The North America segment recorded 39% revenue share in the market in 2023. The North America region leads the workflow orchestration market due to its mature digital ecosystem, widespread cloud adoption, and strong presence of leading technology providers. Organizations across IT, telecom, healthcare, and BFSI heavily invest in automation to improve efficiency, ensure regulatory compliance, and enhance customer experience.

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2024 IBM Corporation and Salesforce have partnered to integrate AI-powered autonomous agents, leveraging Salesforce Agentforce and IBM watsonx Orchestrate. This collaboration enhances workflow automation, streamlines sales and service processes, and enables AI-driven decision-making while ensuring data security and compliance across industries. Moreover, In March, 2025, IBM Corporation partners with Astronomer to enhance Apache Airflow's enterprise capabilities, improving data orchestration, automation, and governance. The collaboration ensures reduced data downtime, better reliability, and scalability, benefiting AI, MLOps, and analytics workloads while simplifying deployment for regulated industries.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunners in the Workflow Orchestration Market. In January 2024, Microsoft Corporation and Blue Yonder partnered to optimize supply chain management using Azure’s AI and machine learning capabilities. Their collaboration enhances real-time decision-making, automation, and sustainability through the Luminate Cognitive Platform, supporting retailers and manufacturers in a dynamic market landscape. Companies such as IBM Corporation, Cisco Systems, Inc. and Oracle Corporation are some of the key innovators in Workflow Orchestration Market.Market Growth Factors

Organizations today face growing complexity in managing workflows that span departments, technologies, and geographies. As a result, there is a critical need to enhance operational efficiency, reduce manual errors, and maintain consistency across business functions. Workflow orchestration emerges as a foundational enabler in this context - automating repetitive tasks, accelerating decision-making, and integrating systems seamlessly to create agile, responsive business processes. Thus, these global insights clarify that workflow orchestration is a digital backbone, ensuring that systems, people, and processes are aligned and responsive.Additionally, In a world that is becoming more reliant on digital technologies, latency is no longer a viable option. Businesses, governments, and service providers must act on data immediately upon its generation. Real-time orchestration enables seamless execution and synchronization of tasks across multiple systems, ensuring continuous data flow and responsiveness. Therefore, as data volumes grow and decision windows shrink, orchestration tools are essential in bridging the gap between data generation and real-world action, ensuring systems stay aligned, agile, and efficient.

Market Restraining Factors

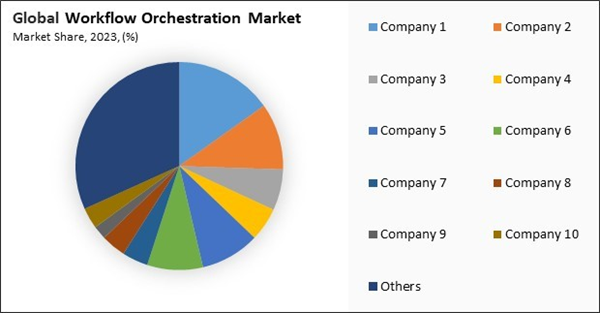

However, Workflow orchestration platforms often incur substantial upfront expenses, including licensing fees, infrastructure upgrades, and integration costs. These financial demands can be particularly overwhelming for small and mid-sized enterprises (SMEs), which typically operate on limited budgets and must carefully allocate resources. Unlike large corporations with expansive IT budgets, SMEs may struggle to justify the investment required to deploy and maintain such systems. As a consequence, the workflow orchestration market's overall growth is slowed by the continued reliance of numerous businesses on manual or semi-automated processes.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Rising Adoption Of Cloud-Based Solutions

- Increasing Need For Streamlined Business Processes

- Growing Demand For Real-Time Data Processing

Restraints

- Substantially High Implementation Costs

- Integration Complexities With Existing It Infrastructure

Opportunities

- Rapid Expansion Of Industry 4.0 And Iot

- Rise In AI And Machine Learning Integration

Challenges

- Shortage Of Skilled Professionals

- Security And Compliance Concerns

Vertical Outlook

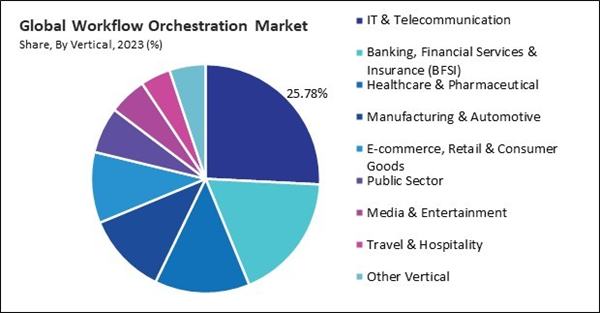

By vertical, the market is divided into IT & telecommunication, banking, financial services, & insurance (BFSI), healthcare & pharmaceutical, automotive & manufacturing, e-commerce, retail, & consumer goods, public sector, media & entertainment, travel & hospitality, and others. The healthcare and pharmaceutical segment acquired 13% revenue share in the market in 2023. The healthcare segment is propelled by the need to automate clinical workflows, streamline patient data management, and improve coordination across departments. As hospitals and clinics adopt electronic health records (EHR), telemedicine platforms, and digital diagnostics, orchestration tools help manage complex processes while ensuring compliance with healthcare regulations.Organization Size Outlook

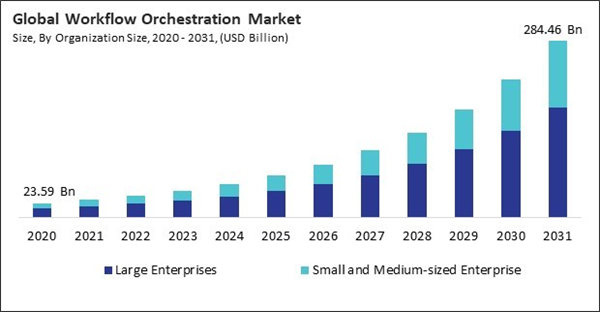

On the basis of organization size, the market is bifurcated into small & medium enterprises and large enterprises. The small & medium enterprises segment recorded 36% revenue share in the market in 2023. Small & medium enterprises (SMEs) face constant pressure to remain competitive, agile, and responsive to customer demands - factors that automation and orchestration can significantly support. The availability of affordable, cloud-based orchestration solutions has made it easier for SMEs to implement and scale their operations without heavy upfront investments.Type Outlook

Based on type, the market is classified into data center orchestration, cloud orchestration, network management, business process orchestration, security orchestration, and others. The data center orchestration segment procured 21% revenue share in the market in 2023. Many large organizations continue to maintain on-premise data centers for security, compliance, or performance reasons. Orchestration tools help manage these environments more efficiently by automating server provisioning, storage management, and network configuration.Market Competition and Attributes

The Workflow Orchestration Market remains highly competitive with numerous startups and mid-sized firms offering specialized solutions. These companies focus on automation, cloud integration, and AI-driven process optimization to attract enterprises. Open-source platforms and industry-specific solutions drive differentiation, fostering innovation and collaboration while creating opportunities for niche players to capture market share in a rapidly evolving landscape.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed 30% revenue share in the market in 2023. Growing digital transformation initiatives, a focus on data protection and regulatory compliance, and the expanding use of cloud and hybrid IT systems are the main factors propelling the European industry. European industries, including manufacturing, government, and healthcare, are focusing on automating complex workflows to meet operational efficiency goals and comply with stringent regulations like GDPR.Recent Strategies Deployed in the Market

- Mar-2025: Microsoft Corporation has launched the public preview of the Azure Functions durable task scheduler, a fully managed backend for workflow orchestration. It enhances performance, scalability, security, and monitoring while simplifying stateful function execution, benefiting automation, distributed transactions, and cloud-based workflow orchestration.

- Feb-2025: Pegasystems launched Pega Agent Experience, an AI-driven orchestration solution that automates enterprise workflows across front and back offices. It integrates AI agents, supports third-party automation, ensures governance, and enhances efficiency, reinforcing Pegasystems' leadership in workflow orchestration and enterprise automation.

- Jan-2025: ServiceNow launches AI Agent Orchestrator and AI Agent Studio to streamline enterprise workflows. These innovations unify AI agents, automate complex tasks, and enhance productivity by integrating with existing systems, redefining workflow orchestration and driving AI-powered business transformation at scale.

- Dec-2024: ServiceNow, Inc. and AWS expand collaboration, integrating Amazon Bedrock for AI-powered workflows on the Now Platform. New automation solutions for security and procurement are available in AWS Marketplace, accelerating GenAI adoption, enhancing digital experiences, and optimizing enterprise workflow orchestration across industries.

- Sep-2024: Oracle Corporation has introduced Intelligent Data Lake as part of its Data Intelligence Platform, enhancing AI-driven analytics, data integration, and workflow automation. Built on Oracle Cloud Infrastructure (OCI), it enables enterprises to unify data, streamline operations, and gain real-time insights.

List of Key Companies Profiled

- Microsoft Corporation

- IBM Corporation

- Cisco Systems, Inc.

- VMware, Inc. (Broadcom Inc.)

- ServiceNow, Inc.

- Oracle Corporation

- Pegasystems, Inc.

- TIBCO Software, Inc.

- Micro Focus International PLC

- BMC Software, Inc. (KKR & Co., Inc.)

Market Report Segmentation

By Vertical

- IT & Telecommunication

- Banking, Financial Services & Insurance (BFSI)

- Healthcare & Pharmaceutical

- Manufacturing & Automotive

- E-commerce, Retail & Consumer Goods

- Public Sector

- Media & Entertainment

- Travel & Hospitality

- Other Vertical

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprise

By Type

- Cloud Orchestration

- Data Center Orchestration

- Business Process Orchestration

- Network Management

- Security Orchestration & Other

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Microsoft Corporation

- IBM Corporation

- Cisco Systems, Inc.

- VMware, Inc. (Broadcom Inc.)

- ServiceNow, Inc.

- Oracle Corporation

- Pegasystems, Inc.

- TIBCO Software, Inc.

- Micro Focus International PLC

- BMC Software, Inc. (KKR & Co., Inc.)