Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The rapid expansion of the foodservice sector is also contributing significantly to demand. Key opportunities for future growth lie in the development of technologically advanced grinders tailored to evolving consumer preferences. Trends such as the rising interest in single-origin coffee, growing demand for fresh-ground coffee, and the adoption of smart grinder technologies are shaping market direction. In a highly competitive landscape, leading companies are leveraging innovation, strategic partnerships, and targeted marketing to differentiate themselves and capture market share.

Key Market Drivers

Increasing Demand for High-Quality Coffee

The growing global demand for superior coffee experiences is a major force driving the commercial coffee bean grinders market. With the rise of specialty coffee culture, establishments like cafés, restaurants, and coffee shops are focusing on grinding fresh beans to preserve flavor and aroma. Unlike pre-ground alternatives, freshly ground coffee retains essential oils, delivering a richer, more aromatic beverage. The popularity of brewing methods like espresso, pour-over, and French press has increased the need for grinders with precise and consistent performance. Burr grinders, favored for their uniform grind sizes, are increasingly preferred over blade models. Furthermore, the influence of the third-wave coffee movement - emphasizing artisanal brewing and ethical sourcing - has intensified the demand for high-performance grinding equipment that can meet exacting quality standards.Expansion of Coffee Shops and Specialty Cafés

The rapid global growth of coffee shops and specialty cafés is further fueling the commercial coffee grinder market. Large chains and independent coffee businesses alike are expanding operations to meet rising demand, necessitating high-capacity, reliable grinders. Urbanization and evolving consumer habits have boosted coffee consumption in workplaces, public spaces, and on-the-go formats such as drive-thru cafés. Many establishments now offer multiple brewing methods, requiring grinders capable of producing a variety of grind sizes with precision. The increasing popularity of niche offerings like nitro cold brew and single-origin espresso has also driven demand for grinders that support specialized coffee preparation. As new cafés and restaurants open globally, the need for dependable grinding solutions will continue to grow.Technological Advancements in Coffee Grinding Equipment

Modern technological advancements are reshaping the commercial coffee bean grinders market. Today's grinders are more sophisticated, featuring automated settings, programmable dosing, and smart digital controls. These features enhance grind accuracy, reduce operator error, and increase operational efficiency. Advanced burr mechanisms, digital interfaces, and real-time monitoring systems enable precise control over grind size and consistency. Some models now offer integrated dosing scales and automated timers to reduce waste and ensure uniform servings. In addition, quieter, energy-efficient designs are gaining popularity, especially in customer-facing environments like cafés where ambiance matters. These improvements not only support better coffee quality but also align with sustainability goals and cost management objectives for businesses.Key Market Challenges

High Initial Investment and Maintenance Costs

Commercial-grade coffee grinders, particularly premium burr models with advanced features, can be cost-prohibitive for smaller cafés and restaurants. The upfront cost of high-quality machines often exceeds several thousand dollars, posing a significant barrier for budget-conscious establishments. Beyond the purchase price, regular maintenance is necessary to preserve grind quality and equipment longevity. Cleaning routines, burr replacements, and periodic servicing contribute to ongoing expenses. Some grinders require specialized technicians for maintenance, further increasing costs. These factors can deter small and mid-sized businesses from investing in top-tier grinders, despite the long-term benefits in performance and customer satisfaction.Market Saturation and Intense Competition

As the coffee industry continues to grow, so does competition among grinder manufacturers. The market is saturated with numerous brands offering similar features across different price points. Leading companies like Mahlkönig, Mazzer, and Baratza compete by frequently launching upgraded models, but smaller or cost-effective brands are also entering the market with more affordable alternatives. This has created a fragmented and competitive landscape, where businesses must carefully weigh product quality against cost. In saturated markets, standing out through innovation becomes increasingly difficult, and customer loyalty is harder to maintain as alternatives are widely available.Key Market Trends

Rise in Demand for Precision Grinding and Consistency

A major trend shaping the commercial coffee grinder market is the rising demand for highly precise and consistent grinding. As coffee drinkers become more discerning, establishments are investing in grinders that ensure uniform particle sizes and customizable grind settings tailored to various brewing techniques. Advanced burr technologies, including flat and conical burrs with micrometric or stepless adjustments, are becoming standard among premium models. These features support fine-tuning for methods such as espresso, pour-over, and cold brew. Additionally, automated features like timed grinding and dosing scales help maintain consistency across multiple servings, improve workflow, and reduce waste. For high-volume establishments, these capabilities are essential to meet quality expectations and maintain operational efficiency.Key Market Players

- Ali Group S.r.l.

- Breville Group Ltd.

- Bunn O Matic Corp.

- Schaerer AG

- Compak Coffee Grinders SA

- Electrolux Professional AB

- Food Equipment Technologies Co.

- Hemro AG

- Kaapi Machines India Pvt. Ltd.

- La Marzocco Srl

Report Scope:

In this report, the global Commercial Coffee Bean Grinders Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Commercial Coffee Bean Grinders Market, By Grinding Capacity:

- Low (less than 100 pounds per hour)

- Medium (100-500 pounds per hour)

- High (over 500 pounds per hour)

Commercial Coffee Bean Grinders Market, By Purpose:

- Espresso

- Drip Coffee

- French Press

- Cold Brew

Commercial Coffee Bean Grinders Market, By Application:

- Cafes

- Restaurants

- Bakeries

- Home Use

- Others

Commercial Coffee Bean Grinders Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global Commercial Coffee Bean Grinders Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ali Group S.r.l.

- Breville Group Ltd.

- Bunn O Matic Corp.

- Schaerer AG

- Compak Coffee Grinders SA

- Electrolux Professional AB

- Food Equipment Technologies Co.

- Hemro AG

- Kaapi Machines India Pvt. Ltd.

- La Marzocco Srl

Table Information

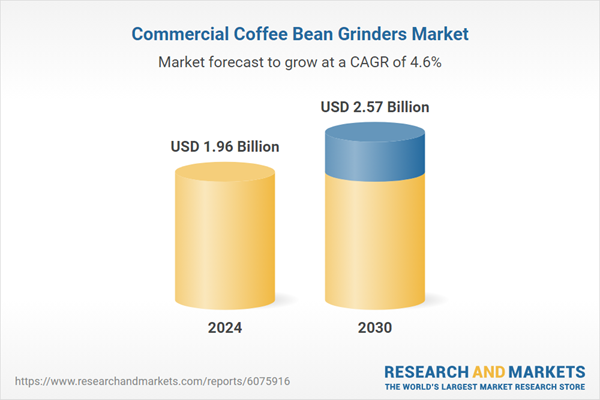

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.96 Billion |

| Forecasted Market Value ( USD | $ 2.57 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |