Speak directly to the analyst to clarify any post sales queries you may have.

The market for roofing shingles in the U.S. has grown significantly in recent years due to several reasons, such as increasing residential construction activities, growing demand for long-lasting and aesthetically pleasing roofing solutions, and growing awareness of eco-friendly and energy-efficient roofing solutions. The market has grown across several segments, including type, application, and end user.

Manufacturers in the U.S. roofing shingles market are turning to advanced methods to satisfy the rising demand for durable and high-quality roofing products. For instance, according to IKO Industries, Inc., in 2024, the introduction of computer-controlled systems in shingle manufacturing plants has greatly improved product uniformity in terms of raw material use, shingle weight, product dimensional control, and appearance. Furthermore, to cater to the growing need for environmentally friendly and weatherproof roofing materials across a range of consumer groups, the market is crucial for improving the durability and appeal of buildings.

UNITED STATES ROOFING SHINGLES MARKET TRENDS

The Rise of Smart Roofing

There is a rising demand for smart roofing as a smart roof is a high-tech roofing system designed to adapt, optimize, and perform better than traditional materials. According to RoofCrafters Roofing in March 2025, Smart roofing solutions include sensors, monitoring systems, and solar roof tiles with built-in energy-capturing capabilities, which are improving the functionality of roofing shingles. Moreover, the Internet of Things (IoT) is a key player in this revolution in the U.S. roofing shingles market.Increasing M&A’s in the U.S. Roofing Shingles Market

The roofing industry is experiencing a surge in mergers and acquisitions, driven by innovations in material performance, sustainability, and integrated technologies. Leading companies are not only enhancing product durability and aesthetics but are also aligning with broader environmental goals through strategic acquisitions and advanced system offerings. In April 2024, Highland Commercial Roofing, a commercial roofing service provider, acquired Fidelity Roof Company, a well-established, full-service roofing provider operating in the Northern California Bay Area. In June 2024, Peak Roofing acquired Action Roofing. The acquisition of Action Roofing is expected to bring numerous benefits to both companies, including expanded resources, enhanced operational efficiencies, and a broader range of services for customers.Focus on Durable Solutions

The longevity and durability of a roof are pillars in safeguarding a home against the elements, and the choice of roofing materials plays a significant role in this protection. There is a rise in the focus on durable roofing shingles driven by several factors, one of which is the rise of extreme weather events. In 2023, the US experienced 28 separate weather or climate disasters that each resulted in at least USD 1 billion in damage, according to climate.gov in 2024. According to Leaf Home in September 2024, 51% of US homeowners showed interest in weather-related improvements. This shows the growing awareness of durable and weather-resistant materials.U.S. ROOFING SHINGLES MARKET ENABLERS

Rise in Residential Construction

There is a rise in residential construction in the U.S., with housing starts and building permits increasing, though the market faces challenges such as a shortage of skilled labor and high mortgage rates. According to construction coverage in March 2025, the spending on residential construction by January 2025 was USD 944.4 billion, driving the demand for roofing shingles in homes, as roofing solutions are required in residential construction.Rising Demand for Modern Aesthetics and Customization

Residential architectural tastes in the U.S. are changing as a result of the growing demand for modern aesthetic and customized living spaces. Demand for small custom houses with straightforward detailing, simpler exteriors, and fewer materials shot up. According to Homes.com in February 2025, architects around the U.S. reported rising demand for simple homes. According to a report in February 2025, investing in a custom home often leads to a higher property value compared to standard homes. Custom builds reflect unique craftsmanship and quality materials that set them apart from mass-produced houses.Increasing Re-roofing Demand

Roof replacement is a fundamental aspect of maintaining the structural integrity of a home or business. It involves the removal or repair of existing roofing materials and the installation of new ones. Over time, roofs suffer from wear and tear due to environmental factors, including weather conditions and pests, necessitating periodic replacement. Curling shingles, gutter granules, cracked shingles, old homes, and attic lights are the common reasons people go for the option of re-roofing, either roof repair or roof replacement. Companies like Atlas Roofing Corporation, Malarkey Roofing Products, TAMKO Building Products, Inc., and many others provide re-roofing services in the US.INDUSTRY RESTRAINTS

High Production and Installation Cost

While considering roofing replacements or improvements, homeowners continue to place high value on production and installation costs. According to Modernize in 2025, the typical cost of a roof replacement ranges between $5,400 to $19,800. However, that range varies depending on several different factors, including home size, the slope of the roof, and the complexity of installation. High cost depends upon other factors such as material and labor costs.Supply Chain Challenges in the U.S. Roofing Shingles Market

Raw material procurement, transportation disruptions, global dependencies, and market volatility are the supply chain challenges faced by the roofing shingles industry. According to Supply Chain Game Changer in 2024, one of the primary challenges faced by roofing companies is the procurement of raw materials. However, manufacturers and contractors can mitigate the impact of supply chain challenges by adequately planning and ordering materials, exploring alternative options when necessary, and maintaining open communication with clients.SEGMENTATION INSIGHTS

INSIGHTS BY TYPE

The U.S. roofing shingles market by type is segmented into asphalt, tiles, metal, wood, and slate. Asphalt shingles are used in single-family homes, multi-family properties, and commercial buildings due to their affordable price, ease of installation, and performance in different weather conditions. Based on the shingle type, this segment was the major revenue contributor, accounting for more than USD 2.24 billion in 2024. Furthermore, the tile shingles include traditional materials like clay and concrete, as well as emerging innovations such as solar tiles, which have recently gained traction for their energy efficiency. Tile shingles are highly durable and excellent for warmer climates, and were the second-largest segment by revenue in 2024.When it comes to metal shingles, durability, aesthetics, and energy efficiency are the key benefits of metal shingles roofs. The segment is also expected to generate incremental revenue of more than USD 557.4 million in the U.S. roofing shingles market during the forecast period. Furthermore, wood shingles such as timber roof shingles help maintain a stable indoor temperature, reducing the need for heating in winter and cooling in summer. Also, the slate shingles segment is growing significantly as these are durable, offering high resistance to weathering, hail damage, and fire. According to CertainTeed, LLC, high-quality roofing slates can last more than 50 years on a roof when properly installed.

INSIGHTS BY APPLICATION

According to construction coverage in March 2025, every sector of the U.S. economy relies on the construction industry in some capacity. The construction industry's share of the U.S. GDP was 4.5% in 2024, with roofing shingles playing an important role in the new construction growth. However, in 2024, the re-roofing application segment dominated the U.S. roofing shingles market share. Over time, roofs suffer from wear and tear due to environmental factors, including weather conditions and pests, necessitating periodic replacement. Aging roofs contribute to the increased demand for re-roofing. As time passes, roofs can become less effective due to weather damage or simply wear and tear. In some cases, entire roofs may need to be replaced to ensure the safety and structural integrity of the home. Amherst Roofing manufactures asphalt shingles, KTM Roofing with Slate, Synthetic Slate, Asphalt, Tile, and Wood shingles, TAMKO Building Products LLC with asphalt and steel shingle,s are known for manufacturing shingles which can be used for re-roofing.INSIGHTS BY END-USER

The U.S. roofing shingles market by end-user is segmented into residential and commercial. The residential segment is expected to witness significant growth in the adoption of roofing shingles owing to reroofing and the rising construction of new homes and buildings. The residential end-user segment was the major revenue contributor to the roofing shingles in the U.S. market in 2024. Furthermore, roofing shingles are widely used in the commercial sector for maintenance and repair work and are mainly used by contractors. The commercial end-user segment accounted for significant revenue and is expected to grow at a CAGR of 5.3% during the forecast period. There are two popular types of asphalt shingles used for commercial roofs: three-tab and architectural. Three-tab shingles are the most common due to their agreeable price point. These shingles provide straightforward installation and maintenance.GEOGRAPHICAL ANALYSIS

The Southern U.S. holds a majority share of the U.S. roofing shingles market due to its large population base and rapid growth of construction in sectors such as housing, real estate, tourism, and hospitality. Furthermore, the Western U.S. roofing shingles market is expected to grow over 5.5% CAGR during the forecast period. The Western region accounted for a significant share of the market due to the excellent growth potential in multiple end-user industries.The Midwest US roofing shingles market accounted for a significant market share in 2024. The Midwest region includes North Dakota, South Dakota, Ohio, Indiana, Michigan, and other states. They have been the locations driving the growth of the roofing shingles market in the past few years. Furthermore, the Northeast US roofing shingles market accounted for the lowest share of the market share in 2024 and is expected to grow at a CAGR of 5.8% during 2024-2030. The market in this region is anticipated to grow due to the developing of residential and hospitality sectors, which will accelerate the demand for roofing shingles in the coming years.

US ROOFING SHINGLES MARKET VENDOR ANALYSIS

Major companies like GAF Materials LLC, Owners Corning, Certain Teed Corporation, Malarkey Roofing Products, Tamko Building Products, and IKO Industries Ltd. are dominating the U.S. roofing shingles market. As competition intensifies, there is a growing emphasis on innovation, with new product extensions expected to drive growth in the coming years. According to Rockstar Roofing Solutions Limited in 2024, the roofing market has witnessed a significant leap forward with the introduction of innovative technologies. These advancements include silicone roof coatings, drone technology, and solar shingles. They are transforming roofs into more durable, energy-efficient, and cost-effective structures.Key Company Profiles

- GAF Materials LLC

- Owens Corning

- CertainTeed, LLC

- Malarkey Roofing Products

- TAMKO Building Products LLC

- IKO Industries Ltd

Other Prominent Company Profiles

- Atlas Roofing Corporation

- Soprema

- Pacific Coast Building Products, Inc.

- Tarco

- Watkins Sawmills

- Imperial Shake Co Ltd

- Amherst Roofing

- Armour Roof & Dek

- DECRA Roofing Systems, Inc.

- KTM Roofing

- Twelve Roofing

- Hangzhou Singer Building Materials Co., Ltd.

- Isaiah Industries, Inc.

- Roofing World

- Reinke Shakes Metal Shingles

- Western Roofing Systems Inc

- FWAVE

- US Shingle LLC

Segmentation by Type

- Asphalt

- Tiles

- Metal

- Wood

- Slate

Segmentation by Application

- New Construction

- Re-Roofing

Segmentation by End-User

- Residential

- Commercial

Segmentation by Geography

- The U.S.

- South

- West

- Midwest

- Northeast

KEY QUESTIONS ANSWERED

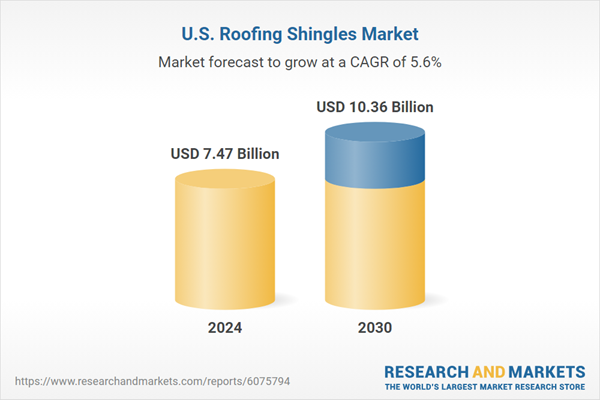

1. What is the growth rate of the U.S. roofing shingles market?2. How big is the U.S. roofing shingles market?

3. Which region dominates the U.S. roofing shingles market share?

4. Who are the key players in the U.S. roofing shingles market?

5. What are the significant trends in the United States roofing shingles market?

Table of Contents

Companies Mentioned

- GAF Materials LLC

- Owens Corning

- CertainTeed, LLC

- Malarkey Roofing Products

- TAMKO Building Products LLC

- IKO Industries Ltd

- Atlas Roofing Corporation

- Soprema

- Pacific Coast Building Products, Inc.

- Tarco

- Watkins Sawmills

- Imperial Shake Co Ltd

- Amherst Roofing

- Armour Roof & Dek

- DECRA Roofing Systems, Inc.

- KTM Roofing

- Twelve Roofing

- Hangzhou Singer Building Materials Co., Ltd.

- Isaiah Industries, Inc.

- Roofing World

- Reinke Shakes Metal Shingles

- Western Roofing Systems Inc

- FWAVE

- US Shingle LLC

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 106 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.47 Billion |

| Forecasted Market Value ( USD | $ 10.36 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 24 |