Brand/Product Comparison

11.6 Company Evaluation Matrix: Key Players, 2023

11.6.1 Stars

11.6.2 EmergIng Leaders

11.6.3 Pervasive Players

11.6.4 Participants

11.6.5 Company FootprInt: Key Players, 2023

11.7 Company Evaluation Matrix: Startups/Smes, 2024

11.7.1 Progressive Companies

11.7.2 Responsive Companies

11.7.3 Dynamic Companies

11.7.4 StartIng Blocks

11.7.5 Competitive BenchmarkIng

11.8 Competitive Scenario

11.8.1 Product Launches

11.8.2 Deals

11.8.3 Other Developments

12.1.1 Thales

12.1.1.1 BusIness Overview

12.1.1.2 Products/Solutions/Services offered

12.1.1.3 Recent Developments

12.1.1.3.1 Deals

12.1.1.3.2 Other Developments

12.1.1.4 The Analyst's View

12.1.1.4.1 Right To WIn

12.1.1.4.2 Strategic Choices

12.1.1.4.3 Weaknesses and Competitive Threats

12.1.2 Lockheed MartIn Corporation

12.1.2.1 BusIness Overview

12.1.2.2 Products/Solutions/Services offered

12.1.2.3 Recent Developments

12.1.2.3.1 Deals

12.1.2.3.2 Other Developments

12.1.2.4 The Analyst's View

12.1.2.4.1 Right To WIn

12.1.2.4.2 Strategic Choices

12.1.2.4.3 Weaknesses and Competitive Threats

12.1.3 Leonardo S.P.A.

12.1.3.1 BusIness Overview

12.1.3.2 Products/Solutions/Services offered

12.1.3.3 Recent Developments

12.1.3.3.1 Deals

12.1.3.3.2 Other Developments

12.1.3.4 The Analyst's View

12.1.3.4.1 Right To WIn

12.1.3.4.2 Strategic Choices

12.1.3.4.3 Weaknesses and Competitive Threats

12.1.4 Spacex

12.1.4.1 BusIness Overview

12.1.4.2 Products/Solutions/Services offered

12.1.4.3 Recent Developments

12.1.4.3.1 Other Developments

12.1.4.4 The Analyst's View

12.1.4.4.1 Right To WIn

12.1.4.4.2 Strategic Choices

12.1.4.4.3 Weaknesses and Competitive Threats

12.1.5 Booz Allen Hamilton Inc.

12.1.5.1 BusIness Overview

12.1.5.2 Products/Solutions/Services offered

12.1.5.3 Recent Developments

12.1.5.3.1 Deals

12.1.5.3.2 Other Developments

12.1.6 Northrop Grumman

12.1.6.1 BusIness Overview

12.1.6.2 Products/Solutions/Services offered

12.1.6.3 Recent Developments

12.1.6.3.1 Deals

12.1.6.3.2 Other Developments

12.1.7 Airbus

12.1.7.1 BusIness Overview

12.1.7.2 Products/Solutions/Services offered

12.1.7.3 Recent Developments

12.1.7.3.1 Deals

12.1.7.3.2 Other Developments

12.1.8 Thales Alenia Space

12.1.8.1 BusIness Overview

12.1.8.2 Products/Solutions/Services offered

12.1.8.3 Recent Developments

12.1.8.3.1 Deals

12.1.9 Bae Systems

12.1.9.1 BusIness Overview

12.1.9.2 Products/Solutions/Services offered

12.1.10 Ohb Se

12.1.10.1 BusIness Overview

12.1.10.2 Products/Solutions/Services offered

12.1.10.3 Recent Developments

12.1.10.3.1 Deals

12.1.11 Maxar Technologies

12.1.11.1 BusIness Overview

12.1.11.2 Products/Solutions/Services offered

12.1.11.3 Recent Developments

12.1.11.3.1 Other Developments

12.1.12 Spider Oak Inc.

12.1.12.1 BusIness Overview

12.1.12.2 Products/Solutions/Services offered

12.1.12.3 Recent Developments

12.1.12.3.1 Product Launches

12.1.12.3.2 Other Developments

12.1.13 General Dynamics Corporation

12.1.13.1 BusIness Overview

12.1.13.2 Products/Solutions/Services offered

12.1.13.3 Recent Developments

12.1.13.3.1 Deals

12.1.13.3.2 Other Developments

12.1.14 Cisco Systems, Inc.

12.1.14.1 BusIness Overview

12.1.14.2 Products/Solutions/Services offered

12.1.14.3 Recent Developments

12.1.14.3.1 Deals

12.1.14.3.2 Other Developments

12.1.15 Leidos

12.1.15.1 BusIness Overview

12.1.15.2 Products/Solutions/Services offered

12.1.15.3 Recent Developments

12.1.15.3.1 Other Developments

12.2 Startups/Smes

12.2.1 Xage Security, Inc.

12.2.2 NightwIng

12.2.3 D-Orbit

12.2.4 Cysec

12.2.5 Redwire Corporation

12.2.6 Globals Inc.

12.2.7 Id Quantique

12.2.8 Kongsberg Defense and Aerospace

12.2.9 Telespazio S.P.A.

12.2.10 Tyvak International

12.2.11 Darktrace HoldIngs Limited

13.2 Annexure

13.3 Knowledgestore: The Subscription Portal

13.4 Customization Options

13.5 Related Reports

13.6 Author Details

Table 2 Space Cybersecurity Market Size Estimation Procedure

Table 3 Role of Players In Ecosystem

Table 4 Nasa Collaborated With Bitsight To Enhance Cybersecurity MonitorIng For Its Vendors

Table 5 Erg Aerospace Reduced It-Related Risks and Costs By ImplementIng Snap Tech It Solutions

Table 6 Spideroak’S Orbitsecure Software Allowed Lockheed MartIn To Protect Sensitive Military and Commercial Satellite Data

Table 7 Airbus Partnered With European Firms To Establish Iris2 Secure Satellite Network

Table 8 Import Data For Hs Code 847330-Compliant Products, By Country, 2020-2024 (Usd Million)

Table 9 Export Data For Hs Code 847330-Compliant Products, By Country, 2020-2024 (Usd Million)

Table 10 Key Conferences & Events, 2025-2026

Table 11 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 12 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Asia Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Middle East: Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Rest of The World: Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 Influence of Stakeholders On BuyIng Process, By End User

Table 17 Key BuyIng Criteria For End Users

Table 18 Indicative PricIng Analysis For Space Cybersecurity offerIngs, 2023

Table 19 Indicative PricIng Analysis of Key Players, 2023

Table 20 Space and Ground-Based Platforms/Assets, By Type, 2021-2025 (Units)

Table 21 Active Satellites, By Orbit, 2021-2025 (Units)

Table 22 Patent Analysis, 2021-2024

Table 23 Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 24 Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 25 Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 26 Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 27 Network Security: Space Cybersecurity Market, By Type, 2021-2023 (Usd Million)

Table 28 Network Security: Space Cybersecurity Market, By Type, 2024-2029 (Usd Million)

Table 29 EndpoInt & Iot Security: Space Cybersecurity Market, By Type, 2021-2023 (Usd Million)

Table 30 EndpoInt & Iot Security: Space Cybersecurity Market, By Type, 2024-2029 (Usd Million)

Table 31 Cloud Security: Space Cybersecurity Market, By Type, 2021-2023 (Usd Million)

Table 32 Cloud Security: Space Cybersecurity Market, By Type, 2024-2029 (Usd Million)

Table 33 Application Security: Space Cybersecurity Market, By Type, 2021-2023 (Usd Million)

Table 34 Application Security: Space Cybersecurity Market, By Type, 2024-2029 (Usd Million)

Table 35 Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 36 Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 37 Professional Services: Space Cybersecurity Market, By Type, 2021-2023 (Usd Million)

Table 38 Professional Services: Space Cybersecurity Market, By Type, 2024-2029 (Usd Million)

Table 39 Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 40 Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 41 Satellites: Space Cybersecurity Market, By Satellite Orbit, 2021-2023 (Usd Million)

Table 42 Satellites: Space Cybersecurity Market, By Satellite Orbit, 2024-2029 (Usd Million)

Table 43 Launch Vehicles: Space Cybersecurity Market, By Type, 2021-2023 (Usd Million)

Table 44 Launch Vehicles: Space Cybersecurity Market, By Type, 2024-2029 (Usd Million)

Table 45 Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 46 Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 47 Space Cybersecurity Market, By Region, 2021-2023 (Usd Million)

Table 48 Space Cybersecurity Market, By Region, 2024-2029 (Usd Million)

Table 49 North America: Space Cybersecurity Market, By Country, 2021-2023 (Usd Million)

