Speak directly to the analyst to clarify any post sales queries you may have.

The roll shapers market is rapidly evolving as wellness, fitness, and therapeutic recovery sectors converge. Senior decision-makers are seeking actionable insights to navigate shifting customer expectations, regulatory requirements, and advances in device technology that are shaping market direction.

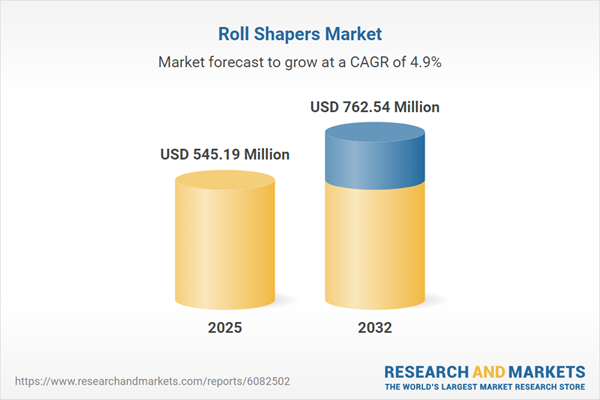

Market Snapshot: Roll Shapers Market Growth and Momentum

The roll shapers market expanded from USD 521.06 million in 2024 to USD 545.19 million in 2025 and is projected to reach USD 762.54 million by 2032 at a CAGR of 4.87%. This growth highlights the mounting importance of wellness, recovery, and personalized fitness, driven by a demand for advanced device features and broader global reach. Leading companies are pursuing innovation and diversifying distribution strategies to secure sustained international engagement. Industry participants are leveraging both product development pipelines and expanding channel access as core elements of their growth strategy.

Scope & Segmentation: Roll Shapers Market Landscape

This report provides a detailed analysis of the roll shapers market, outlining core growth segments, regional drivers, and emerging technology themes influencing purchasing decisions. Key breakdowns include:

- Product Types: Electric roll shapers designed for automated therapy; manual units preferred for cost-effective entry points; portable models supporting mobile and flexible applications in various client environments.

- Material Types: Metal rollers valued for durability; plastic alternatives that provide lightweight options; wood-based rollers targeting preferences for natural materials and sustainability.

- Distribution Channels: Offline retail outlets catering to traditional purchasing behaviors; online retail supporting convenience; company-owned digital channels enabling direct engagement; e-commerce platforms enhancing global reach.

- Applications: Integration across beauty and wellness services; utilization in core fitness and exercise regimens; deployment in physical therapy; adoption for rehabilitation in both individual and institutional settings.

- End-User Industries: Fitness centers and gyms adopting advanced recovery and fitness solutions; healthcare providers leveraging therapeutic benefits; spas and salons expanding service offerings; individual consumers influencing demand trends.

- Regional Coverage: Insights into the Americas, Europe, Middle East, Africa, and Asia-Pacific, reflecting shifts in buyer behavior, technology adoption, and regulatory frameworks across geographies.

- Company Profiles: Strategic reviews of market leaders such as Fitnesswell, Life Fitness, Inc., Torque Fitness LLC, Bodylastics Inc., Body Boll Studio Inc., ROLL Recovery, Technogym S.p.A., Planet Fitness, Inc., Vacuactivus, and Studio Figura International sp. z o. o., including their product strategies and innovation focus.

The analysis also considers the impact of smart integration technology and the increasing adoption of eco-friendly materials, demonstrating how these features influence regional and segment-specific purchase decisions.

Key Takeaways: Strategic Insights for Decision-Makers

- The market’s intersection of wellness and medical recovery creates value for both personal and institutional buyers seeking comprehensive solutions.

- Innovative designs, such as modular features and digital integration, enable tailored therapy programs and enhance device management for professional operators.

- Sustainable procurement practices, including certified eco-materials and responsible manufacturing, are driving shifts in supplier selection and end-user preferences.

- Expansion into new markets is supported by robust digital engagement and diversified distribution models that increase brand visibility and facilitate customer retention.

- Proactive localization of manufacturing and deeper collaboration with suppliers help organizations adapt to evolving cost structures and complex regulatory demands.

- The adoption of advanced device components is closely aligned with the evolving needs of healthcare, fitness, and wellness service providers.

Tariff Impact: Supply Chain and Cost Dynamics

- Recent U.S. tariffs on steel, aluminum, and specialized polymers are elevating input costs, prompting a thorough evaluation of sourcing and supplier networks.

- Organizations are increasing local fabrication efforts, strengthening regional supplier alignments, and exploring hybrid inventory models to manage supply variability and maintain cost efficiency.

- These regulatory developments are spurring product redesign initiatives and renewed focus on operational efficiency throughout the manufacturing value chain.

Methodology & Data Sources

This research applies structured interviews with senior executives and product developers, buyer-focused surveys, and robust validation through trade publications and company reports. The approach uses data triangulation and multiple scenario analyses to deliver highly reliable, actionable recommendations.

Why This Report Matters

- Provides executives with a foundation for strategic resource planning by identifying key trends in technology adoption, consumer engagement, and evolving sales channels across global regions.

- Delivers timely and practical guidance to mitigate supplier risk and ensure supply continuity amid ongoing regulatory and trade challenges.

- Equips stakeholders with competitive intelligence through in-depth company profiles, shedding light on operational innovation and sector collaboration opportunities.

Conclusion

This report gives senior leaders clear guidance to identify growth opportunities, prepare for emerging risks, and implement strategies for long-term sustainability in the advancing roll shapers sector.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Roll Shapers Market report include:- Fitnesswell

- Life Fitness, Inc.

- Torque Fitness LLC

- Bodylastics Inc.

- Body Boll Studio Inc.

- ROLL Recovery

- Technogym S.p.A.

- Planet Fitness, Inc.

- Vacuactivus

- Studio Figura International sp. z o. o.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 545.19 Million |

| Forecasted Market Value ( USD | $ 762.54 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |