Ongoing regulatory reforms and global sustainability targets are compelling the industry to prioritize green technologies. Equipment powered by hybrid or electric systems reduces fuel usage and lowers emissions-related costs. At the same time, the addition of battery innovations and renewable energy installations is helping accelerate the adoption of cleaner technologies across mining operations. Government-backed funding and strict environmental rules are further pushing mining companies to invest in advanced, efficient machinery that aligns with future sustainability goals. The industry's overall transition toward digitization and cleaner energy sources is driving manufacturers to offer solutions that address performance, reliability, and emissions reduction simultaneously.

In terms of equipment type, the market is categorized into haul trucks, excavators, drills and breakers, loaders and dozers, and others. Haul trucks held the largest share in 2024, accounting for 32% of the overall market. This segment is projected to exceed USD 38 billion by 2034. The growing use of electric and autonomous haul trucks is enhancing productivity while lowering fuel dependency. These trucks now feature AI-driven systems for better fleet management, and advanced telematics allow for predictive maintenance and optimized routing. Operators are rapidly adopting these models to meet both their operational efficiency goals and environmental targets.

On the basis of application, the mobile mining equipment market is segmented into metal mining, coal mining, and mineral mining. The metal mining segment led the market in 2024 with a share of 41%. With demand for essential minerals such as lithium, copper, and nickel rising, especially due to global electrification trends, companies are adopting newer, automated methods to maximize resource recovery. The adoption of advanced extraction technologies and digital tracking systems is also improving yield rates and reducing inefficiencies in metal extraction activities.

By power source, the market is segmented into diesel, electric, and hybrid. Diesel-powered equipment accounted for 81% of the global share in 2024. These machines continue to dominate due to their reliability, energy density, and ability to operate in off-grid or extreme environments. While cleaner diesel technologies are making progress by reducing harmful emissions, diesel engines still provide unmatched performance for high-power, long-duration applications. Many remote operations still rely on diesel due to the lack of infrastructure needed to support full electrification.

Looking at the end-user segmentation, the market includes mining companies, equipment rental firms, contract miners, and government or regulatory bodies. Mining companies led the market in 2024 by leveraging automation, digital tools, and smart machinery to improve profitability and reduce manual labor costs. They are also forming collaborations with OEMs and software providers to use AI-based fleet systems and predictive maintenance, helping them reduce downtime and increase resource efficiency. These advancements are making mining operations more scalable and less prone to disruption.

Meanwhile, contract miners are experiencing growing demand as mining projects increasingly opt for outsourced solutions. From operating equipment to full-scale project execution, contract miners are benefiting from their ability to deploy technology-driven, cost-efficient solutions. Their agility in incorporating digital tools into contract-based mining operations is helping them secure larger, long-term deals.

Regionally, Asia Pacific leads the global mobile mining equipment market with a share of approximately 47%, with China contributing USD 13.3 billion in 2024 alone. The region benefits from rapid industrialization and strong partnerships between local and global equipment manufacturers. Automation and AI integration are central to fleet modernization efforts, which are being supported by the rising demand for environmentally compliant solutions. The accelerated replacement of outdated diesel machinery with electric and hybrid alternatives reflects the growing emphasis on sustainable mining practices in this region.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Mobile Mining Equipment market report include:- Austin Engineering

- Bell Equipment

- Caterpillar

- Doosan Bobcat

- Epiroc

- Hitachi Construction Machinery

- JCB

- John Deere

- Kennametal

- KGHM Zanam

- Komatsu

- Konecranes

- Liebherr

- Metso Outotec

- Sandvik

- Sany

- Terex

- Vipeak Mining Machinery

- Volvo Construction Equipment

- XCMG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

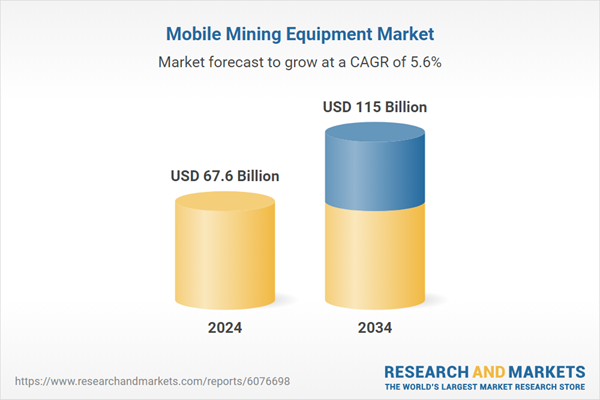

| Estimated Market Value ( USD | $ 67.6 Billion |

| Forecasted Market Value ( USD | $ 115 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |