Moreover, pet insurance coverage is gradually expanding to include advanced diagnostic tests and treatments, which is further encouraging owners to opt for specialized care. The market is also gaining momentum with the growing presence of veterinary specialists, expanding infrastructure in animal healthcare, and rising R&D investments aimed at improving cardiology outcomes in companion animals. With the convergence of veterinary medicine and technology, the industry is undergoing a rapid transformation that is redefining how heart conditions in animals are diagnosed, monitored, and treated.

This growth is driven by a rising number of pets with heart disease and advancements in diagnostic and treatment methods. Minimally invasive procedures, such as balloon valvuloplasty and pacemaker implantation, are gaining popularity due to reduced risks and quicker recovery times. Newer medications like pimobendan, ACE inhibitors, and beta-blockers are also helping extend the lifespan of pets diagnosed with heart conditions.

The market is divided into pharmaceuticals and diagnostics. The pharmaceuticals segment generated USD 1.5 billion in 2023. This notable performance is mainly attributed to ongoing innovation in treatment protocols and a growing incidence of cardiovascular conditions in senior pets. There is a rising demand for medications that can regulate heart function, manage fluid buildup, and control blood pressure in animals, leading to increased investments and product development in this space.

The companion animal segment in the veterinary cardiology market held a 71.1% share in 2024. This category, which includes dogs, cats, and other domestic pets, continues to dominate due to increasing adoption rates and the higher likelihood of pets developing heart issues as they age. Pet owners today are far more conscious about the early detection of diseases, prompting them to pursue specialized cardiology services. Advanced diagnostics such as echocardiograms and electrocardiograms (ECGs) are seeing growing demand.

North America Veterinary Cardiology Market held a 41% share in 2024. The region’s dominance is supported by a large population of companion animals, advancements in diagnostic tools, and the expansion of specialty veterinary hospitals. The U.S. market, in particular, is seeing growing integration of artificial intelligence and wearable heart monitors, which are changing how cardiac health is monitored in pets.

Major players involved in the veterinary cardiology market include TriviumVet, ESAOTE, Bionet America, Medtronic, Jurox, Siemens Healthineers, Fujifilm, Zoetis, Antech Diagnostics, General Electric Company, IDEXX, Merck, Boehringer Ingelheim International, Ceva, and GSK among others. Companies are focusing on innovative product development, introducing advanced diagnostic tools like echocardiograms and catheter-based therapies. Strategic collaborations with veterinary clinics, research bodies, and tech firms are helping them expand their reach and influence across global markets.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Veterinary Cardiology market report include:- Antech Diagnostics

- Boehringer Ingelheim International

- Jurox

- Ceva

- Merck

- IDEXX

- General Electric Company

- FUJIFILM

- ESAOTE

- Medtronic

- Siemens Healthineers

- TriviumVet

- Zoetis

- Bionet America

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | April 2025 |

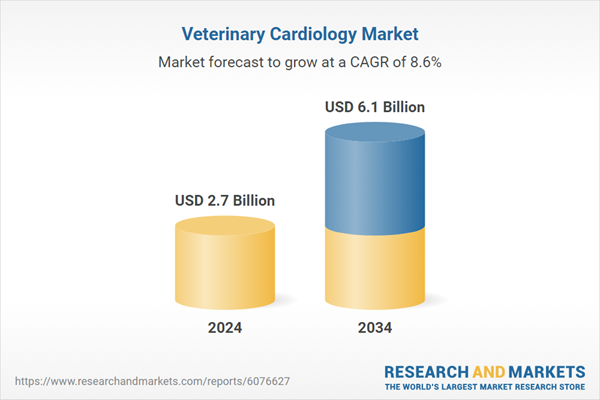

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |