The Australia water pump market is being shaped by various factors, with positive displacement water pumps leading the market due to their strong durability and effectiveness in heavy-duty applications that require minimal maintenance. They are widely utilised across sectors such as manufacturing for their ability to handle a variety of fluids efficiently. Furthermore, their high energy efficiency, including advanced designs like rotary lobe pumps, helps reduce carbon footprints and operational expenses. Centrifugal water pumps operate quietly, making them suitable for use in residential areas, and they are also equipped with safety features. In November 2023, Panasonic Australia and Reclaim Energy announced a partnership to launch a CO2 hot water heat pump solution in the Australian market.

Demand in the Australia water pump market is driven by the growing adoption of technologies, such as sensors, designed to monitor performance, identify faults, and enhance efficiency. Moreover, the integration of variable speed drive systems allows the speed of water pumps to be adjusted according to various application demands. Furthermore, there is an increasing integration of advanced materials such as polymers and ceramics to enhance pump performance in challenging environmental conditions. The development of smart pump systems includes predictive maintenance capabilities and remote monitoring features, enhancing reliability and minimising operational downtime.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Centrifugal Water Pumps

- Axial Flow

- Radial Flow

- Mixed Flow

- Others

- Positive Displacement Water Pumps

- Reciprocating Pumps

- Rotary Pumps

- Others

Market Breakup by Driving Force

- Electric Driven

- Engine Driven

Market Breakup by Application

- Building Services

- Power, Oil & Gas

- Agriculture

- Metal & Mining

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Water Pump Market Share

The power, oil & gas sector holds a significant share in the Australia water pump market due to its extensive operational needs for robust, high-performance pumps. These industries rely on water pumps for critical applications such as cooling, wastewater management, and operational processes.Leading Companies in the Australia Water Pump Market

The growth of the water pump market is fuelled by advanced materials utilisation, smart pump systems, technological integration, water conservation initiatives, variable speed drive systems, and energy efficiency measures.- The Weir Group PLC

- Grundfos Pumps Pty Ltd.

- Davey Water Products Pty Ltd.

- KSB Australia Pty Ltd.

- Nov Australia Pty Ltd.

- Pentair Water Australia Pty Ltd.

- SULZER Australia PTY Ltd.

- ITT Blackers Pty Ltd.

- Others

Table of Contents

Companies Mentioned

- The Weir Group PLC

- Grundfos Pump Pty Ltd.

- Davey Water Products Pty Ltd.

- KSB Australia Pty Ltd.

- Nov Australia Pty Ltd.

- Pentair Water Australia Pty Ltd.

- SULZER Australia PTY Ltd.

- ITT Blackers Pty Ltd.

Table Information

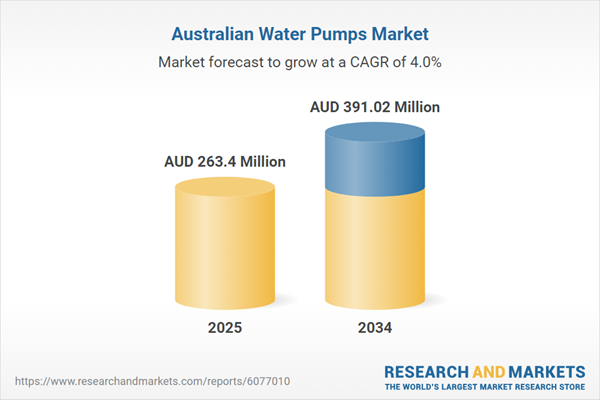

| Report Attribute | Details |

|---|---|

| No. of Pages | 107 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 263.4 Million |

| Forecasted Market Value ( AUD | $ 391.02 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 8 |