Speak directly to the analyst to clarify any post sales queries you may have.

Navigating the Evolving World of Automotive Solenoid Valves: An Overview of Technological Advances Market Drivers and Critical Dynamics

The automotive solenoid valve market stands at the crossroads of innovation and operational excellence, driven by the convergence of electrification trends and stringent emission regulations. As vehicles transition toward electrified powertrains and advanced driver assistance systems, solenoid valves have emerged as critical enablers of precise fluid control and rapid actuation. Beyond traditional hydraulic systems, modern variants are finding applications in battery thermal management and regenerative braking circuits, reflecting their expanding role within the vehicle ecosystem.This report delves into the multifaceted drivers reshaping the landscape, from advancements in microelectronics and sensor integration to the growing emphasis on lightweight materials and manufacturing efficiency. Rapid developments in additive manufacturing techniques are enabling bespoke design geometries while reducing lead times and production costs. At the same time, global regulatory bodies are enforcing tighter emission limits, prompting automakers and suppliers to seek solutions that optimize fuel injection, exhaust gas recirculation, and cabin climate control.

Navigating this intricate landscape requires a holistic understanding of component-level innovations, supply chain dynamics, and end-market trends. The analysis that follows builds on rigorous primary research and secondary data synthesis to equip decision-makers with the knowledge necessary to capitalize on emerging opportunities and mitigate risks. Through a blend of technical insights and strategic perspectives, this introduction establishes the foundation for a thorough exploration of the automotive solenoid valve market’s trajectory.

Transformative Forces Reshaping the Automotive Solenoid Valve Market Landscape and Accelerating Innovation Through Sustainability and Integration

The automotive solenoid valve sector is experiencing transformative shifts driven by the pursuit of sustainability, digital integration, and enhanced performance. Materials innovation has moved beyond traditional metals, with high-strength polymers and composite alloys enabling weight reduction and corrosion resistance without sacrificing structural integrity. Simultaneously, the integration of embedded sensors and smart actuators is allowing real-time monitoring of pressure, temperature, and flow rates, ushering in a new era of predictive maintenance and over-the-air calibration capabilities.Moreover, the electrification of powertrains has accelerated the demand for high-precision solenoid valves capable of operating under extreme voltage conditions. This shift has catalyzed close collaboration between electronic component manufacturers and fluid control specialists to ensure seamless communication between power electronics and mechanical actuation systems. In parallel, OEMs are embedding artificial intelligence algorithms within control modules to optimize valve actuation patterns, reducing energy consumption and improving system responsiveness.

As environmental regulations tighten, there is a growing emphasis on circular design principles, prompting suppliers to adopt closed-loop manufacturing processes and promote material recyclability. These initiatives, combined with the digital twin methodologies employed during product development, are reducing time to market while ensuring compliance with global standards. Ultimately, these interconnected advances are reshaping the competitive landscape, creating opportunities for agile players ready to embrace technological convergence.

Assessing the Ripple Effects of Newly Imposed United States Tariffs on Automotive Solenoid Valve Supply Chains and Strategic Sourcing Decisions

The imposition of new United States tariffs has introduced significant complexities into the automotive solenoid valve supply chain, compelling global suppliers to reexamine manufacturing footprints and sourcing strategies. Components traditionally imported under preferential trade agreements now face elevated duties, prompting strategic realignment to minimize cost exposure. As a result, many manufacturers are exploring nearshoring options in adjacent markets or renegotiating agreements with domestic partners to preserve price competitiveness.These tariff dynamics have also accelerated the adoption of dual-sourcing models, enabling companies to pivot between suppliers in different regions based on duty applicability and lead times. At the same time, automotive OEMs are leveraging long-term contracts and forward-buying practices to hedge against further tariff escalations. This proactive stance has spurred deeper collaboration within supply chain ecosystems, fostering joint risk assessments and contingency planning workshops designed to maintain uninterrupted production.

Furthermore, the ripple effects extend into inventory management, with organizations adjusting safety stock levels and recalibrating just-in-time delivery paradigms. These adjustments aim to balance the cost of holding additional inventory against the risk of production delays arising from customs clearances and compliance audits. As regulatory frameworks continue to evolve, stakeholders are urged to engage in active dialogue with trade authorities and industry associations, ensuring that tariff impacts are anticipated and mitigated through agile sourcing strategies.

Unveiling Segmentation Insights to Drive Automotive Solenoid Valve Product Development Strategic Market Positioning and Value Creation

In dissecting the automotive solenoid valve market through a segmentation lens, several dimensions emerge as critical for strategic decision-making. When considering valve type, the industry is bifurcated into configurations that direct fluid across two ports, three ports, or four ports, each design tailored to specific actuation and flow control requirements. Inline and manifold installation methods further differentiate product offerings, with inline units favored for their ease of integration into existing pipelines and manifold assemblies chosen for compact, centralized fluid management in complex systems.Material selection adds another layer of nuance: aluminum variants offer weight savings and thermal conductivity, brass delivers corrosion resistance in harsh chemical environments, plastic models provide cost-effective solutions for low-pressure applications, and steel remains the material of choice where high pressure and mechanical robustness are paramount. End use segmentation highlights the divergent demands of passenger vehicles and commercial fleets, the latter subdivided into heavy duty operations requiring extreme durability and light duty applications prioritizing fuel efficiency.

Application-specific requirements drive further differentiation across body control and interior functions, engine cooling and control circuits, fuel delivery and emission management modules, heating ventilation and air conditioning subsystems, and safety and security applications. Finally, distribution channels play a vital role in shaping market reach, with original equipment manufacturers securing long-term production contracts while aftermarket providers address retrofitting and replacement needs. Together, these segmentation dimensions offer a comprehensive framework for aligning product development and marketing initiatives with end-customer priorities.

Key Regional Insights Highlighting the Americas EMEA and Asia Pacific Dynamics Shaping the Automotive Solenoid Valve Industry Growth

Regional dynamics in the automotive solenoid valve industry reveal divergent growth drivers and regulatory landscapes across major geographies. In the Americas, sustained investment in electric vehicle infrastructure and federal incentives for emissions reduction are spurring demand for advanced solenoid solutions within battery thermal management and regenerative braking systems. Domestic manufacturing is further supported by policy measures favoring onshore production, creating opportunities for suppliers to establish localized capabilities.Across Europe, the Middle East, and Africa, stringent CO2 emission targets and Euro 7 regulation proposals are exerting pressure on OEMs to integrate high-precision actuation technologies within exhaust aftertreatment and engine control systems. Meanwhile, economic diversification initiatives in the Middle East are accelerating infrastructure projects, driving commercial vehicle adoption and associated demand for robust fluid control components. African markets, though nascent, are receiving incremental investment in logistics and fleet modernization, laying the groundwork for future growth.

In the Asia-Pacific region, a blend of manufacturing prowess and rising consumer demand is creating a unique ecosystem. East Asian economies are advancing toward smart factory adoption, leveraging Internet of Things connectivity to monitor valve performance in real time. South and Southeast Asian markets are witnessing rapid urbanization and expanding passenger vehicle ownership, amplifying requirements for cost-effective HVAC and safety applications. These regional disparities underscore the importance of tailored market strategies that align with local policy directives and technological readiness.

Examining Leading Industry Players Innovations Competitive Strategies and Collaborative Ventures in the Automotive Solenoid Valve Sector

Leading players in the automotive solenoid valve sector are differentiating themselves through a combination of product innovation, strategic partnerships, and vertical integration. Several established corporations have expanded their R&D centers to focus on mechatronic solutions, embedding microcontrollers within valve assemblies to deliver adaptive flow control capabilities. Partnerships with software developers have further enhanced the ability to deploy over-the-air updates, ensuring that solenoid performance can be optimized throughout the vehicle lifecycle.In addition to technological differentiation, collaboration with raw material suppliers has enabled these companies to secure high-performance polymers and specialty alloys that meet stringent automotive standards. Joint ventures with fabrication specialists have also expedited scale-up processes, shortening time to market for newly designed valve architectures. On the mergers and acquisitions front, selective transactions have allowed companies to broaden their product portfolios and extend their geographic footprints, particularly in emerging markets where aftermarket opportunities are gaining momentum.

Moreover, certification to international quality standards and participation in industry consortia have reinforced these players’ reputations for reliability and regulatory compliance. As the pace of innovation accelerates, successful companies are those that integrate cross-functional expertise-from fluid dynamics to embedded software-creating holistic solutions that anticipate evolving vehicle architectures and end-user expectations.

Actionable Recommendations for Industry Leaders to Enhance Supply Chain Resilience Innovation Capabilities and Regulatory Preparedness

Industry leaders seeking to navigate the complexities of the automotive solenoid valve market should prioritize a multi-pronged approach that enhances resilience and fosters continuous innovation. First, diversifying the supplier base across multiple geographies can mitigate tariff exposure and minimize the risk of disruptions caused by regional trade policy shifts. Establishing strategic partnerships with tiered suppliers and logistics providers will ensure greater visibility into lead times and inventory positions.Simultaneously, investing in advanced product development capabilities, including digital twins and computational fluid dynamics simulations, can accelerate validation cycles and support iterative design improvements. This approach reduces reliance on physical prototypes and enables rapid correlation of performance metrics under a variety of operating scenarios. At the same time, embedding smart sensors within valve systems will facilitate predictive maintenance strategies, reducing unplanned downtime and bolstering aftermarket service offerings.

On the regulatory front, proactive engagement with standards organizations and government agencies will help companies anticipate new compliance requirements and influence technical specifications. This engagement should be complemented by continuous enhancement of quality management systems and supply chain traceability protocols. Finally, fostering talent development through targeted training programs will build the cross-disciplinary skills required to integrate mechanical, electrical, and software domains, ensuring that organizations remain at the forefront of the solenoid valve innovation curve.

Comprehensive Research Methodology Blending Primary Discussions Secondary Data Triangulation and Rigorous Validation Protocols

This study employs a rigorous research methodology that blends primary interviews with key automotive OEMs, tier-one suppliers, and industry experts alongside secondary data analysis from technical publications, patent filings, and regulatory databases. Initial scoping discussions with fluid control engineers and procurement professionals established the core themes and pain points driving market evolution. These qualitative insights were then supplemented by a systematic review of industry white papers and standards documentation to capture emerging technological benchmarks.Quantitative data collection included disaggregated shipment statistics, capacity utilization rates, and trade flow analysis derived from customs records. Triangulation techniques were applied to reconcile discrepancies between public datasets and interview findings, enhancing the overall reliability of the conclusions. Analytical frameworks such as Porter’s Five Forces and value chain mapping provided structured lenses for evaluating competitive intensity and margin pressures.

Quality assurance protocols involved iterative validation workshops with subject matter experts to validate key assumptions and refine scenario analyses. Throughout the research process, adherence to ethical standards and confidentiality commitments ensured the integrity of proprietary information. The result is a comprehensive evidence base that supports actionable insights and robust strategic planning.

Conclusion Synthesizing Key Takeaways Emerging Trends and Strategic Imperatives Guiding the Future of Automotive Solenoid Valves

Synthesizing the insights presented, several overarching imperatives emerge for stakeholders in the automotive solenoid valve ecosystem. Technological convergence-marked by the integration of smart sensors and advanced materials-remains central to delivering the precision and reliability demanded by next-generation vehicle architectures. At the same time, the recalibration of supply chains in response to regulatory shifts and tariff regimes underscores the importance of geographic diversification and agile sourcing models.Segmentation analysis reveals that tailored product offerings, whether defined by type, installation method, material composition, end use, application, or distribution channel, are key to capturing value across diverse customer segments. Regional dynamics further highlight the need for localized strategies that align with policy incentives, regulatory frameworks, and market maturity. Leading companies are those that combine deep domain expertise with cross-functional collaboration, leveraging partnerships and acquisitions to expand their technical capabilities and geographic reach.

Looking ahead, the ability to anticipate regulatory changes, adopt circular economy principles, and harness digital technologies will differentiate market leaders from followers. By translating these strategic imperatives into concrete investment and operational initiatives, stakeholders can secure sustainable growth and reinforce their competitive positioning as the automotive industry continues its rapid transformation.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

- Aisin Corporation

- BorgWarner Inc.

- Burkert GmbH & Co. KG

- CKD Corporation

- Continental AG

- Curtiss-Wright Corporation

- Danfoss A/S

- Danfoss Industries Ltd

- Denso Corporation

- Eaton Corporation plc

- Emerson Electric Co.

- Flowserve Corporation

- Fluitron, Inc.

- GEMÜ Group

- GW Lisk, Inc.

- HELLA GmbH & Co. KGaA

- Hitachi Astemo, Inc.

- IMI Precision Engineering

- Infineon Technologies AG

- Johnson Electric Holdings Limited

- KYB Corporation

- Magna International Inc.

- Magnatrol Valve Corporation

- Mahle GmbH

- Marelli Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- Norgren Ltd.

- Parker Hannifin Corporation

- Rheinmetall Automotive AG

- Robert Bosch GmbH

- Rotex Automation Limited

- Rotork plc

- Samson AG

- SMC Corporation

- Stoneridge, Inc.

- TLX Technologies, LLC

- Vitesco Technologies GmbH

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

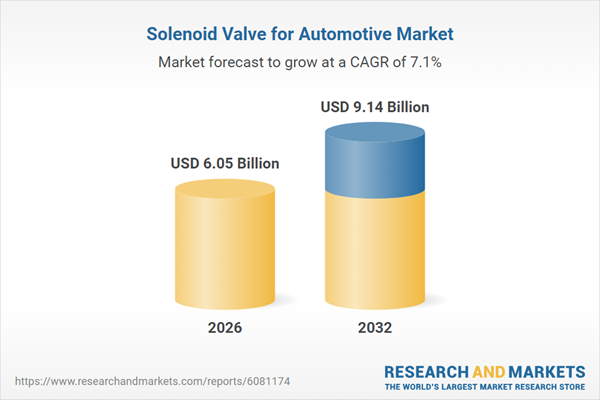

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 6.05 Billion |

| Forecasted Market Value ( USD | $ 9.14 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 39 |