The early adoption of cutting-edge IT infrastructure, the robust presence of major market players, and the rising need for high-performance memory in industries like cloud computing, healthcare, financial services, and the military are all contributing factors to the regional market's expansion. The region is home to some of the world’s largest data centers and hyperscale service providers, which are increasingly relying on memory solutions that combine speed and data persistence to ensure uninterrupted operations. Thus, the North America segment procured 34% revenue share in the market in 2023. Additionally, the emphasis on business continuity, cybersecurity, and real-time data processing has made NVDIMMs essential in enterprise IT strategies, driving consistent demand across the U.S. and Canada.

NVDIMMs combine the ultra-fast speed of DRAM with the non-volatile nature of NAND flash, creating a hybrid memory solution that significantly reduces system latency. This integration ensures that data remains intact even during power failures without sacrificing the rapid access and processing speeds expected from traditional volatile memory. As a result, NVDIMMs play a critical role in enhancing system responsiveness and reliability in demanding computing environments.

Additionally, Companies like Micron Technology, Samsung, and Hewlett Packard Enterprise (HPE) remain at the forefront, investing in NVDIMM-compatible hardware and pushing the innovation envelope in persistent memory solutions. These companies help integrate NVDIMMs into mainstream server and enterprise systems, driving awareness and adoption across industries that rely on data persistence, speed access, and system resiliency. Together, these efforts are shaping a robust, forward-looking ecosystem that supports the continued advancement of NVDIMM technology.

However, NVDIMMs are engineered to combine DRAM's speed with NAND flash's data retention capabilities, creating a high-performance hybrid memory solution. However, this technological advancement has a much higher manufacturing cost than traditional memory modules. The complexity of integrating two types of memory technologies into a single module contributes heavily to the overall pricing. This elevated cost becomes a major barrier for organizations with limited budgets, particularly small and medium enterprises (SMEs). This pricing concern is a deterrent, slowing down broader industry adoption and limiting NVDIMM’s penetration in the market.

Driving and Restraining Factors

Drivers

- Growth in Data Centers and Cloud Computing

- Rising Demand Due to Performance and Latency Benefits

- Emerging Support from Technology Giants and Ecosystem Development

Restraints

- High Cost of NVDIMM Technology

- Complex Integration and Compatibility Issues

Opportunities

- Emergence of Hybrid Memory Solutions

- Increase in Real-Time Processing Applications

Challenges

- Limited Awareness and Adoption

- Challenges Regarding Vendor Ecosystem and Security

Product Outlook

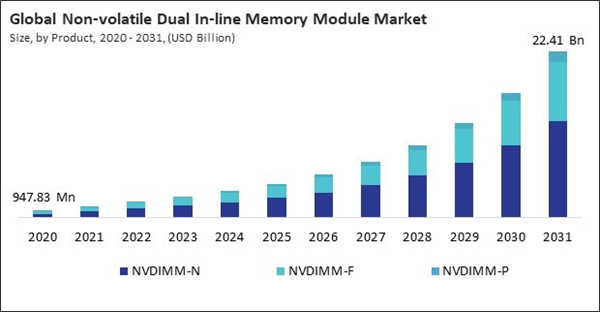

Based on product, the market is classified into NVDIMM-N, NVDIMM-F, and NVDIMM-P. The NVDIMM-N segment garnered 59% revenue share in the market in 2023. It integrates DRAM for high-speed data access and NAND flash for data persistence, ensuring that information is not lost during unexpected power failures. This distinctive combination renders it highly appropriate for critical enterprise applications, including financial transactions, server virtualization, and database management systems, where data integrity and performance are indisputable.Capacity Outlook

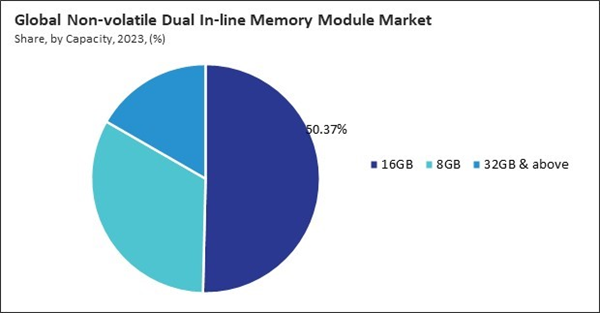

On the basis of capacity, the market is divided into 8GB, 16 GB, and 32 GB & above. The 32 GB & above segment recorded 17% revenue share in the market in 2023. As industries embrace advanced technologies like artificial intelligence, big data analytics, and in-memory databases, the demand for larger NVDIMM capacities continues to grow. This segment caters to high-end servers and next-generation data centers that require superior speed, endurance, and reliability for large-scale operations.End Use Outlook

By end-use, the market is divided into enterprise storage & server, high-end workstation, and others. The enterprise storage & server segment witnessed 83% revenue share in the market in 2023. Banking and finance, healthcare, telecom, and e-commerce organizations handle mission-critical applications demanding high-speed performance and uncompromised data integrity. NVDIMMs address these needs by combining the speed of DRAM with the persistence of NAND flash, ensuring that vital data is retained even in the event of sudden power loss.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment acquired 31% revenue share in the market in 2023. The region's growing emphasis on data protection, conformance with stringent data security regulations (such as GDPR), and the adoption of high-performance computing in the automotive, manufacturing, and research sectors are the primary factors driving Europe's robust growth.List of Key Companies Profiled

- Micron Technology, Inc.

- Kingston Technology Company, Inc.

- Everspin Technologies, Inc.

- Hewlett Packard Enterprise Company

- Fujitsu Limited

- Samsung Electronics Co., Ltd. (Samsung Group)

- Unigen Corporation

- Netlist, Inc

- Smart Modular Technologies, Inc. (Penguin Solutions, Inc.)

- Viking Technology Inc. (Sanmina Corporation)

Market Report Segmentation

By Product

- NVDIMM-N

- NVDIMM-F

- NVDIMM-P

By Capacity

- 16GB

- 8GB

- 32GB & above

By End-use

- Enterprise Storage & Server

- High-End Workstation

- Other End-use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Micron Technology, Inc.

- Kingston Technology Company, Inc.

- Everspin Technologies, Inc.

- Hewlett Packard Enterprise Company

- Fujitsu Limited

- Samsung Electronics Co., Ltd. (Samsung Group)

- Unigen Corporation

- Netlist, Inc

- Smart Modular Technologies, Inc. (Penguin Solutions, Inc.)

- Viking Technology Inc. (Sanmina Corporation)