Table 50 North America: Space Cybersecurity Market, By Country, 2024-2029 (Usd Million)

Table 51 North America: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 52 North America: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 53 North America: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 54 North America: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 55 North America: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 56 North America: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 57 North America: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 58 North America: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 59 North America: Space Cybersecurity Market, By Satellite Orbit, 2021-2023 (Usd Million)

Table 60 North America: Space Cybersecurity Market, By Satellite Orbit, 2024-2029 (Usd Million)

Table 61 North America: Space Cybersecurity Market, By Launch Vehicle, 2021-2023 (Usd Million)

Table 62 North America: Space Cybersecurity Market, By Launch Vehicle, 2024-2029 (Usd Million)

Table 63 North America: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 64 North America: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 65 Us: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 66 Us: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 67 Us: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 68 Us: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 69 Us: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 70 Us: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 71 Us: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 72 Us: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 73 Us: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 74 Us: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 75 Canada: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 76 Canada: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 77 Canada: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 78 Canada: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 79 Canada: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 80 Canada: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 81 Canada: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 82 Canada: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 83 Canada: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 84 Canada: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 85 Asia Pacific: Space Cybersecurity Market, By Country, 2021-2023 (Usd Million)

Table 86 Asia Pacific: Space Cybersecurity Market, By Country, 2024-2029 (Usd Million)

Table 87 Asia Pacific: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 88 Asia Pacific: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 89 Asia Pacific: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 90 Asia Pacific: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 91 Asia Pacific: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 92 Asia Pacific: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 93 Asia Pacific: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 94 Asia Pacific: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 95 Asia Pacific: Space Cybersecurity Market, By Satellite Orbit, 2021-2023 (Usd Million)

Table 96 Asia Pacific: Space Cybersecurity Market, By Satellite Orbit, 2024-2029 (Usd Million)

Table 97 Asia Pacific: Space Cybersecurity Market, By Launch Vehicle, 2021-2023 (Usd Million)

Table 98 Asia Pacific: Space Cybersecurity Market, By Launch Vehicle, 2024-2029 (Usd Million)

Table 99 Asia Pacific: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 100 Asia Pacific: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 101 Japan: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 102 Japan: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 103 Japan: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 104 Japan: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 105 Japan: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 106 Japan: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 107 Japan: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 108 Japan: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 109 Japan: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 110 Japan: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 111 India: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 112 India: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 113 India: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 114 India: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 115 India: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 116 India: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 117 India: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 118 India: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 119 India: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 120 India: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 121 Australia: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 122 Australia: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 123 Australia: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 124 Australia: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 125 Australia: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 126 Australia: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 127 Australia: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 128 Australia: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 129 Australia: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 130 Australia: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 131 Malaysia: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 132 Malaysia: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 133 Malaysia: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 134 Malaysia: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 135 Malaysia: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 136 Malaysia: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 137 Malaysia: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 138 Malaysia: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 139 Malaysia: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 140 Malaysia: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 141 Rest of Asia Pacific: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 142 Rest of Asia Pacific: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 143 Rest of Asia Pacific: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 144 Rest of Asia Pacific: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 145 Rest of Asia Pacific: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 146 Rest of Asia Pacific: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 147 Rest of Asia Pacific: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 148 Rest of Asia Pacific: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 149 Rest of Asia Pacific: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 150 Rest of Asia Pacific: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 151 Europe: Space Cybersecurity Market, By Country, 2021-2023 (Usd Million)

Table 152 Europe: Space Cybersecurity Market, By Country, 2024-2029 (Usd Million)

Table 153 Europe: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 154 Europe: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 155 Europe: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 156 Europe: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 157 Europe: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 158 Europe: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 159 Europe: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 160 Europe: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 161 Europe: Space Cybersecurity Market, By Satellite Orbit, 2021-2023 (Usd Million)

Table 162 Europe: Space Cybersecurity Market, By Satellite Orbit, 2024-2029 (Usd Million)

Table 163 Europe: Space Cybersecurity Market, By Launch Vehicle, 2021-2023 (Usd Million)

Table 164 Europe: Space Cybersecurity Market, By Launch Vehicle, 2024-2029 (Usd Million)

Table 165 Europe: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 166 Europe: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 167 Uk: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 168 Uk: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 169 Uk: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 170 Uk: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 171 Uk: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 172 Uk: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 173 Uk: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 174 Uk: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 175 Uk: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 176 Uk: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 177 Germany: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 178 Germany: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 179 Germany: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 180 Germany: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 181 Germany: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 182 Germany: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 183 Germany: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 184 Germany: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 185 Germany: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 186 Germany: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 187 France: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 188 France: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 189 France: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 190 France: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 191 France: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 192 France: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 193 France: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 194 France: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 195 France: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 196 France: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 197 Italy: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 198 Italy: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 199 Italy: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 200 Italy: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 201 Italy: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 202 Italy: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 203 Italy: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 204 Italy: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 205 Italy: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 206 Italy: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 207 Rest of Europe: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 208 Rest of Europe: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 209 Rest of Europe: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 210 Rest of Europe: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 211 Rest of Europe: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 212 Rest of Europe: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 213 Rest of Europe: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 214 Rest of Europe: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 215 Rest of Europe: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 216 Rest of Europe: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 217 Middle East: Space Cybersecurity Market, By Country, 2021-2023 (Usd Million)

Table 218 Middle East: Space Cybersecurity Market, By Country, 2024-2029 (Usd Million)

Table 219 Middle East: Space Cybersecurity Market, By Gcc Country, 2021-2023 (Usd Million)

Table 220 Middle East: Space Cybersecurity Market, By Gcc Country, 2024-2029 (Usd Million)

Table 221 Middle East: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 222 Middle East: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 223 Middle East: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 224 Middle East: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 225 Middle East: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 226 Middle East: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 227 Middle East: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 228 Middle East: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 229 Middle East: Space Cybersecurity Market, By Satellite Orbit, 2021-2023 (Usd Million)

Table 230 Middle East: Space Cybersecurity Market, By Satellite Orbit, 2024-2029 (Usd Million)

Table 231 Middle East: Space Cybersecurity Market, By Launch Vehicle, 2021-2023 (Usd Million)

Table 232 Middle East: Space Cybersecurity Market, By Launch Vehicle, 2024-2029 (Usd Million)

Table 233 Middle East: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 234 Middle East: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 235 Uae: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 236 Uae: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 237 Uae: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 238 Uae: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 239 Uae: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 240 Uae: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 241 Uae: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 242 Uae: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 243 Uae: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 244 Uae: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 245 Saudi Arabia: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 246 Saudi Arabia: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 247 Saudi Arabia: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 248 Saudi Arabia: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 249 Saudi Arabia: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 250 Saudi Arabia: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 251 Saudi Arabia: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 252 Saudi Arabia: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 253 Saudi Arabia: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 254 Saudi Arabia: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 255 Israel: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 256 Israel: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 257 Israel: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 258 Israel: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 259 Israel: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 260 Israel: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 261 Israel: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 262 Israel: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 263 Israel: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 264 Israel: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 265 Rest of The World: Space Cybersecurity Market, By Region, 2021-2023 (Usd Million)

Table 266 Rest of The World: Space Cybersecurity Market, By Region, 2024-2029 (Usd Million)

Table 267 Rest of The World: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 268 Rest of The World: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 269 Rest of The World: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 270 Rest of The World: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 271 Rest of The World: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 272 Rest of The World: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 273 Rest of The World: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 274 Rest of The World: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 275 Rest of The World: Space Cybersecurity Market, By Satellite Orbit, 2021-2023 (Usd Million)

Table 276 Rest of The World: Space Cybersecurity Market, By Satellite Orbit, 2024-2029 (Usd Million)

Table 277 Rest of The World: Space Cybersecurity Market, By Launch Vehicle, 2021-2023 (Usd Million)

Table 278 Rest of The World: Space Cybersecurity Market, By Launch Vehicle, 2024-2029 (Usd Million)

Table 279 Rest of The World: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 280 Rest of The World: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 281 LatIn America: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 282 LatIn America: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 283 LatIn America: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 284 LatIn America: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 285 LatIn America: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 286 LatIn America: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 287 LatIn America: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 288 LatIn America: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 289 LatIn America: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 290 LatIn America: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 291 Africa: Space Cybersecurity Market, By offerIng, 2021-2023 (Usd Million)

Table 292 Africa: Space Cybersecurity Market, By offerIng, 2024-2029 (Usd Million)

Table 293 Africa: Space Cybersecurity Market, By Solution, 2021-2023 (Usd Million)

Table 294 Africa: Space Cybersecurity Market, By Solution, 2024-2029 (Usd Million)

Table 295 Africa: Space Cybersecurity Market, By Service, 2021-2023 (Usd Million)

Table 296 Africa: Space Cybersecurity Market, By Service, 2024-2029 (Usd Million)

Table 297 Africa: Space Cybersecurity Market, By Platform, 2021-2023 (Usd Million)

Table 298 Africa: Space Cybersecurity Market, By Platform, 2024-2029 (Usd Million)

Table 299 Africa: Space Cybersecurity Market, By End User, 2021-2023 (Usd Million)

Table 300 Africa: Space Cybersecurity Market, By End User, 2024-2029 (Usd Million)

Table 301 Key Player Strategies/Right To WIn, 2021-2025

Table 302 Space Cybersecurity Market: Degree of Competition

Table 303 Company Region FootprInt

Table 304 Company offerIng FootprInt

Table 305 Company Platform FootprInt

Table 306 Detailed List of Key Startups/Smes and Medium/Large Enterprises

Table 307 Competitive BenchmarkIng of Key Startups/Smes

Table 308 Space Cybersecurity Market: Product Launches, June 2021-March 2025

Table 309 Space Cybersecurity Market: Deals, June 2021-March 2025

Table 310 Space Cybersecurity Market: Other Developments, June 2021-March 2025

Table 311 Thales: Company Overview

Table 312 Thales: Products/Solutions/Services offered

Table 313 Thales: Deals

Table 314 Thales: Other Developments

Table 315 Lockheed MartIn Corporation: Company Overview

Table 316 Lockheed MartIn Corporation: Products/Solutions/Services offered

Table 317 Lockheed MartIn Corporation: Deals

Table 318 Lockheed MartIn Corporation: Other Developments

Table 319 Leonardo S.P.A.: Company Overview

Table 320 Leonardo S.P.A.: Products/Solutions/Services offered

Table 321 Leonardo S.P.A.: Deals

Table 322 Leonardo S.P.A.: Other Developments

Table 323 Spacex: Company Overview

Table 324 Spacex: Products/Solutions/Services offered

Table 325 Spacex: Other Developments

Table 326 Booz Allen Hamilton Inc.: Company Overview

Table 327 Booz Allen Hamilton Inc.: Products/Solutions/Services offered

Table 328 Booz Allen Hamilton Inc.: Deals

Table 329 Booz Allen Hamilton Inc.: Other Developments

Table 330 Northrop Grumman: Company Overview

Table 331 Northrop Grumman: Products/Solutions/Services offered

Table 332 Northrop Grumman: Deals

Table 333 Northrop Grumman: Other Developments

Table 334 Airbus: Company Overview

Table 335 Airbus: Products/Solutions/Services offered

Table 336 Airbus: Deals

Table 337 Airbus: Other Developments

Table 338 Thales Alenia Space: Company Overview

Table 339 Thales Alenia Space: Products/Solutions/Services offered

Table 340 Thales Alenia Space: Deals

Table 341 Bae Systems: Company Overview

Table 342 Bae Systems: Products/Solutions/Services offered

Table 343 Ohb Se: Company Overview

Table 344 Ohb Se: Products/Solutions/Services offered

Table 345 Ohb Se: Deals

Table 346 Maxar Technologies: Company Overview

Table 347 Maxar Technologies: Products/Solutions/Services offered

Table 348 Maxar Technologies: Other Developments

Table 349 Spideroak Inc.: Company Overview

Table 350 Spideroak Inc.: Products/Solutions/Services offered

Table 351 Spideroak Inc.: Product Launches

Table 352 Spideroak Inc.: Other Developments

Table 353 General Dynamics Corporation: Company Overview

Table 354 General Dynamics Corporation: Products/Solutions/Services offered

Table 355 General Dynamics Corporation: Deals

Table 356 General Dynamics Corporation: Other Developments

Table 357 Cisco Systems, Inc.: Company Overview

Table 358 Cisco Systems, Inc.: Products/Solutions/Services offered

Table 359 Cisco Systems, Inc.: Deals

Table 360 Cisco Systems, Inc.: Other Developments

Table 361 Leidos: Company Overview

Table 362 Leidos: Products/Solutions/Services offered

Table 363 Leidos: Other Developments

Table 364 Xage Security, Inc.: Company Overview

Table 365 NightwIng: Company Overview

Table 366 D-Orbit: Company Overview

Table 367 Cysec: Company Overview

Table 368 Redwire Corporation: Company Overview

Table 369 Globals Inc.: Company Overview

Table 370 Id Quantique: Company Overview

Table 371 Kongsberg Defense and Aerospace: Company Overview

Table 372 Telespazio S.P.A.: Company Overview

Table 373 Tyvak International: Company Overview

Table 374 Darktrace HoldIngs Limited: Company Overview

Figure 2 Space Cybersecurity Market: Research Design

Figure 3 Breakdown of Primaries: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Services To Be Fastest-GrowIng Segment DurIng Forecast Period

