The market is also benefitting from the growing trend of integrating digital imaging, AI-powered modeling software, and biocompatible printing materials, offering veterinarians access to tools that deliver faster recovery, improved mobility, and better quality of life for their patients. Increasing awareness among pet owners regarding advanced treatment options and the expanding role of veterinary specialists are accelerating the adoption of 3D printing in clinical practices. As the industry moves toward more customized, efficient, and minimally invasive interventions, veterinary 3D printing continues to carve a strong niche across orthopedics, dentistry, oncology, and education-based surgical simulations.

The market is categorized into various product types, including implants, prosthetics, anatomical models, and others. Among these, the implants segment leads the market with a strong revenue share, largely due to the surging demand for customized orthopedic 3D-printed solutions for both pets and livestock. These implants - ranging from bone plates and screws to prosthetics - offer greater surgical precision, shorten operation times, and support faster recovery. A growing number of pets suffering from fractures and degenerative joint diseases is further fueling the segment’s growth.

Based on animal type, the market is segmented into companion animals and livestock. The companion animals segment accounted for 73.8% of the global share in 2024. Increased demand for tailored veterinary care, including 3D-printed prosthetics, implants, and surgical guides, is pushing this segment forward. Dogs and cats, in particular, are benefiting from innovations that help restore mobility, enhance treatment accuracy, and speed up post-op recovery.

North America held a dominant 39.1% share of the global Veterinary 3D Printing Market in 2024 and is anticipated to grow at a CAGR of 9.8% from 2025 to 2034. The U.S. is leading regional growth, driven by the large pet population and continuous advancements in veterinary healthcare technologies. AI-enabled 3D modeling and the growing use of biocompatible materials are reshaping treatment protocols in clinics and hospitals. The expanding footprint of specialty veterinary hospitals and research institutions is contributing to the broader adoption of 3D printing in clinical practice.

Key players in the market include Med Dimensions, Ortho Vet 3D, Vimian, bio3Dvet, 3D Systems, OrthoDesigns, WhiteClouds, CABIOMEDE Vet, WIMBA, 3D Pets (DiveDesign LLC), r3volutionD, and Novus Life Sciences. These companies are focused on expanding their technological capabilities and forming strategic partnerships with veterinary clinics to deliver advanced, customized care solutions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Veterinary 3D Printing market report include:- 3D Pets (DiveDesign LLC)

- 3D Systems

- bio3Dvet

- CABIOMEDE Vet

- Med Dimensions

- Novus Life Sciences

- OrthoDesigns

- Ortho Vet 3D

- r3volutionD

- Vimian

- WhiteClouds

- WIMBA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | April 2025 |

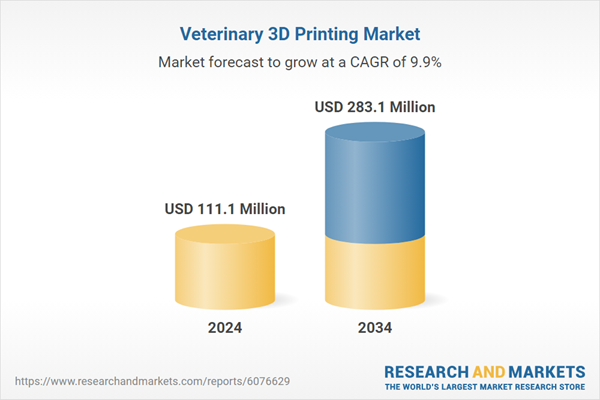

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 111.1 Million |

| Forecasted Market Value ( USD | $ 283.1 Million |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |

![3D Printing Market by Offering (Printers, Materials, Software, Services), Technology [Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective Laser Sintering (SLS)], Process, Application, Vertical - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12731/12731683_60px_jpg/3d_printing_market.jpg)