Based on components, the Australia smart home market share is led by smart appliances as they perform various tasks including cleaning and cooking

The Australia smart home market is thriving due to smart appliances, which feature automatic functions and can adapt to changing temperature conditions, thereby enhancing task efficiency. Moreover, they are equipped with specific features to perform specific tasks with higher efficiency and convenience. Due to the presence of sensors and timers, they can be operated by the users without getting in direct contact with the appliances.The Australia smart home market development is being guided by various trends including the integration of voice control such as Apple Siri and Google Assistant to control the smart home appliances via voice commands. Moreover, to promote the sustainability the smart home appliances are being equipped with the smart thermostats and LED lighting. They are also being integrated with the sleep-trackers and air quality monitor to help users in maintaining their health. Nowadays, the smart home appliances are being installed with the two-factor authentication and end-to-end encryption features to provide data privacy to the users. Recently, Samsung has launched smart TVs equipped with AI features.

The Australia smart home market development is being guided by various trends including the integration of voice control such as Apple Siri and Google Assistant to control the smart home appliances via voice commands.

Market Breakup by Component

- Hardware

- AI Speaker

- Smart Appliances

- Services

- Others

Market Breakup by Application

- Security

- Smart Appliances

- Energy Management

- Comfort and Lighting

- Home Entertainment

- Control and Connectivity

Market Breakup by Distribution Channel

- Specialty Stores

- Online

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Table of Contents

Companies Mentioned

- Sonos, Inc

- Signify

- Allegion Plc

- Electrolux Home Products Pty Ltd

- Brilliant Lighting (Aust) Pty Ltd

- Ring LLC

- Access Hardware (TAS) Pty Ltd.

- Clarke Security Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 105 |

| Published | October 2025 |

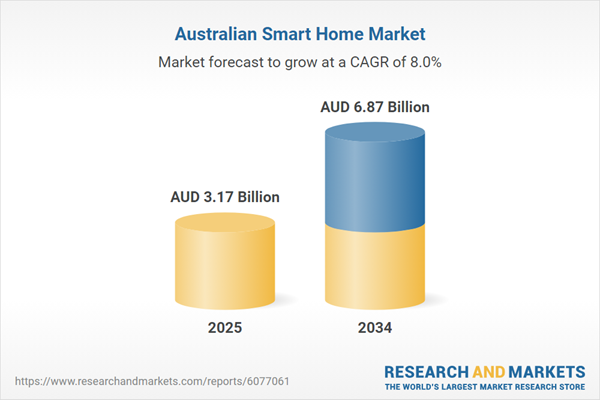

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 3.17 Billion |

| Forecasted Market Value ( AUD | $ 6.87 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 8 |