Figure 8 Satellites Segment To Secure LeadIng Position DurIng Forecast Period

Figure 9 Defense To Surpass Other Segments DurIng Forecast Period

Figure 10 North America To Be Largest Market For Space Cybersecurity DurIng Forecast Period

Figure 11 Need To Secure Satellite and Critical Infrastructure From Cyberattacks To Drive Market

Figure 12 Network Security Segment To Be DomInant DurIng Forecast Period

Figure 13 Network Firewalls Segment To Lead Market DurIng Forecast Period

Figure 14 Leo Segment To Account For Largest Share DurIng Forecast Period

Figure 15 Design, ConsultIng, and Implementation Segment To Lead Market DurIng Forecast Period

Figure 16 Space Cybersecurity Market: Drivers, RestraInts, Opportunities, and Challenges

Figure 17 Trends & Disruptions ImpactIng Customer BusIness

Figure 18 Ecosystem Analysis

Figure 19 Value ChaIn Analysis

Figure 20 Investment & FundIng Scenario, 2019-2024 (Usd Million)

Figure 21 Import Data For Hs Code 847330-Compliant Products, By Country, 2020-2024 (Usd Million)

Figure 22 Export Data For Hs Code 847330-Compliant Products, By Country, 2020-2024 (Usd Million)

Figure 23 Influence of Stakeholders On BuyIng Process, By End User

Figure 24 Key BuyIng Criteria For End Users

Figure 25 Space Cybersecurity: BusIness Models

Figure 26 Evolution of Space Cybersecurity Technologies

Figure 27 Roadmap For Space Cybersecurity Technologies

Figure 28 EmergIng Technology Trends In Space Cybersecurity Market

Figure 29 Patents Granted, 2014-2024

Figure 30 Space Cybersecurity Market, By offerIng, 2024 Vs. 2029 (Usd Million)

Figure 31 Space Cybersecurity Market, By Platform, 2024 Vs. 2029 (Usd Million)

Figure 32 Space Cybersecurity Market, By End User, 2024 Vs. 2029 (Usd Million)

Figure 33 Space Cybersecurity Market: Regional Snapshot

Figure 34 North America: Space Cybersecurity Market Snapshot

Figure 35 Asia Pacific: Space Cybersecurity Market Snapshot

Figure 36 Europe: Space Cybersecurity Market Snapshot

Figure 37 Middle East: Space Cybersecurity Market Snapshot

Figure 38 Rest of The World: Space Cybersecurity Market Snapshot

Figure 39 Revenue Analysis of Top Five Players, 2021-2024 (Usd Million)

Figure 40 Market Share Analysis of Top Five Players, 2023

Figure 41 Brand/Product Comparison

Figure 42 Space Cybersecurity Market: Company Evaluation Matrix (Key Players), 2023

Figure 43 Company FootprInt

Figure 44 Space Cybersecurity Market: Company Evaluation Matrix (Startups/Smes), 2023

Figure 45 Thales: Company Snapshot

Figure 46 Lockheed MartIn Corporation: Company Snapshot

Figure 47 Leonardo S.P.A.: Company Snapshot

Figure 48 Booz Allen Hamilton Inc.: Company Snapshot

Figure 49 Northrop Grumman: Company Snapshot

Figure 50 Airbus: Company Snapshot

Figure 51 Bae Systems: Company Snapshot

Figure 52 Ohb Se: Company Snapshot

Figure 53 Maxar Technologies: Company Snapshot

Figure 54 General Dynamics Corporation: Company Snapshot

Figure 55 Cisco Systems, Inc.: Company Snapshot

Figure 56 Leidos: Company Snapshot

Companies Mentioned

- THALES

- LOCKHEED MARTIN CORPORATION

- LEONARDO S.P.A.

- SPACEX

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 308 |

| Published | April 2025 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 4.52 Billion |

| Forecasted Market Value ( USD | $ 6.96 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |