Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Butyl rubber, in particular, is critical to tire manufacturing and automotive components, supported by the rebound in global vehicle production and infrastructure development. However, crude oil price volatility, as the primary raw material source for n-butylene, continues to pose a major challenge by increasing production costs and impacting margins. Moreover, regulatory efforts to reduce emissions in chemical manufacturing are pushing companies to explore greener alternatives, which could potentially affect long-term market expansion.

Key Market Drivers

Growth in Polymer Industry

The rapid expansion of the polymer industry is a major driver for the global N-butylene market. In India, polymer demand grew by 12% in FY 2022-23, reaching 17.1 million tonnes, according to Reliance Industries Ltd, reflecting post-pandemic recovery in consumer activity. N-butylene plays a crucial role in producing polymer products such as synthetic rubbers and plastics, serving as a key raw material for butene-based polymers like low-density polyethylene (LDPE) and polypropylene (PP). These materials are extensively used in sectors including automotive, packaging, and consumer goods. The shift toward lightweight, durable components in the automotive industry to improve fuel efficiency and sustainability has increased demand for N-butylene. It enhances the mechanical and chemical properties of polymers, making it vital in the production of parts such as dashboards, bumpers, and other interior components, thereby linking polymer industry growth directly with rising N-butylene consumption.Key Market Challenges

Volatility in Raw Material Prices

Fluctuations in crude oil prices represent one of the most critical challenges for the N-butylene market. Since N-butylene is derived from petroleum refining, its production cost is highly sensitive to changes in oil and natural gas prices. Price spikes - triggered by geopolitical events, supply chain disruptions, or global demand shifts - can significantly impact manufacturer margins and pricing strategies. This volatility complicates long-term planning and adds uncertainty across the supply chain. Furthermore, as N-butylene is an input for numerous downstream applications such as butyl rubber and plasticizers, these pricing fluctuations propagate through the value chain, potentially affecting the pricing and availability of end products.Key Market Trends

Technological Advancements in N-Butylene Production

Advancements in production technologies are shaping the future of the N-butylene market. One such innovation is the Lummus Technology CDAlky gasoline alkylation process, a low-temperature sulfuric acid alkylation method that enhances n-butylene isomer formation while minimizing unwanted side reactions. Operating below 0°C, this process reduces acid consumption and improves yield quality. These technological improvements are responding to industry demands for more efficient, economical, and environmentally friendly production methods. As a result, modernized manufacturing approaches are increasing the commercial viability of N-butylene while enabling its use in more advanced applications across synthetic rubbers, polymers, and fuel additives.Key Market Players

- Chevron Philips Chemical Company

- SABIC

- Evonik Industries AG

- CNOOC and Shell Petrochemicals Company Limited

- Shell Chemical LP

- Inner Mongolia China Coal Mengda New Energy and Chemical Co., Ltd.

- Zhonghua Quanzhou Petrochemical Co., Ltd.

- Qinghai Damei Coal Industry Co., Ltd.

- Taizhou Donglian Chemical Co., Ltd.

- PTT Global Chemical Public Company Limited

Report Scope:

In this report, the Global N-Butylene Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:N-Butylene Market, By Sales Channel:

- Direct

- Indirect

N-Butylene Market, By End Use:

- Polymers

- Synthetic Rubber & Elastomer

- Chemicals

- Surfactant

- Detergents

N-Butylene Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global N-Butylene Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Chevron Philips Chemical Company

- SABIC

- Evonik Industries AG

- CNOOC and Shell Petrochemicals Company Limited

- Shell Chemical LP

- Inner Mongolia China Coal Mengda New Energy and Chemical Co., Ltd.

- Zhonghua Quanzhou Petrochemical Co., Ltd.

- Qinghai Damei Coal Industry Co., Ltd.

- Taizhou Donglian Chemical Co., Ltd.

- PTT Global Chemical Public Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

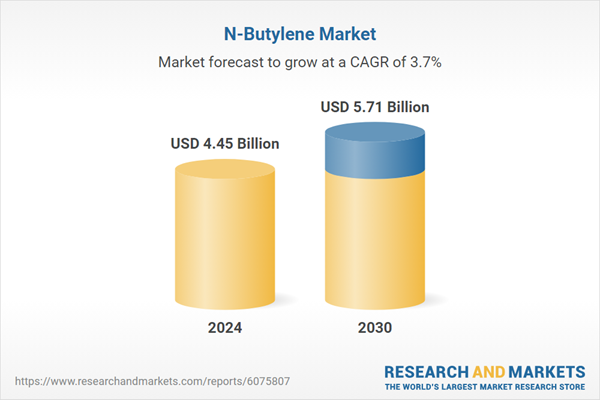

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.45 Billion |

| Forecasted Market Value ( USD | $ 5.71 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |