This market is witnessing transformative shifts, particularly due to evolving consumer lifestyles, increased awareness of electrical safety, and growing support from government policies promoting smarter and safer living spaces. Additionally, climate change concerns and the global push toward energy-efficient residential infrastructure are driving the demand for innovative circuit breaker technologies. The integration of solar panels and home EV charging stations is also playing a key role in elevating the need for more reliable and digitally enhanced circuit protection systems. These ongoing trends are expected to shape the competitive landscape, making residential circuit breakers an indispensable element of future-ready electrical grids.

Several factors drive this market, including rapid urbanization, increased energy consumption, and rising concerns over electrical safety. As electricity consumption increases with modern lifestyles, the need for effective circuit protection systems becomes essential. Additionally, building codes and safety regulations continue to shape the demand for residential circuit breakers. Increasing adoption of smart home technologies, such as IoT-enabled breakers, contributes to market growth as consumers seek enhanced monitoring and control of their electrical systems.

The market is further supported by the growing integration of renewable energy systems and home automation technologies. While this presents growth opportunities, challenges such as counterfeit products, supply chain disruptions, and fluctuating raw material costs can hinder market expansion. Despite these challenges, the ongoing growth in global infrastructure and residential construction projects underscores the importance of circuit breakers in ensuring safe and reliable electrical systems in homes. This positions the residential circuit breaker market as a vital segment within the broader electrical equipment industry.

Miniature circuit breakers (MCBs) lead the market due to their affordability, user-friendliness, and advanced protective features and are expected to generate USD 9 billion by 2034. Molded case circuit breakers (MCCBs) are also gaining traction in residential settings due to their added protection and durable features. Air circuit breakers (ACBs), commonly used in industrial environments, are now being integrated into high-end residential and smart home systems. The incorporation of digital monitoring and remote-control functionalities is boosting the appeal of these products by enhancing safety and operational efficiency.

The outdoor installation segment held a 62% share in 2024 and is expected to grow at a CAGR of 8.5% through 2034. While indoor circuit breakers dominate residential electrical panels due to space-saving and safety features, outdoor installations are becoming increasingly popular, driven by the demand for smart home technologies that allow homeowners to monitor power consumption and identify electrical faults remotely.

U.S. Residential Circuit Breaker Market generated USD 1.16 billion in 2024. This growth is attributed to a surge in housing construction, stricter electrical safety regulations, and greater adoption of smart home technologies. The market is projected to generate USD 2 billion by 2034, benefiting from innovations in energy-efficient and IoT-enabled breakers, especially for renewable energy systems and electric vehicle charging stations.

Major companies operating in the residential circuit breaker industry include Mitsubishi Electric, GE, Hitachi, Schneider Electric, ABB, C&S Electric, L&T Electrical & Automation, Eaton, Rockwell Automation, Legrand, Fuji Electric, Siemens, LS Electric, WEG, Chint Electric, and Socomec. To strengthen their market presence, companies focus on product innovation, such as integrating IoT capabilities and enhancing energy-efficient solutions. Partnerships with technology firms enable the development of advanced, smart circuit breakers. Companies are also working to streamline their supply chains and improve production efficiency to keep pace with growing demand.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Residential Circuit Breaker market report include:- ABB

- Chint Electric

- C&S Electric

- Eaton

- Fuji Electric

- GE

- Hitachi

- L&T Electrical & Automation

- Legrand

- LS Electric

- Mitsubishi Electric

- Rockwell Automation

- Schneider Electric

- Siemens

- Socomec

- WEG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | April 2025 |

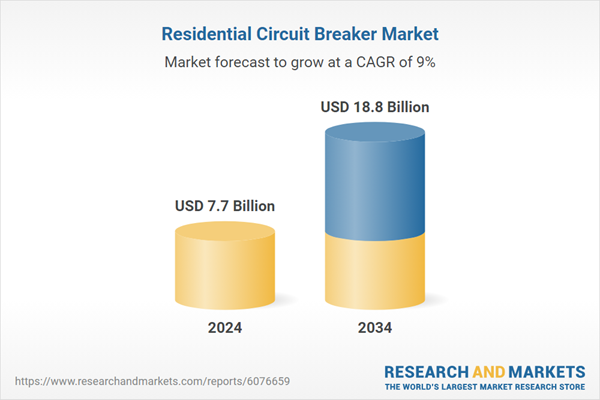

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.7 Billion |

| Forecasted Market Value ( USD | $ 18.8 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |