Growing Strategic Initiatives by Key Players Drive Europe Carbonated Soft Drinks Market

Beverage companies are investing heavily in product diversification and innovation to meet the changing demands of consumers. This includes introducing new flavors, formulations, and packaging options to appeal to a broader audience. Whether it’s launching low-sugar or zero-calorie variants to cater to health-conscious consumers or introducing exotic and unique flavors to capture the interest of adventurous taste buds, strategic product initiatives are driving market expansion and differentiation. In addition, there is a growing emphasis on marketing and branding strategies to create compelling narratives and engage consumers on multiple platforms.Beverage companies leverage social media, influencer partnerships, and experiential marketing campaigns to build brand awareness, foster consumer loyalty, and drive product adoption. By crafting authentic and relatable brand stories that resonate with target demographics, companies can strengthen their market position and drive sustained growth over the long term. Moreover, strategic initiatives extend beyond product and marketing efforts to include sustainability and corporate responsibility initiatives.

With increasing consumer awareness and concern about environmental issues, beverage companies are implementing sustainability practices throughout their supply chains, including packaging innovations, water conservation efforts, and carbon footprint reduction strategies. These initiatives align with consumer values and contribute to brand differentiation and competitive advantage in the marketplace.

Strategic partnerships and collaborations are also driving innovation and expansion within the carbonated soft drinks market. Beverage companies are partnering with other brands, technology firms, and startups to leverage complementary expertise, access new end users, and co-create innovative products. For instance, in February 2022, Coca-Cola launched its new global innovation platform, Coca-Cola Creations, along with its first limited-edition product, Coca-Cola Starlight. In addition, in April 2024, Microsoft Corp and The Coca-Cola Company announced a five-year strategic partnership to align Coca-Cola’s core technology strategy systemwide, enable the adoption of leading-edge technology, and foster innovation and productivity globally.

As part of the partnership, Coca-Cola has made a US$ 1.1 billion commitment to the Microsoft Cloud and its generative artificial intelligence (AI) capabilities. The collaboration underscores Coca-Cola’s ongoing technology transformation, underpinned by the Microsoft Cloud as Coca-Cola’s globally preferred and strategic cloud and AI platform. Whether it's collaborating with celebrity influencers to launch limited-edition flavors, advanced technology integration, or partnering with beverage delivery services, alliances are driving market growth and unlocking new opportunities for revenue generation.

Europe Carbonated Soft Drinks Market Overview

The carbonated soft drinks market in Europe is characterized by a diverse range of products and shifting consumer preferences. Despite increasing health consciousness among consumers, carbonated soft drinks remain deeply ingrained in European culture and consumption habits. Many European countries have long-standing traditions of enjoying fizzy beverages, particularly during social gatherings, meals, and celebrations. Among the most extensively consumed brands are Coca-Cola and Pepsi, which offer a range of flavors, including classic soda, lemon-lime, and orange. Furthermore, major brands such as Coca-Cola cater to European consumers by offering a wider range of diet and zero-sugar drinks.This variety appeals to different tastes and preferences across the continent, contributing to sustained demand. In addition, according to the Statistics Netherlands (CBS), countries such as Ireland, Denmark, the Netherlands, Austria, and Belgium have the highest per capita income. As income rises, consumers often have more disposable income to spend on premium beverages. This increased purchasing power allows consumers to indulge in carbonated soft drinks more frequently, contributing to higher sales volumes.

Higher disposable incomes can lead to changes in lifestyle and consumption habits. Consumers may be more inclined to dine out at restaurants or purchase beverages from convenience stores, where carbonated soft drinks are often readily available. This shift toward convenience consumption further boosts demand for these beverages. Companies in the region are continuously innovating to meet the changing needs and preferences of consumers, ensuring the market remains dynamic and competitive.

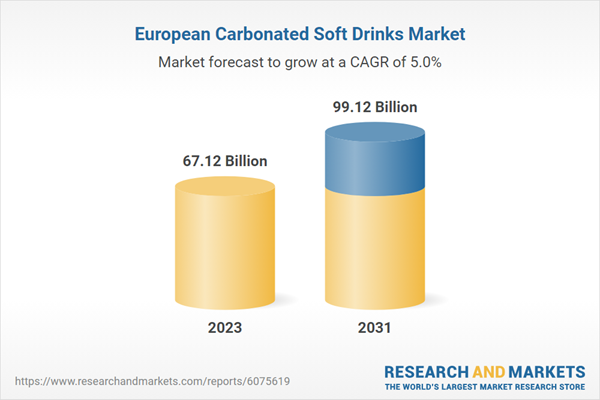

Europe Carbonated Soft Drinks Market Revenue and Forecast to 2031 (US$ Million)

Europe Carbonated Soft Drinks Market Segmentation

The Europe carbonated soft drinks market is categorized into flavor type, category, packaging type, end user, and country.Based on flavor type, the Europe carbonated soft drinks market is segmented into cola, orange, lemonade, ginger, and others. The cola segment held the largest Europe carbonated soft drinks market share in 2023.

In terms of category, the Europe carbonated soft drinks market is bifurcated into sugar-free and conventional. The conventional segment held a larger Europe carbonated soft drinks market share in 2023.

By packaging type, the Europe carbonated soft drinks market is bifurcated into bottles and cans. The bottles segment held a larger Europe carbonated soft drinks market share in 2023.

Based on end user, the Europe carbonated soft drinks market is categorized into on-trade and off-trade. The on-trade segment held a larger Europe carbonated soft drinks market share in 2023.

Based on country, the Europe carbonated soft drinks market is categorized into Germany, France, Italy, the UK, Spain, Sweden, the Netherlands, and the Rest of Europe. The Rest of Europe dominated the Europe carbonated soft drinks market share in 2023.

Three Cents Co, The Coca-Cola Co, PepsiCo Inc, Red Bull, Fevertree Drinks Plc, Monster Beverage Corp, Britvic Plc, Keurig Dr Pepper Inc, Refresco Group, and Asahi Group Holdings Ltd are some of the leading companies operating in the Europe carbonated soft drinks market.

Reasons to buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe carbonated soft drinks market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe carbonated soft drinks market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe carbonated soft drinks market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Europe Carbonated Soft Drinks Market include:- Three Cents Co

- The Coca-Cola Co

- PepsiCo Inc

- Red Bull

- Fevertree Drinks Plc

- Monster Beverage Corp

- Britvic Plc

- Keurig Dr Pepper Inc

- Refresco Group

- Asahi Group Holdings Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | February 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 67.12 Billion |

| Forecasted Market Value ( USD | $ 99.12 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 11 |