As logistics and retail sectors focus on waste reduction and enhanced supply chain sustainability, reusable paper and cardboard options are quickly becoming essential. The market is also witnessing a notable boost in adoption from the food and beverage industry, where regulatory pressure and consumer demand for green alternatives have intensified. With a greater emphasis on durability, recyclability, and reusability, manufacturers are investing in advanced technologies and materials to extend the lifecycle and performance of their packaging solutions.

Key factors driving this market growth include the rising demand from the fast-moving consumer goods (FMCG) sector, tightening government regulations on packaging waste, and the growing use of corrugated packaging in industries such as automotive and pharmaceuticals. As awareness of environmental sustainability continues to grow, demand for eco-friendly and reusable packaging solutions has seen a major surge. Companies across sectors are prioritizing cost-effective, environmentally responsible packaging options over conventional alternatives. This shift is particularly evident in emerging economies, where urban migration, higher disposable incomes, and changing consumer preferences toward green products are fueling market expansion.

The market for reusable cartons and boxes was valued at USD 44 billion in 2023 and continues to play a central role in shaping the overall growth of reusable packaging solutions. Businesses are actively exploring sustainable alternatives, pushing the demand for durable, collapsible, and long-lasting packaging formats. As industries like e-commerce and FMCG strive to meet waste management regulations and minimize their environmental footprint, the adoption of reusable packaging has accelerated significantly.

Based on material type, the market is segmented into kraft paper, molded fiber, recycled paper, and cardboard, among others. The kraft paper segment is forecasted to reach USD 116.8 billion by 2034, driven by its essential role in reducing carbon emissions and supporting environmental policies. Kraft paper is now widely used for void filling, packaging bags, and wrapping applications, with recent enhancements like water-resistant coatings and reinforced strength expanding its appeal across food, retail, and industrial sectors.

The U.S. Reusable Paper and Cardboard Packaging Market is anticipated to reach USD 85 billion by 2034. This growth is propelled by rising consumer demand, growing aversion to plastic waste, and government support for circular economy initiatives. Corporate efforts to integrate sustainability into core business operations are further reinforcing the shift toward eco-friendly packaging.

Key market players include Amcor, DS Smith, Huhtamaki, International Paper, and WestRock. These companies are strengthening their competitive positioning through strategic partnerships, investments in green innovation, and product enhancement initiatives. By incorporating advanced materials and technologies, they are improving packaging performance, making reusable paper and cardboard packaging more adaptable and efficient across diverse applications.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Reusable Paper And Cardboard Packaging market report include:- Amcor

- Billerud

- Cascades

- DS Smith

- Georgia-Pacific

- Graphic Packaging

- Holmen

- Hood Packaging

- Huhtamaki

- International Paper

- Klabin

- Lee & Man Paper Manufacturing

- Mayr-Melnhof Karton

- Mondi

- Nine Dragons Paper

- Oji Holdings

- Packaging Corporation of America

- Pratt Industries

- Rengo

- Smurfit Kappa

- Sonoco Products

- Stora Enso

- Svenska Cellulosa Aktiebolaget

- WestRock

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

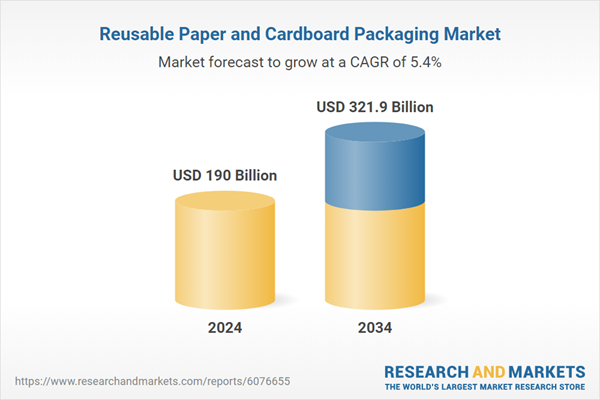

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 190 Billion |

| Forecasted Market Value ( USD | $ 321.9 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |