Ongoing technological advancements, combined with supportive regulatory frameworks, are making ablation devices more accessible and affordable. Governments and healthcare bodies are also recognizing the role of ablation technologies in reducing hospital stays and overall treatment costs, which is accelerating their integration into mainstream care. Additionally, the rise in outpatient procedures and the push toward personalized healthcare have opened new avenues for product innovation and patient-specific treatment planning. As the demand for precision medicine increases, manufacturers are investing heavily in R&D to bring smarter, safer, and more adaptable ablation solutions to market.

Ablation devices are specialized medical instruments designed to remove or destroy abnormal tissues through focused energy delivery. These devices play a critical role in offering precise and controlled treatment options with minimal damage to surrounding healthy tissue. The market features a broad range of technologies, including radiofrequency, laser/light, ultrasound, cryoablation, and more- each with unique advantages based on clinical needs and patient profiles.

The radiofrequency devices segment held a dominant 49.2% share of the global ablation devices market in 2024 and is expected to maintain this lead in the years ahead. This stronghold is largely attributed to the technology’s growing use in treating chronic conditions like cancer and cardiac arrhythmias. Radiofrequency ablation (RFA) is widely recognized for its minimally invasive nature and high treatment efficacy, making it a preferred choice among physicians. Continued advancements in RFA technology, including more precise targeting and enhanced safety profiles, are further driving adoption.

Ablation devices are widely used in various medical applications, including cardiology, oncology, gynecology, urology, ophthalmology, and cosmetic surgery. In 2024, the cardiology segment alone generated USD 4.5 billion, driven by a rising elderly population and the growing demand for non-invasive cardiac treatments. Early diagnosis supported by advanced imaging technologies has empowered patients to pursue timely treatment, while strong physician recommendations continue to boost procedure volumes in both urban and rural healthcare settings.

The U.S. Ablation Devices Market is projected to reach USD 8.9 billion by 2034. The U.S. FDA’s fast-track approval processes and favorable Medicare and private insurer reimbursement policies have significantly enhanced patient access and encouraged providers to broaden their treatment offerings.

Key players in the global ablation devices industry include CONMED Corporation, Medtronic, Boston Scientific Corporation, Johnson & Johnson, Smith & Nephew plc, Olympus Corporation, Biosense Webster, Inc., AngioDynamics, Inc., Abbott Laboratories, and Varian Medical Systems Inc. These companies are focused on strategic growth through partnerships, acquisitions, and the launch of next-gen technologies like pulsed-field ablation systems. By collaborating with research institutions and investing in advanced device development, they aim to deliver safer, more effective ablation solutions and strengthen their global footprint.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Ablation Devices market report include:- Abbott Laboratories

- Alcon Laboratories

- Angiodynamics

- Atricure

- Bausch & Lomb

- Biotronik

- Boston Scientific

- CONMED

- Elekta

- Ethicon

- Medtronic

- Olympus

- Varian

Table Information

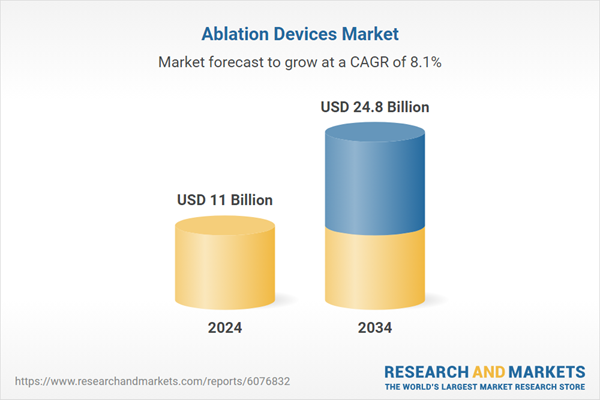

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 11 Billion |

| Forecasted Market Value ( USD | $ 24.8 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |