The Asia Pacific segment recorded 38% revenue share in the market in 2023. The high population density, increasing smartphone penetration, and government-backed 5G initiatives have significantly contributed to the region’s growth. China, in particular, has taken the lead with aggressive investments in 5G infrastructure, widespread network coverage, and strong support from government policies.

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December, 2023, Ericsson AB entered into an agreement with AT&T, an American telecommunications company, to deploy 5G Open RAN solutions across the U.S. Ericsson will leverage its 5G Smart Factory in Texas to produce infrastructure under Build America laws, enabling a cloud-native open network. This agreement aims to advance programmable networks, intelligent automation, and sustainability, driving innovation and monetization opportunities while enhancing digital infrastructure in the U.S. Moreover, In February, 2024, Verizon Communications, Inc., partnered with Ericsson to complete a trial of Low-Latency, Low-Loss, Scalable Throughput (L4S) technology, enhancing its 5G network. This trial focused on improving the performance of high-bandwidth applications like augmented reality (AR), virtual reality (VR), real-time video, and autonomous systems. The L4S capability will help Verizon deliver faster, more reliable connections, reducing latency by up to 50% for time-critical communications.

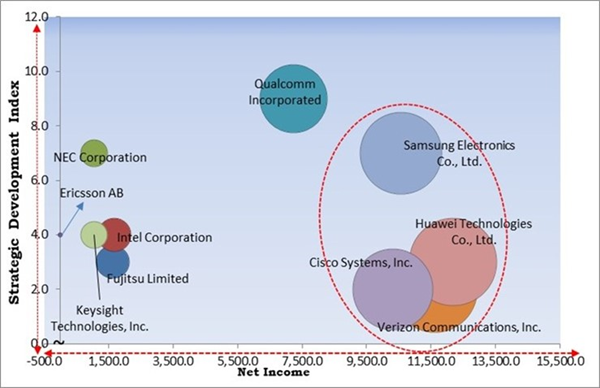

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Cisco Systems, Inc., and Verizon Communications, Inc. are the forerunners in the 5G New Radio Market. In February, 2024, Samsung and TELUS are collaborating to establish Canada’s first commercial virtualized and Open RAN network, enhancing performance, flexibility, and energy efficiency. This deployment will leverage Samsung's vRAN technology and multi-vendor solutions, marking a significant advancement in Canadian telecommunications. Companies such as Qualcomm Incorporated, Intel Corporation and Fujitsu Limited are some of the key innovators in 5G New Radio Market.Market Growth Factors

A salient characteristic of 5G NR is its capacity to deliver ultra-low latency, which is essential for real-time applications, including autonomous vehicles, industrial automation, and remote healthcare services. For instance, in telemedicine, doctors can perform remote surgeries and monitor patients with minimal lag, ensuring more precise and effective treatments. Similarly, in the automotive industry, self-driving cars rely on instantaneous communication with sensors, traffic systems, and other vehicles to navigate safely, making high-speed connectivity necessary. Hence, these factors will aid in the expansion of the market.Additionally, the Internet of Things (IoT) transforms industries and everyday life by enabling billions of connected devices to communicate and share data in real-time. According to the World Bank’s Digital Progress and Trends Report 2023, in 2022, more than 13 billion IoT devices were in use. Driven largely by the real-time connectivity of 5G technology, these devices are expected to more than double between 2023 and 2028. IoT is becoming integral to the modern digital ecosystem, from smart home applications and industrial automation to healthcare monitoring and autonomous transportation. Thus, as the world moves towards a hyper-connected digital future, integrating IoT and 5G NR will play a pivotal role in revolutionizing industries.

Market Restraining Factors

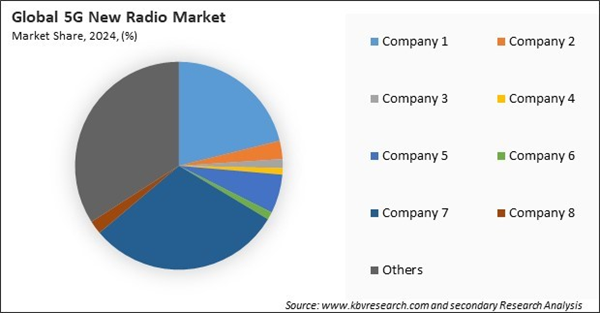

However, The deployment of 5G New Radio (NR) demands substantial investment due to the need for new base stations, fiber optic networks, and spectrum allocation. Unlike previous generations, 5G requires an overhaul of network infrastructure, making it a costly transition for telecom operators. The cost is particularly high in emerging markets, where financial constraints slow adoption. Additionally, acquiring 5G spectrum licenses through government auctions adds a significant financial burden, making it difficult for operators to justify large-scale deployments. Hence, these factors may hamper the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Driving and Restraining Factors

Drivers

- Increasing Demand For High-Speed Connectivity

- Rising Penetration Of Iot And Smart Devices

- Surge In Private 5G Networks Deployment

Restraints

- High Deployment And Infrastructure Costs

- Limited And Fragmented Allocations Of Spectrum

Opportunities

- Increasing Industrial Automation & Enterprise Digitalization

- Growth In 5g-Compatible Devices & Chipsets

Challenges

- Compatibility And Interoperability Issues

- High Power Consumption & Hardware Limitations

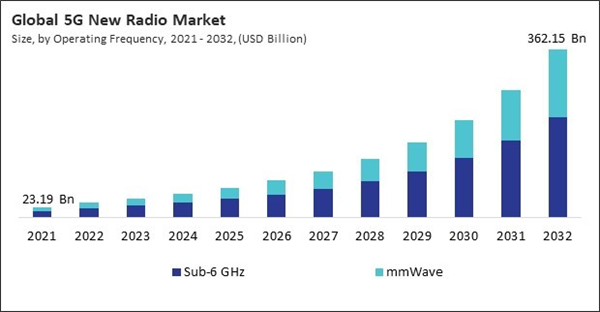

Operating Frequency Outlook

On the basis of operating frequency, the market is bifurcated into sub-6 GHz and mmWave. The mmWave segment garnered 37% revenue share in the market in 2023. Operating in the 24 GHz to 100 GHz range, mmWave technology enables multi-gigabit speeds, making it essential for high-density areas, smart cities, and enterprise applications. Nevertheless, mmWave signals exhibit a reduced range and limited ability to penetrate obstacles, necessitating the implementation of dense small-cell deployments, thereby escalating infrastructure expenditures.Application Outlook

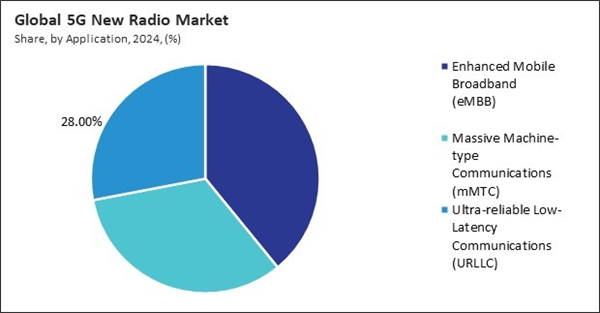

Based on application, the market is segmented into enhanced mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive machine-type communications (mMTC). The ultra-reliable low-latency communications (URLLC) segment witnessed 28% revenue share in the market in 2023. URLLC enables low-latency communication with near-zero packet loss, making it essential for autonomous vehicles, industrial automation, remote healthcare (telemedicine and robotic surgeries), and smart grid technologies.Offering Outlook

Based on offering, the market is classified into hardware, software, and services. The services segment procured 25% revenue share in the market in 2023. As telecom operators expanded their 5G coverage, they relied on managed services, consulting, and professional support to optimize their networks and ensure seamless integration with existing 4G/LTE infrastructure. Additionally, the growing adoption of private 5G networks in manufacturing, healthcare, and logistics industries drove the need for specialized 5G-as-a-service (5GaaS) solutions.Architecture Outlook

By architecture, the market is divided into non-standalone (NSA) and standalone (SA). The standalone (SA) segment acquired 34% revenue share in the market in 2023. SA networks do not rely on legacy 4G infrastructure, allowing telecom operators to unlock the full potential of 5G, including ultra-low latency, high-speed data transmission, and network slicing capabilities. SA architecture is gaining traction, particularly in private 5G deployments, industrial IoT (IIoT), and smart city initiatives, where dedicated 5G networks are required for mission-critical applications.Industry Outlook

On the basis of industry, the market is divided into IT & telecommunication, manufacturing, automotive, healthcare, retail, and others. The manufacturing segment witnessed 21% revenue share in the market in 2023. 5G enables low-latency communication, real-time data analysis, and remote monitoring, allowing manufacturers to optimize production efficiency and reduce downtime. With robotics, AI-powered automation, and predictive maintenance integral to modern manufacturing, 5G NR has become a key enabler of Industry 4.0 initiatives.Market Competition and Attributes

The 5G New Radio Market is highly fragmented and competitive, driven by startups and regional firms offering specialized solutions. These players focus on securing specific IoT layers like device authentication, data encryption, and network protection. Innovation, affordability, and adaptability to evolving threats define competition, enabling agile companies to address niche demands and gain traction in emerging IoT ecosystems.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed 29% revenue share in the market in 2023. Early adoption of 5G technology, large telecommunications investments, and a high level of customer demand for ultra-fast connectivity are the main factors propelling the regional market's growth. The United States and Canada have led the way in 5G spectrum auctions, infrastructure expansion, and private 5G deployments for enterprise applications.Recent Strategies Deployed in the Market

- Oct-2024: Huawei launched its 5G-AA solutions, enhancing network capabilities for the Mobile AI era. These solutions feature advanced Massive MIMO technology, full-domain site digitalization, and improved network autonomy to meet diverse service demands.

- Aug-2023: Fujitsu Limited has unveiled a new millimeter-wave chip technology for 5G that supports multibeam multiplexing, enabling up to four beams to be multiplexed by a single chip. This breakthrough reduces the size of radio units (RUs) by 50%, achieving high-speed, high-capacity communication at over 10Gbps while cutting power consumption by 30%. The development aims to advance 5G base stations, contributing to cost and energy savings and enhancing the spread of millimeter-wave technology.

- Aug-2023: Ericsson AB renewed its partnership with Telkomsel to expand 4G and 5G networks in Indonesia. This collaboration will enhance Telkomsel’s connectivity with Ericsson’s energy-efficient Massive MIMO technology, supporting Industry 4.0, smart cities, and digital transformation initiatives.

- Aug-2023: Keysight Technologies and MediaTek collaborated to verify that MediaTek's 5G modem technology supports 5G New Radio (NR) and IoT technologies for Non-Terrestrial Networks (NTN) based on 3GPP Release 17 standards. The verification utilized Keysight's end-to-end mixed terrestrial and space test bed to simulate satellite orbits and channel effects. This achievement accelerates the development of commercial satellite communications, ensuring reliable, high-bandwidth connectivity for remote areas without terrestrial network coverage.

- Feb-2023: Samsung Electronics extended its collaboration with Red Hat, an open-source solutions provider, to develop a virtualized Radio Access Network (vRAN) solution with enhanced integration and automation. This partnership aims to improve network scalability, flexibility, and efficiency for 5G service providers. The solution will incorporate Red Hat OpenShift, Enterprise Linux, and Ansible Automation Platform, helping optimize energy consumption and simplify operations. By leveraging open-source technologies, Samsung and Red Hat will enable seamless vRAN deployments across multi-cloud environments, supporting advanced 5G applications, private networks, and edge computing solutions.

List of Key Companies Profiled

- Ericsson AB

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Fujitsu Limited

- Intel Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- Verizon Communications, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- NEC Corporation

- Keysight Technologies, Inc.

Market Report Segmentation

By Operating Frequency

- Sub-6 GHz

- mmWave

By Application

- Enhanced Mobile Broadband (eMBB)

- Massive Machine-type Communications (mMTC)

- Ultra-reliable Low-Latency Communications (URLLC)

By Offering

- Hardware

- Database Administration

- Radio Units

- Antennas

- Customer Premises Equipment (CPE)

- Other Hardware

- Services

- Software

By Architecture

- Non-Standalone (NSA)

- Standalone (SA)

By Industry

- IT & Telecommunication

- Manufacturing

- Automotive

- Healthcare

- Retail

- Other Industry

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Ericsson AB

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Fujitsu Limited

- Intel Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- Verizon Communications, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- NEC Corporation

- Keysight Technologies, Inc.