The Australia used car financing market is being strengthened by banks, which lead the sector by offering customers a wide range of potential borrowers interested in financing used vehicles. Banks also leverage cross-selling of their other financial products, such as used car loans, to strengthen customer relationships. Moreover, to remain competitive in the market, banks offer attractive interest rates on used car loans. The non-banking financial companies offer tailored products with features such as lower down payment requirements and competitive interest rates to make financing more accessible to consumers. In October 2022, INCHCAPE Australasia launched its new online and physical used-car division, Bravoauto, with its first store in Penrith, NSW.

Various trends and innovations driving the growth of the Australia used car financing industry include the increase in online platforms, which allow users to secure financing directly through marketplaces, thereby simplifying the purchasing process. Moreover, fintech companies are integrating innovative solutions such as blockchain-based financing and AI-driven credit scoring algorithms to improve efficiency and reduce costs for buyers. Furthermore, lenders are offering more flexible financing options, including lower down payment requirements and customised repayment schedules, to provide buyers with greater flexibility and affordability.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Car Type

- Multi-purpose Vehicle (MPV)

- Sedan

- Hatchback

- Sport Utility Vehicle (SUV)

Market Breakup by Financier

- Non-Banking Financial Companies (NBFC)

- OEM

- Banks

Market Breakup by Fuel Type

- Petrol

- Diesel

- CNG/LPG

- Electric

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Used Car Financing Market Share

Sedans hold a significant share in the Australia used car financing market, driven by their popularity, affordability, and versatility. They attract diverse buyers with accessible financing options, stable resale values, and suitability for various purposes, ensuring their strong market presence and growth.Leading Companies in the Australia Used Car Financing Market

The growth of the used car financing market is fuelled by fintech innovations, flexible financing options, online financing platforms, digital transformation, and the rise of sustainable transportation.- Ozcar Pty Ltd.

- Plenti Group Limited (Plenti Pty Limited)

- Pepper Money Limited

- Sojitz Corp. (Albert Automotive Holdings Pty Ltd.)

- Wisr Finance Pty Ltd.

- Quantum Savvy Pty Ltd.

- Adelaide Vehicle Centre

- Others

Table of Contents

Companies Mentioned

- Ozcar Pty Ltd.

- Plenti Group Limited (Plenti Pty Limited)

- Pepper Money Limited

- Sojitz Corp. (Albert Automotive Holdings Pty Ltd.)

- Wisr Finance Pty Ltd.

- Quantum Savvy Pty Ltd.

- Adelaide Vehicle Centre

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | October 2025 |

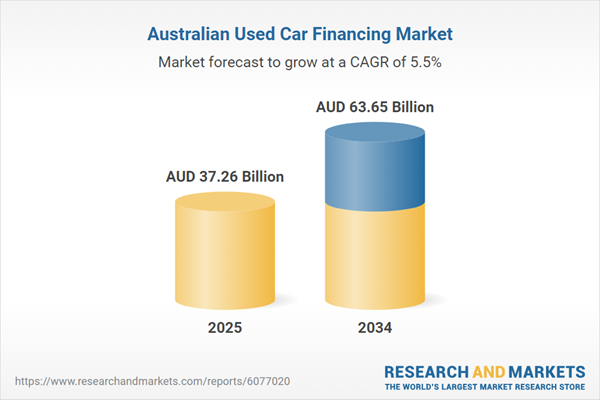

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 37.26 Billion |

| Forecasted Market Value ( AUD | $ 63.65 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 7 |