Speak directly to the analyst to clarify any post sales queries you may have.

The ultra thin foil with copper foil carrier market is a vital pillar for high-growth sectors, supplying essential materials to electronics, energy, and industrial fields. Senior decision-makers require succinct insights to keep pace with rapid advancements, shifting demand centers, and evolving innovation priorities that influence strategy and investment.

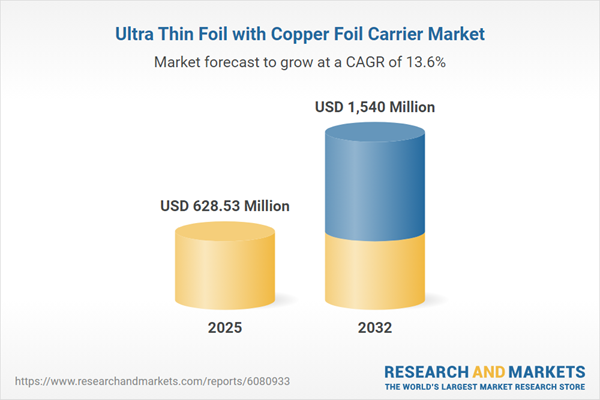

Market Snapshot: Ultra Thin Foil with Copper Foil Carrier Market

The ultra thin foil with copper foil carrier market expanded from USD 558.39 million in 2024 to USD 628.53 million in 2025, with expectations to reach USD 1.54 billion by 2032, reflecting a CAGR of 13.60%. Key factors fueling this growth include robust adoption in electric vehicles, 5G infrastructure, advanced consumer electronics, and renewable energy solutions. Innovations in foil manufacturing and material integration are enabling more compact, efficient, and resilient products that serve the evolving requirements of next-generation industries.

Scope & Segmentation

- Thickness: Options spanning less than 5 µm, 5–9 µm, 9–12 µm, and 12–20 µm provide tailored solutions meeting nuanced technical and functional needs, particularly in miniaturized and precision applications.

- Construction: Dual Carrier and Single Carrier materials deliver device-specific functional benefits, aligning with various architectural demands present across electronic assemblies and customized modules.

- Product Form: Market offerings include coil formats such as bulk and spool, custom die-cut or embossed parts, and sheet variants for standard and specialized sizing, supporting lean manufacturing and supply chain flexibility.

- Manufacturing Process: Methods range from Electrolytic/Electroforming and Lamination & Transfer to advanced Patterning, including Modified SAP and Semi-Additive Process, PVD/Sputtering, and Rolled/Annealed (RA) techniques, serving diverse precision-oriented industrial applications.

- Application: Use cases span Antennas & RF (for high-frequency modules), Displays & Touch systems, EMI/EMC Shielding, multiple types of Printed Circuit Boards, advanced Semiconductor Packaging, plus Sensors & Wearables for both biomedical and industrial solutions.

- End Use Industry: Aerospace & Defense, Automotive (interiors, exteriors, powertrains), Electronics (consumer, telecom, industrial), the Energy sector (battery, fuel cell, solar), and Healthcare make up the principal verticals leveraging these advanced materials.

- Geography: Coverage spans the Americas (including both North and Latin America), Europe, Middle East & Africa, and Asia-Pacific, highlighting established markets and spotlighting emerging regional opportunities.

- Companies Profiled: Leading innovators include Mitsui Mining & Smelting, SK Nexilis, Fukuda Metal Foil & Powder, Furukawa Electric, JX Nippon Mining & Metals, and additional major players, underscoring ongoing technological and geographic expansion in the sector.

Key Takeaways

- Ultra thin foil with copper foil carrier technology is central to miniaturization and performance improvements in high-frequency, high-density electronics, emphasizing reliability and efficiency for specialized use cases.

- Strategic collaborations between OEMs and material suppliers foster customized solutions, ensuring applications—from automotive to telecom—meet precise regulatory and technical specifications.

- Advancements in rolling, etching, and surface modification techniques are optimizing product consistency and production efficiency, while also enabling ongoing cost management and sustainability advancement.

- Asia-Pacific leads in consumption, benefiting from its manufacturing strength in both electronics and automotive sectors; meanwhile, North America and EMEA are registering growing demand for domestic solutions and local innovations.

- Comprehensive segmentation by thickness, construction, and application allows procurement teams and suppliers to target configurations that precisely fulfill increasingly specialized industrial requirements, from energy storage components to advanced shielding for sensitive electronics.

Impact of U.S. Tariffs (2025) on the Ultra Thin Foil with Copper Foil Carrier Market

- Recent U.S. tariffs on imported copper foil carriers have caused a shift toward regional sourcing and domestic manufacturing. This has resulted in short-term supply chain volatility and driven notable investments in local production capabilities and process innovation.

- Companies have adapted to these regulatory changes by building strategic inventories, negotiating supplier terms to balance rising costs, and examining alternative logistics networks to foster secure and competitive supply chains.

Methodology & Data Sources

This report is based on rigorous primary interviews with sector stakeholders and thorough review of technical literature, patents, trade databases, and company filings. Triangulation and validation by subject-matter experts ensure actionable and credible insights for senior leaders navigating the ultra thin foil with copper foil carrier landscape.

Why This Report Matters

- Enables executive teams to tailor sourcing, investment, and innovation strategies in line with current market realities and emerging use cases.

- Presents timely perspectives on tariff impacts, regulatory shifts, and technology changes that influence decision-making in copper foil carrier manufacturing.

- Provides segmented intelligence and company profiles to help identify growth opportunities and refine planning for both established and developing applications.

Conclusion

The ultra thin foil with copper foil carrier market continues to evolve, shaped by emerging supply chain dynamics and shifting performance expectations. Responsive innovation and cross-sector collaboration will be key to capturing sustained value in this sector.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Ultra Thin Foil with Copper Foil Carrier market report include:- Mitsui Mining & Smelting Co., Ltd.

- SK Nexilis Co., Ltd.

- Fukuda Metal Foil & Powder Co., Ltd.

- Furukawa Electric Co Ltd

- JX Nippon Mining & Metals Co., Ltd.

- Advanced Copper Foil

- American Elements

- Solus Advanced Materials

- Chang Chun Petrochemical Co., Ltd.

- Civen Metal

- Doosan Corporation Electro-Materials

- Fangbang Electronics Co., Ltd.

- GUANGDONG DONGSEN ZHICHUANG TECHNOLOGY CO., LTD.

- Guangdong Jia Yuan Technology Shares Co., Ltd.

- ILJIN Materials Co., Ltd.

- INSULECTRO

- Jima Copper

- Jiujiang Defu Technology Co., Ltd.

- LS Mtron Ltd.

- Nan Ya Plastics Corporation

- Nippon Denkai, Ltd.

- Shanghai Friend Metals Technology_Co.,LTD

- Shenzhen Huachang Weiye Metal Materials Co., Ltd

- Tatsuta Electric Wire & Cable Co., Ltd.

- Tongling Nonferrous Metals Group Co., Ltd.

- TOP Nanometal Corporation

- Volta Energy Solutions

- Wieland Group

- Zhejiang Huanergy Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 628.53 Million |

| Forecasted Market Value ( USD | $ 1540 Million |

| Compound Annual Growth Rate | 13.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |