Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Ongoing technological advancements are also transforming the market, with a growing shift toward smart and energy-efficient machinery integrated with IoT capabilities for real-time monitoring and predictive maintenance. Manufacturers are focusing on sustainability by developing equipment that supports recyclable and bio-based plastics, aligning with environmental regulations and government incentives worldwide. Asia-Pacific dominates the market, driven by rapid industrial growth and manufacturing activity in countries like China, India, and Japan. North America and Europe, although mature markets, continue to invest in precision and eco-friendly technologies. Meanwhile, Latin America and the Middle East & Africa are emerging as new areas of opportunity, fueled by infrastructure growth and rising plastic consumption.

Key Market Drivers

Integration of Smart Manufacturing and Industry 4.0 Technologies

The rising implementation of Industry 4.0 in the plastics sector is a major growth driver for plastics processing machinery. Technologies such as automation, AI, IoT, and robotics are being embedded into production systems to boost efficiency, lower operating costs, and reduce machine downtime. These smart systems allow for real-time data tracking and analytics, enabling manufacturers to adjust settings dynamically and achieve higher precision and consistency in molded or formed parts. Predictive maintenance, facilitated by sensors and IoT connectivity, helps prevent unplanned downtime by identifying wear and performance issues before failures occur. In addition to boosting uptime, smart machinery also enhances energy efficiency and supports sustainability initiatives. The shift toward connected, automated manufacturing systems is helping companies in sectors such as medical devices, electronics, and automotive meet increasingly stringent product quality and compliance requirements.Key Market Challenges

Volatility in Raw Material Prices

Raw material cost fluctuations remain a key challenge for the plastics processing machinery market. Materials like steel, aluminum, and other metal alloys - integral to the construction of plastic processing machines - are subject to global price volatility. This directly impacts manufacturing costs and disrupts pricing strategies. Sharp price surges, such as the over 50% rise in global steel prices between 2020 and 2022, put pressure on profit margins, especially for small and mid-sized manufacturers. Additionally, global events, including geopolitical conflicts and supply chain disruptions, can delay material availability, increase lead times, and hinder production schedules. The unpredictability of energy prices also adds to operational costs, affecting transportation and manufacturing overheads. Although manufacturers are exploring alternative materials and local sourcing strategies to mitigate these risks, raw material instability continues to pose challenges to cost control and production planning.Key Market Trends

Rise in Demand for High-Precision Machinery in Medical and Electronics Sectors

A growing trend in the market is the demand for high-precision plastics processing equipment, especially from the medical and electronics industries. Applications such as diagnostic instruments, drug delivery devices, microelectronic casings, and connectors require components produced to exacting standards with minimal tolerance for error. This has led to a surge in demand for advanced injection molding and micro-molding machines equipped with servo-electric drives, rapid mold cooling systems, and integrated quality inspection capabilities. These machines enable defect-free production in cleanroom environments and support complex mold configurations. In electronics, ongoing miniaturization is prompting investment in compact, accurate molding systems to produce intricate parts. This trend is especially strong in developed markets where regulatory compliance and precision standards are stringent, prompting manufacturers to prioritize investments in cutting-edge, smart, and contamination-controlled equipment.Key Market Players

- Husky Injection Molding Systems Ltd.

- Milacron LLC

- ENGEL Austria GmbH

- Haitian International Holdings Limited

- ARBURG GmbH + Co KG

- Sumitomo Heavy Industries, Ltd.

- The Japan Steel Works, Ltd.

- Chen Hsong Holdings Limited

- KraussMaffei Group

- Nissei Plastic Industrial Co., Ltd.

Report Scope:

In this report, the Global Plastics Processing Machinery Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Plastics Processing Machinery Market, By Machine Type:

- Injection Molding Machines

- Extrusion Machines

- Blow Molding Machines

- Thermoforming Machines

- Others

Plastics Processing Machinery Market, By Plastic Type:

- Thermoplastics

- Thermosets

- Elastomers

- Bioplastics

Plastics Processing Machinery Market, By Application:

- Packaging

- Automotive

- Consumer Goods

- Construction

- Electrical & Electronics

- Medical Devices

- Others

Plastics Processing Machinery Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Plastics Processing Machinery Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Husky Injection Molding Systems Ltd.

- Milacron LLC

- ENGEL Austria GmbH

- Haitian International Holdings Limited

- ARBURG GmbH + Co KG

- Sumitomo Heavy Industries, Ltd.

- The Japan Steel Works, Ltd.

- Chen Hsong Holdings Limited

- KraussMaffei Group

- Nissei Plastic Industrial Co., Ltd.

Table Information

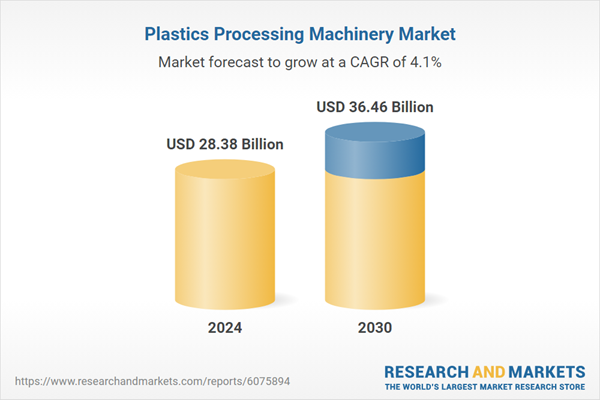

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 28.38 Billion |

| Forecasted Market Value ( USD | $ 36.46 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |