The Brazil aluminium market growth is bolstered by the country's abundant bauxite reserves, which form the raw material base for aluminium production. With a well-established mining and refining infrastructure, Brazil continues to position itself as a global leader in aluminium exports, while expanding domestic applications in construction, automotive, packaging, and renewable energy. The increasing integration of green energy sources and recycling processes further solidifies aluminium’s role in Brazil’s transition to a low-carbon economy.

Rapid urbanization and large-scale infrastructure projects are key growth drivers of the Brazil aluminium market expansion. As the country invests in new airports, highways, bridges, and housing developments under public-private partnerships, the demand for lightweight, durable, and corrosion-resistant materials like aluminium is rising significantly. Aluminium’s flexibility, structural strength, and recyclability make it ideal for use in both modern architecture and large-scale infrastructure. Aluminium panels, frames, roofing materials, and structural components are being extensively adopted, supporting market expansion in both residential and commercial segments.

The growing automotive industry is a major contributor to the overall Brazil aluminium market development. Automakers are increasingly turning to aluminium to produce lighter, fuel-efficient vehicles that comply with environmental standards. With Brazil being one of the largest vehicle producers in Latin America, the shift towards electric and hybrid vehicles is expected to further accelerate aluminium usage in manufacturing body panels, engine parts, heat exchangers, and wheels. Additionally, aluminium’s recyclability supports the circular economy goals of auto manufacturers, making it a preferred material in sustainable mobility solutions.

The region’s focus on expanding its renewable energy capacity is fueling the demand in the Brazil aluminium market as aluminium components used in wind, solar, and hydroelectric installations. Aluminium is extensively used in the production of solar panel frames, wind turbine housings, and electrical transmission lines due to its lightweight and conductive properties. With government incentives and private investments pouring into renewable projects, the aluminium market is expected to benefit from a steady increase in energy infrastructure. Moreover, the push for decarbonization and energy efficiency across sectors further boosts aluminium's role in sustainable development.

The packaging sector is witnessing robust growth, largely due to increased consumption of beverages, processed foods, and pharmaceutical products, boosting the overall Brazil aluminium market expansion. Aluminium is a key material in the production of cans, foils, and flexible packaging, owing to its ability to preserve product quality and extend shelf life. The rise of convenience food, urban lifestyles, and environmental concerns over plastic waste are contributing to a shift towards aluminium packaging. With consumer preference leaning toward recyclable and lightweight materials, aluminium’s role in sustainable packaging continues to grow, driving demand across retail and FMCG sectors.

Technological innovations in smelting, casting, and recycling have significantly improved the efficiency and cost-effectiveness, thereby accelerating Brazil aluminium market dynamics. The adoption of advanced machinery, digital monitoring systems, and automation technologies has allowed manufacturers to optimize energy usage and reduce waste. Moreover, the growing application of Industry 4.0 solutions across aluminium plants has enhanced production consistency and quality control. These advancements are helping local producers meet both domestic and export market demands while aligning with environmental regulations, ultimately supporting long-term growth in the aluminium sector.

Supportive government policies and strategic trade partnerships are playing a vital role in strengthening the Brazil aluminium market development. Incentives such as tax exemptions, infrastructure grants, and export subsidies for mining and metal industries are encouraging both domestic production and foreign investment. Brazil’s participation in trade agreements within Mercosur and with global partners has opened up new opportunities for aluminium exports. At the same time, anti-dumping measures and quality regulations are protecting the domestic industry from low-grade imports, ensuring a more stable and competitive market landscape.

Despite strong growth prospects, the Brazil aluminium market faces several challenges. Volatility in global commodity prices, particularly for bauxite and energy, can affect production costs and profitability. Additionally, the high energy intensity of aluminium smelting presents environmental concerns and raises operational costs, especially in regions where renewable energy sources are limited. Regulatory complexities and infrastructure bottlenecks in logistics and transportation also pose obstacles to seamless market expansion, requiring continued investment and policy reform to maintain long-term competitiveness.

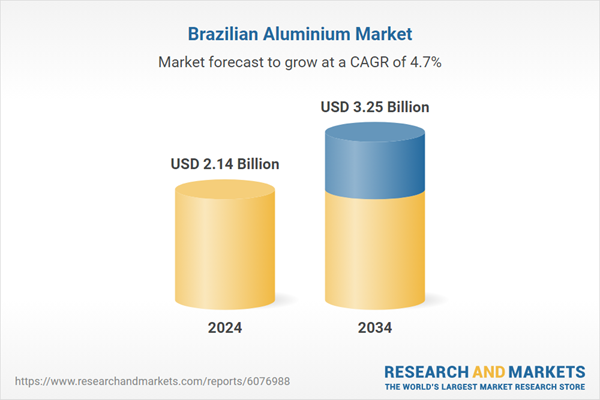

Looking ahead, the Brazil aluminium market outlook is expected to sustain its upward trajectory, driven by industrial diversification, green energy investments, and technological advancements. As domestic and global demand rises across automotive, construction, and packaging sectors, Brazil’s role as a major aluminium producer and exporter will continue to grow. Innovations in recycling, smelting, and alloy development will further enhance material performance and sustainability. With a supportive policy environment and increasing emphasis on eco-efficient practices, the aluminium market in Brazil is poised for robust, sustainable growth through 2034.

Market Segmentation

The market can be divided based on processing type, application, and region.Market Breakup by Processing Type

- Castings

- Extrusions

- Forgings

- Flat Rolled Products

- Pigments and Powders

Market Breakup by Application

- Automotive

- Aerospace and Defence

- Building and Construction

- Electrical and Electronics

- Packaging

- Industrial

- Others

Market Breakup by Region

- São Paulo

- Minas Gerais

- Rio de Janeiro

- Bahia

- Rio Grande do Sul

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Brazil aluminium market.Some of the major players explored in the report are as follows:

- Companhia Brasileira de Alumínio (CBA)

- Alcoa Corporation

- Norsk Hydro ASA

- ASA Alumínio

- Alux do Brasil

- Others

Table of Contents

Companies Mentioned

- Alcoa Corporation

- Norsk Hydro ASA

- ASA Alumínio

- Alux do Brasil

- Others

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 101 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.14 Billion |

| Forecasted Market Value ( USD | $ 3.25 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Brazil |

| No. of Companies Mentioned | 5 |