The Canada automotive carbon fibre composites market growth is being driven by the increasing demand for lightweight and high-performance materials in the automotive industry. Carbon fibre composites are widely used in vehicle manufacturing due to their superior strength-to-weight ratio, corrosion resistance, and durability. These properties make them an ideal choice for reducing vehicle weight, enhancing fuel efficiency, and improving overall performance. The shift towards sustainable and energy-efficient transportation solutions has further accelerated the adoption of carbon fibre composites in Canada’s automotive sector.

As per the Canada automotive carbon fibre composites market analysis, the growing emphasis on reducing carbon emissions and improving fuel economy has led automakers to explore advanced materials for vehicle manufacturing. Carbon fibre composites play a crucial role in this transition by enabling weight reduction without compromising structural integrity. Lighter vehicles require less energy for propulsion, contributing to lower fuel consumption and reduced greenhouse gas emissions. Additionally, the adoption of electric vehicles (EVs) in Canada has fuelled the demand for carbon fibre composites, as these materials enhance battery efficiency and increase the overall driving range of EVs.

Apart from weight reduction, carbon fibre composites offer excellent impact resistance and crash performance, making them a preferred material for vehicle safety enhancements. Automakers are increasingly incorporating carbon fibre-reinforced polymer (CFRP) components in structural parts, body panels, and chassis to improve vehicle safety while maintaining lightweight properties. The growing integration of advanced driver assistance systems (ADAS) and autonomous vehicle technologies has also aided the Canada automotive carbon fibre composites market expansion, as manufacturers seek to develop stronger yet lighter materials for vehicle frameworks.

The expansion of Canada’s automotive manufacturing industry is a key factor boosting the Canada automotive carbon fibre composites market revenue. With major automotive companies investing in research and development to improve vehicle performance and efficiency, the demand for high-quality carbon fibre composites continues to rise. The presence of global automakers, coupled with increasing investments in automotive innovation, has created a favourable market environment for the adoption of advanced composite materials. Furthermore, collaborations between material suppliers and automotive manufacturers are fostering the development of cost-effective and scalable carbon fibre composite solutions.

Despite the advantages of carbon fibre composites, challenges such as high production costs and complex manufacturing processes hinder the Canada automotive carbon fibre composites market. Carbon fibre production requires significant energy and specialised equipment, leading to higher costs compared to traditional materials such as steel and aluminium.

However, ongoing advancements in manufacturing technologies, including automated production processes and recycling techniques, are expected to reduce costs and enhance the affordability of carbon fibre composites. The increasing focus on sustainable manufacturing practices has also led to the development of bio-based and recycled carbon fibre materials, further supporting market expansion.

However, government initiatives and regulatory frameworks in Canada aimed at promoting sustainable automotive solutions have positively influenced the Canada automotive carbon fibre composites market dynamics. Stringent emissions regulations and fuel efficiency standards have encouraged automakers to integrate lightweight materials into vehicle designs.

Additionally, financial incentives and research grants provided by the government for electric vehicle development have contributed to the rising demand for carbon fibre composites. The automotive industry’s transition towards sustainability aligns with Canada’s commitment to reducing carbon emissions and adopting green technologies, further boosting the market growth.

The rising consumer preference for high-performance and luxury vehicles has also created lucrative Canada automotive carbon fibre composites market opportunities. Premium car manufacturers are extensively utilising carbon fibre composites in vehicle exteriors, interiors, and performance components to enhance aesthetics, aerodynamics, and overall driving experience. The motorsport and high-performance vehicle segments continue to drive innovation in carbon fibre composite applications, with a focus on increasing strength, reducing weight, and optimizing vehicle efficiency.

Economic factors, including fluctuations in raw material prices and supply chain disruptions, pose challenges to the Canada automotive carbon fibre composites market. The dependence on global carbon fibre suppliers and the limited availability of domestic production facilities have led to supply constraints, impacting the overall market dynamics. However, increasing investments in local production capabilities and the expansion of carbon fibre manufacturing facilities in Canada are expected to mitigate these challenges. The establishment of partnerships between automotive manufacturers and composite material producers will further enhance supply chain resilience and drive market growth.

Overall, the Canada automotive carbon fibre composites market is poised for steady expansion in the coming years, supported by the increasing demand for lightweight, high-performance materials and the growing focus on sustainable automotive solutions. Technological advancements, regulatory support, and strategic industry collaborations are expected to accelerate the market development, enabling the widespread adoption of carbon fibre composites in vehicle manufacturing. As automakers continue to prioritise fuel efficiency, safety, and environmental sustainability, the role of carbon fibre composites in shaping the future of the automotive industry in Canada will remain pivotal.

Market Segmentation

The market can be divided based on production type, vehicle type, application, and region.Breakup by Production Type

- Hand Layup

- Resin Transfer Moulding

- Vacuum Infusion Processing

- Injection Moulding

- Compression Moulding

Breakup by Vehicle Type

- Passenger Car

- Commercial Vehicle

Breakup by Application

- Structural Assembly

- Powertrain Component

- Interior

- Exterior

- Others

Breakup by Region

- Northern Canada

- British Columbia

- Alberta

- The Prairies

- Central Canada

- Atlantic Canada

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Canada automotive carbon fibre composites market.Some of the major players explored in the report are as follows:

- Hexcel Corporation

- Solvay S.A.

- BASF SE

- Spartec Composites Inc.

- Sigmatex (UK) Limited

- Teijin Limited

- Fibrotek Advanced Materials Inc.

- Others

Table of Contents

Companies Mentioned

- Solvay S.A.

- BASF SE

- Spartec Composites Inc.

- Sigmatex (UK) Limited

- Teijin Limited

- Fibrotek Advanced Materials Inc.

- Others

Table Information

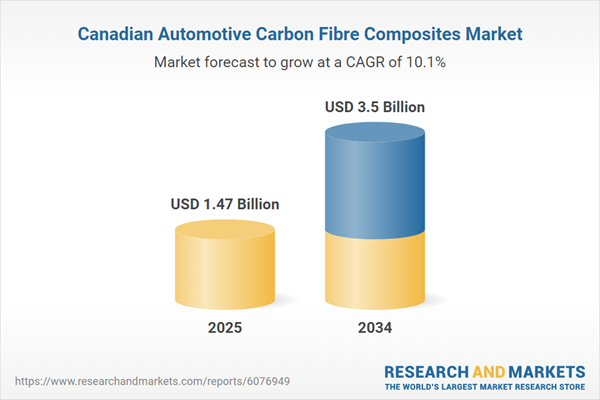

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.47 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 7 |