Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market growth is largely driven by increasing environmental regulations and the push for sustainable industrial practices. Magnesium hydroxide is widely utilized for flue gas desulfurization in power plants and industrial setups to control sulfur dioxide emissions. Its application as a neutralizing agent in wastewater treatment has gained momentum, especially in developing economies striving for regulatory compliance. Additionally, its role as a halogen-free flame retardant has grown significantly in plastics and rubber, particularly with increased demand from the construction, automotive, and electronics sectors where fire resistance is essential.

Key Market Drivers

Growth in Automotive Industry

The expanding global automotive industry is a major growth driver for the magnesium hydroxide market. In 2024, global automobile sales rose to around 78 million units, with China maintaining its position as the largest market, contributing roughly 25.8 million vehicle sales in 2023. Despite temporary sales slumps driven by pandemic-related disruptions and supply shortages, the sector is rebounding. Automakers are under growing pressure to meet stringent safety and environmental standards while enhancing fuel efficiency.Magnesium hydroxide is increasingly utilized as a flame retardant in vehicle interior components, wiring insulation, and under-the-hood applications. The shift toward lightweight vehicles - facilitated by the use of polymer composites, magnesium alloys, and aluminum - further supports demand for magnesium hydroxide, which enhances the fire safety of these materials. A reduction of just 10% in vehicle weight can improve fuel efficiency by 6% to 8%, making magnesium hydroxide a valuable material in eco-conscious vehicle manufacturing.

Key Market Challenges

Volatility in Raw Material Prices

The magnesium hydroxide market is challenged by unpredictable fluctuations in raw material prices, particularly magnesite and seawater-derived magnesium compounds. These materials are essential to magnesium hydroxide production, and price instability - caused by geopolitical disruptions, regulatory restrictions on mining, and energy cost surges - poses significant hurdles for manufacturers. Countries like China and Turkey, key sources of these raw materials, are often subject to political and regulatory uncertainties, complicating procurement. Moreover, high energy consumption in processing and transportation inflates operational expenses. This price volatility impairs long-term supply agreements and financial planning for manufacturers and end users, especially in cost-sensitive downstream industries.Key Market Trends

Growing Use of Magnesium Hydroxide in Flame Retardants

A prominent trend in the market is the rising adoption of magnesium hydroxide in flame-retardant applications, driven by regulatory mandates and the shift away from toxic halogenated compounds. Its non-corrosive, inert properties make it a preferred flame retardant across multiple industries. In sectors such as cable manufacturing, construction, and consumer electronics, magnesium hydroxide offers thermal stability, smoke suppression, and recyclability - key features aligned with fire safety and environmental goals. Products such as those offered by Magnifin demonstrate the efficacy of magnesium hydroxide in meeting these stringent requirements. This trend is expected to gain further momentum as industries increasingly prioritize safer, sustainable, and performance-driven materials to meet evolving regulatory standards.Key Market Players

- Dingxi KMT Co Ltd.

- Martin Marietta Magnesia Specialties

- The Dow Chemical

- Barcroft Co.

- National Refractories & Minerals Corp.

- SPI Pharma Inc.

- Qinghai Western Magnesium Industry Co., Ltd

- Shandong Chenxu New Material Co., Ltd.

- Dalian Futai Mineral New Materials Technology Co., Ltd.

- Shandong Runfu Ca Mg Chemical Technology Co., Ltd.

Report Scope

In this report, the Global Magnesium Hydroxide Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Magnesium Hydroxide Market, By Sales Channel:

- Direct

- Indirect

Magnesium Hydroxide Market, By End Use:

- Wastewater Treatment

- Flame Retardant

- Pharmaceuticals

- Construction

- Automotive

- Others

Magnesium Hydroxide Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Magnesium Hydroxide Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dingxi KMT Co Ltd.

- Martin Marietta Magnesia Specialties

- The Dow Chemical

- Barcroft Co.

- National Refractories & Minerals Corp.

- SPI Pharma Inc.

- Qinghai Western Magnesium Industry Co., Ltd

- Shandong Chenxu New Material Co., Ltd.

- Dalian Futai Mineral New Materials Technology Co., Ltd.

- Shandong Runfu Ca Mg Chemical Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

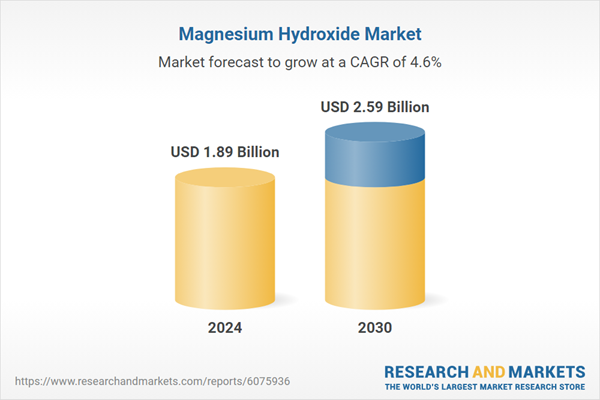

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.89 Billion |

| Forecasted Market Value ( USD | $ 2.59 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |