As consumer expectations for smarter, more responsive devices continue to rise, manufacturers are integrating MEMS technology to elevate user experiences and enable real-time analytics. Additionally, the rapid evolution of Industry 4.0, growing investments in electric vehicles, and the expanding footprint of the Internet of Things (IoT) ecosystem are reinforcing the role of MEMS sensors in reshaping technological infrastructures. Global OEMs are also focusing on multi-functional sensor integration to enhance device efficiency and minimize component redundancy, further boosting market growth.

MEMS sensors play an increasingly critical role in both consumer electronics and automotive applications. In the automotive sector, the growing demand for advanced driver-assistance systems (ADAS) and safety technologies is fueling the integration of MEMS sensors. These systems rely on precise and real-time data, and MEMS sensors ensure accuracy and responsiveness as global regulations around automotive safety tighten. In electronics, MEMS sensors enhance device performance by enabling features like gesture recognition, motion tracking, and environmental monitoring, thus aligning with consumer expectations for intelligent, multifunctional gadgets.

The materials used in manufacturing MEMS sensors include silicon, polymers, ceramics, and metals. Among these, silicon continues to dominate, with the segment projected to generate USD 16.9 billion by 2034. Silicon’s compatibility with CMOS fabrication processes, along with its superior mechanical and thermal stability, makes it a preferred material across high-performance applications. Its adoption is expanding rapidly in healthcare, wearables, and consumer electronics as demand for lightweight, durable components increases.

The market is segmented by sensor types such as inertial sensors, pressure sensors, microphones, environmental sensors, optical sensors, and ultrasonic sensors. Inertial sensors alone accounted for USD 3.7 billion in 2024, with applications spanning industrial automation, robotics, drones, and automotive systems, including self-driving vehicles. These sensors are vital for motion detection, orientation, and stabilization, key requirements for emerging smart technologies.

The U.S. MEMS sensors market is on an upward trajectory, projected to reach USD 3.84 billion by 2034. Growth in the U.S. is attributed to increasing deployment across aerospace, defense, healthcare, and autonomous systems. Progress in AI, robotics, and medical innovations further reinforces demand. Leading players such as Robert Bosch GmbH, STMicroelectronics, Broadcom Inc., Texas Instruments, and Qorvo Inc. are focusing on expanding product lines, advancing R&D, and forming strategic alliances to strengthen their global market presence.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this MEMS Sensors market report include:- Robert Bosch GmbH

- STMicroelectronics

- Broadcom Inc.

- Texas Instruments

- Qorvo Inc.

- Goertek Inc.

- Hewlett Packard Enterprise Development LP

- TDK Corporation

- Knowles Electronics LLC

- Infineon Technologies AG

- Honeywell International

- Analog Devices Inc.

- Murata Manufacturing Co. Ltd.

- Teledyne DALSA

- Sony Semiconductor

- X-FAB Silicon Foundries

- Tower Semiconductor

- TSMC (Taiwan Semiconductor Manufacturing Company)

- United Microelectronics Corporation (UMC)

- Safran Sensing Technologies Norway AS

- MEMS Engineering Limited

- Redbud Labs

- USound

- Windfall Bio

- ZERO POINT MOTION LTD.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | April 2025 |

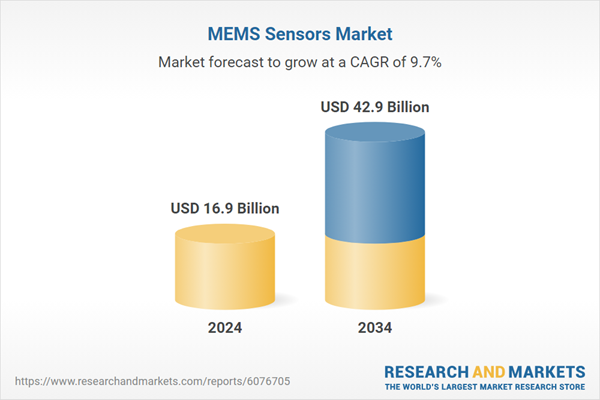

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 16.9 Billion |

| Forecasted Market Value ( USD | $ 42.9 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |