The Chile aquaculture market growth is being driven by the increasing demand for seafood, technological advancements in fish farming, and the country’s favourable geographic and climatic conditions. Aquaculture plays a crucial role in Chile’s economy, contributing significantly to exports and employment. With its extensive coastline and pristine waters, Chile has positioned itself as a leading global producer of farmed seafood, particularly salmon, trout, and shellfish. The market growth is fuelled by the rising global consumption of fish protein, sustainability initiatives, and improvements in aquaculture infrastructure and management.

One of the primary drivers aiding the Chile aquaculture market expansion is the growing preference for seafood as a healthy and sustainable protein source. Consumers worldwide are becoming more health-conscious, leading to increased demand for high-protein, low-fat dietary options. Seafood is recognised for its rich nutritional profile, including omega-3 fatty acids, essential vitamins, and minerals that promote heart health and overall well-being. As a result, the demand for farmed seafood has surged, reinforcing the role of aquaculture in meeting global food security needs. Additionally, Chile’s reputation as a leading salmon producer has positioned it as a key supplier to international markets, particularly in North America, Europe, and Asia.

Technological advancements in aquaculture practices have significantly contributed to the Chile aquaculture market development, enabling higher efficiency, improved fish health management, and sustainability. The adoption of automated feeding systems, real-time water quality monitoring, and genetic improvements in fish stocks has enhanced productivity while minimising environmental impact.

Innovations in recirculating aquaculture systems (RAS) and offshore farming techniques have also played a crucial role in increasing yield and reducing disease outbreaks. Additionally, the use of artificial intelligence and data analytics in aquaculture management has helped optimize feeding schedules, detect early signs of disease, and improve overall operational efficiency.

Sustainability has emerged as a key Chile aquaculture market trend, with efforts directed towards reducing the industry’s ecological footprint. Companies are implementing responsible farming practices, such as minimising antibiotic use, reducing fishmeal dependency in feed, and enhancing waste management systems. Certifications such as the Aquaculture Stewardship Council (ASC) and Best Aquaculture Practices (BAP) have gained prominence, ensuring that Chilean aquaculture products meet stringent environmental and social responsibility standards. The integration of sustainable practices in aquaculture operations has strengthened the industry's reputation and appeal among environmentally conscious consumers and retailers.

The Chile aquaculture market dynamics is further shaped by government policies and regulatory frameworks aimed at promoting responsible fish farming. Authorities have introduced stricter biosecurity measures, enhanced monitoring of aquaculture sites, and encouraged investment in research and development to improve disease control and breeding programmes.

Collaborations between industry stakeholders, research institutions, and government bodies have facilitated the development of innovative solutions to address challenges such as algal blooms, climate change effects, and resource management. Public-private partnerships have played a crucial role in enhancing Chile’s competitiveness in the global aquaculture market.

Export growth remains a significant factor driving the Chile aquaculture market, with salmon and trout leading the country’s seafood exports. Chilean salmon is highly sought after in major international markets, competing with Norway as one of the world’s top suppliers. The demand for high-quality Chilean seafood products has been bolstered by increasing consumer awareness of sustainably sourced seafood and the rising popularity of sushi, poke bowls, and other seafood-based cuisines. Trade agreements and improved logistics infrastructure have further facilitated export expansion, strengthening Chile’s position as a global aquaculture powerhouse.

Challenges in the Chile aquaculture market include environmental risks, disease outbreaks, and market fluctuations. The industry has faced issues such as harmful algal blooms, which have caused significant fish mortality and economic losses. Climate change-related factors, including ocean temperature variations and changes in water quality, also pose risks to aquaculture operations. To mitigate these challenges, industry players are investing in research, genetic advancements, and adaptive farming strategies to enhance resilience and sustainability. Additionally, fluctuations in global seafood prices and trade uncertainties require market participants to adopt flexible business strategies and diversify product offerings.

Consumer trends in the seafood industry are influencing the Chile aquaculture market landscape, with increasing demand for organic, antibiotic-free, and sustainably sourced seafood. The rise of plant-based seafood alternatives and cellular aquaculture is also shaping market dynamics, prompting traditional aquaculture companies to explore alternative protein sources and sustainable feed formulations. Additionally, the growing popularity of direct-to-consumer seafood delivery services and online retail channels has provided new avenues for market expansion. Companies are leveraging digital marketing strategies and traceability technologies to enhance consumer trust and transparency in seafood sourcing.

Looking ahead, the Chile aquaculture market is expected to witness sustained growth, driven by continuous innovation, sustainability initiatives, and strong international demand for high-quality seafood. Investment in research and development, improved disease management practices, and responsible resource utilisation will be critical in maintaining the industry’s long-term viability. As consumer preferences evolve towards healthier and more sustainable food choices, Chilean aquaculture companies that prioritise innovation, environmental responsibility, and market adaptability will be well-positioned for success in the competitive global seafood market.

Market Segmentation

The market can be divided based on environment and fish type.Market Breakup by Environment

- Marine Water

- Fresh Water

- Brackish Water

Market Breakup by Fish Type

- Carps

- Mollusks

- Crustaceans

- Mackerel

- Sea Bream

- Others

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Chile aquaculture market.Some of the major players explored in the report are as follows:

- Blumar Seafoods

- Australis Seafoods

- Camanchaca S.A.

- Santa Monica Seafood Company

- AquaChile

- Mowi ASA

- Others

Table of Contents

Companies Mentioned

- Australis Seafoods

- Camanchaca S.A.

- Santa Monica Seafood Company

- AquaChile

- Mowi ASA

- Others

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 111 |

| Published | May 2025 |

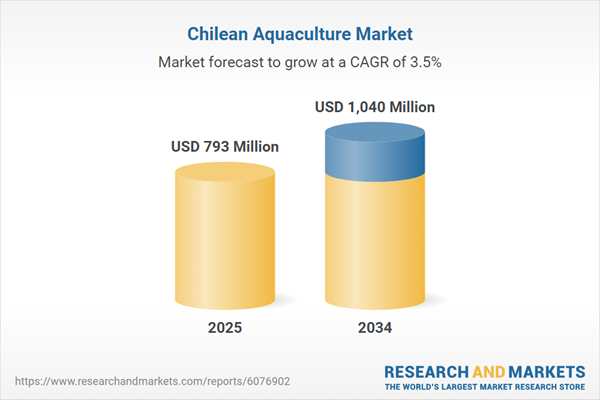

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 793 Million |

| Forecasted Market Value ( USD | $ 1040 Million |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Chile |

| No. of Companies Mentioned | 6 |