The Brazilian government's ambitious infrastructure plans, such as the New Growth Acceleration Program (PAC), are pivotal in driving the Brazil construction market expansion. These initiatives focus on enhancing transportation, energy, and sanitation infrastructure. Public-private partnerships (PPPs) are also being utilized to fund large-scale projects, ensuring the development of critical infrastructure across the country.

Rapid urbanization and increasing population are fueling the demand for residential and commercial construction, boosting the Brazil construction market growth. Urban areas are expanding, leading to a higher need for housing, schools, hospitals, and commercial spaces. This urban growth necessitates significant investments in construction to accommodate the rising population and urban dwellers' needs.

On the other hand, the expansion of commercial and industrial sectors is driving demand for construction services. Increased investments in retail spaces, office buildings, and manufacturing facilities are contributing to the growth of the market. These developments are essential for supporting economic growth and accommodating the needs of a diversifying economy.

Programs like "Minha Casa Minha Vida" aim to address Brazil's housing deficit by constructing affordable homes for low-income families. These initiatives are leading to significant investments in residential construction, particularly in underserved areas, fueling the Brazil construction market value. The government's commitment to reducing the housing gap is a key driver of growth in the residential construction sector.

Brazil's commitment to renewable energy is driving construction in the energy sector. The government's focus on expanding solar, wind, and hydroelectric power projects is leading to increased demand in the Brazil construction market. These projects not only contribute to sustainable energy goals but also stimulate economic growth through infrastructure development.

The adoption of advanced technologies such as Building Information Modeling (BIM), automation, and prefabrication is revolutionizing the Brazil construction market dynamics. These technologies enhance efficiency, reduce costs, and improve project delivery times. The integration of digital tools in construction processes is becoming increasingly prevalent, leading to more streamlined and cost-effective projects.

There is a growing emphasis on sustainable and green building practices that is shaping the future Brazil construction market trends. Developers and construction companies are adopting eco-friendly materials and energy-efficient designs to meet environmental standards and consumer demand for sustainable living spaces. This trend is fostering the growth of green construction projects and promoting environmental responsibility within the industry.

The region has witnessed a steady rise in foreign direct investment in its construction and real estate sectors, which have further propelled the Brazil construction market revenue. Multinational corporations and institutional investors are increasingly channeling funds into infrastructure, commercial, and residential projects due to Brazil’s large consumer base and improving economic outlook. Strategic reforms to ease business operations and regulatory compliance have further encouraged FDI inflows. This influx of international capital is expected to accelerate project timelines, boost innovation, and enhance the overall competitiveness of the Brazilian construction market.

Moreover, as per the Brazil construction market analysis, the thriving tourism industry is driving demand for the development of hotels, resorts, and entertainment facilities. With the country attracting millions of international visitors annually and preparing for major global events, the need for modern hospitality infrastructure has increased. Government incentives and private sector interest are fueling investments in airport expansions, transportation networks, and tourism-related construction. This ongoing development is expected to significantly contribute to the construction sector’s expansion, while also enhancing Brazil’s global image as a premier travel destination.

Despite efforts to streamline processes, Brazil construction market still faces significant bureaucratic challenges. Lengthy permitting procedures, complex regulations, and inconsistent enforcement can delay project timelines and increase costs. These regulatory hurdles pose a challenge to the efficient execution of construction projects and can deter potential investors.

The industry, further, is experiencing labor shortages, partly due to an aging workforce and insufficient training programs for new workers. Additionally, incidents of labor exploitation have been reported, leading to increased scrutiny and regulatory oversight. Addressing these labor issues is crucial for maintaining a sustainable and ethical construction industry.

The future of Brazil construction market outlook appears promising, with continued growth expected across various sectors. Government initiatives, technological advancements, and a focus on sustainability are likely to drive the industry forward. However, addressing challenges such as regulatory complexities and labor issues will be essential for sustaining long-term growth and ensuring the sector's resilience in the face of economic fluctuations.

Market Segmentation

The market can be divided based on construction type, end use, and region.Market Breakup by Construction Type

- New Construction

- Renovations

Market Breakup by End Use

- Commercial

- Residential

- Industrial

- Institutional

Market Breakup by Region

- São Paulo

- Minas Gerais

- Rio de Janeiro

- Bahia

- Rio Grande do Sul

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Brazil construction market.Some of the major players explored in the report are as follows:

- Odebrecht Engineering and Construction S.A.

- Andrade Gutierrez S.A.

- Queiroz Galvão S.A.

- Camargo Corrêa Construction Company

- MRV&CO Group

- Construcap CCPS Engenharia and Comérico SA

- Grupo A.R.G.

- Racional Engenharia Ltda.

- Direcional Engenharia

- GAFISA S/A

- Others

Table of Contents

Companies Mentioned

- Andrade Gutierrez S.A.

- Queiroz Galvão S.A.

- Camargo Corrêa Construction Company

- MRV&CO Group

- Construcap CCPS Engenharia and Comérico SA

- Grupo A.R.G.

- Racional Engenharia Ltda.

- Direcional Engenharia

- GAFISA S/A

- Others

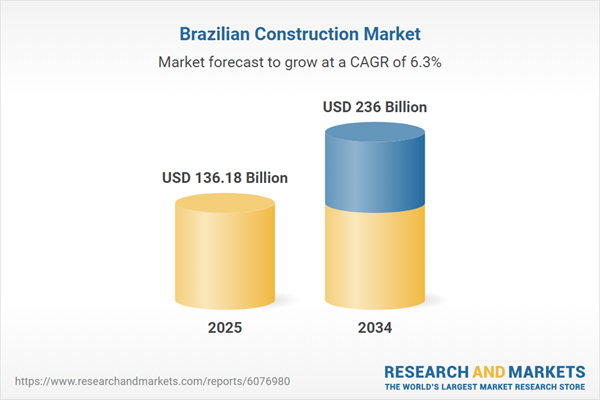

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 136.18 Billion |

| Forecasted Market Value ( USD | $ 236 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Brazil |

| No. of Companies Mentioned | 10 |