The evolving landscape of digital retail is also influenced by changing customer expectations for transparency, cost-efficiency, and personalized experiences. On top of that, the growing focus on sustainable vehicle maintenance and rising awareness about the benefits of timely part replacement are further enhancing the demand for online automotive aftermarket services across Europe. A rising number of aging vehicles on the road, extended ownership cycles, and increased DIY repairs have created a perfect storm for market expansion. With more vehicle owners looking to keep their cars running longer without incurring dealership costs, the demand for easy-to-access, affordable parts through online channels is expected to grow stronger.

As internet usage surged across Europe, the trend of buying vehicle parts and accessories online picked up speed. The demand for replacements skyrocketed with the increase in total vehicle count and longer vehicle lifespans. Shoppers quickly realized the benefits of online retail- easy navigation, diverse product selections, and competitive pricing drove them away from traditional stores. The rise of mobile commerce and secure digital payment platforms made it even easier for buyers to compare options, check specs, and receive doorstep delivery. E-commerce platforms with streamlined logistics, extensive inventory, and fast shipping continued to gain traction during the forecast period.

Third-party retailers held a 95.2% market share in 2024 and are expected to expand at a CAGR of 11.8% through 2034. These platforms won customer trust by offering broader inventories, lower prices, and faster deliveries. Their efficient supply chains, quick return policies, and wide distribution networks gave them a competitive edge in the European market.

The B2C segment reached USD 20.4 billion in 2024 and is projected to grow at an 11.8% CAGR by 2034. Consumers preferred direct purchases for better deals and access to a variety of DIY maintenance products. Online channels eliminated middlemen and allowed car owners to perform simple repairs themselves, reducing costs.

The replacement parts segment dominated with a 75.3% share in 2024. High demand for filters, brake components, lighting systems, and drivetrain parts, along with benefits like home delivery, digital catalogs, and warranties, made online purchases more appealing than ever.

Germany alone generated USD 7.1 billion in 2024 and is poised to grow at a CAGR of 11.7% through 2034. The country’s solid automotive ecosystem, digital maturity, and advanced logistics made it a major player in the regional market.

Key players include ZF Friedrichshafen AG, Mekonomen, Bosch, KYB Corporation, DENSO Corporation, Autodoc GmbH, Valeo SA, Continental AG, Magna International, Auto-Teile-Unger (ATU), Euro Car Parts Limited, Amazon, MANN HUMMEL, Aisin Seiki Co., Ltd., and Halfords. These companies are strengthening their presence by enhancing digital platforms, launching user-friendly websites and mobile apps, expanding product offerings, and optimizing last-mile delivery through logistics partnerships. Personalization tools, AI-driven inventory management, and loyalty programs are transforming the customer experience. Brands are also prioritizing local warehousing and multilingual support to address regional preferences across Europe.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Europe E-Commerce Automotive Aftermarket market report include:- Bosch

- DENSO Corporation

- Magna International

- Continental AG

- Aisin Seiki Co., Ltd.

- Valeo SA

- ZF Friedrichshafen AG

- KYB Corporation

- Halfords

- Euro Car Parts Limited

- Mekonomen

- MANN HUMMEL

- Auto-Teile-Unger (ATU)

- Amazon

- Autodoc GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | April 2025 |

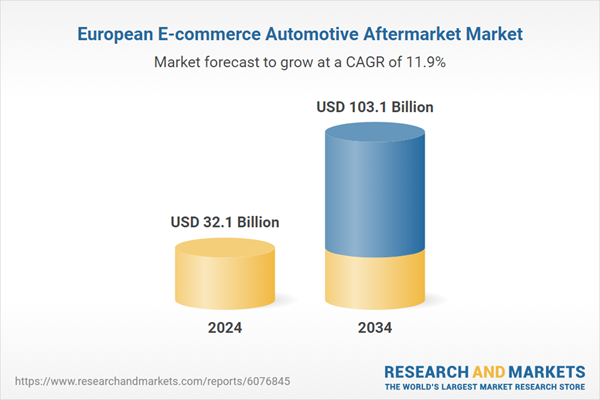

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 32.1 Billion |

| Forecasted Market Value ( USD | $ 103.1 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 16 |