Speak directly to the analyst to clarify any post sales queries you may have.

Navigating the Evolving URD Cable Market with a Comprehensive Overview of Emerging Drivers, Challenges, and Opportunities Shaping Industry Dynamics

The underground residential distribution cable sector is undergoing a period of profound transformation driven by evolving regulatory frameworks, technological breakthroughs, and shifting end-user expectations. These cables form the backbone of suburban and urban power grids, ensuring reliable energy delivery to homes, commercial complexes, and public infrastructure. As municipalities pursue grid modernization programs and utilities strive to accommodate renewable energy integration, demand for robust, flexible URD cable solutions has intensified. This dynamic environment presents both challenges and opportunities for manufacturers, system integrators, and installers alike.Against this backdrop, this executive summary offers a concise yet thorough introduction to the forces reshaping the URD cable market. It highlights emerging technological drivers such as digital monitoring and predictive maintenance, policy shifts mandating higher safety and environmental standards, and supply chain pressures stemming from raw material fluctuations and global trade policies. By synthesizing current trends, this section sets the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, regional dynamics, leading companies, actionable recommendations, research methodology, and concluding perspectives.

Uncovering Transformations Redefining Urban Residential Distribution Cable Infrastructure Amid Accelerated Technological Advances and Heightened Environmental Imperatives

In recent years, the underground residential distribution cable domain has witnessed unprecedented shifts fueled by technological innovation and environmental imperatives. Smart grid integration has accelerated the adoption of advanced copper and aluminum conductor designs that support real-time network monitoring, enabling utilities to detect and isolate faults with minimal service interruption. Simultaneously, digital twin platforms and Internet of Things sensors have begun to permeate cable diagnostics, offering predictive insights that extend asset lifespans and optimize maintenance schedules.Meanwhile, heightened environmental scrutiny and stricter emission targets have spurred research into low-impact materials and recyclable insulation compounds. Stakeholders are also embracing collaborative supply chain models to enhance transparency and agility, anticipating disruptions from evolving trade policies and raw material availability. As urbanization intensifies and distributed generation gains traction, the URD cable landscape continues to morph, demanding agile strategies from manufacturers, regulators, and system operators alike.

Assessing the Cumulative Impact of United States 2025 Tariff Adjustments on Supply Chain Dynamics, Cost Structures, and Competitive Positioning in URD Cable Market

The introduction of new tariff measures by the United States in early 2025 has exerted significant pressure on URD cable supply chains. Duties applied to imported copper and aluminum cable components have led to a reevaluation of sourcing strategies, prompting some manufacturers to seek near-shore production alternatives or to renegotiate long-term agreements with domestic suppliers. Cost structures have been challenged, with procurement teams balancing the need to maintain competitive pricing against the imperative of securing high-quality raw materials.In response, companies have pursued operational adjustments including inventory hedging and enhanced demand planning to mitigate the volatility introduced by tariff fluctuations. Price pass-through strategies have been calibrated carefully to preserve end-user relationships while safeguarding margin integrity. These developments underscore the importance of supply chain resilience and cost transparency in navigating policy-driven disruptions within the URD cable market.

Unveiling Critical Segmentation Insights Illustrating How Type, Installation, Voltage, Conductor Material, Sales Channels, and Application Shape the URD Cable Market Landscape

A detailed segmentation analysis reveals how distinct market dimensions shape demand patterns and technology adoption. When examining cable type, configurations range from compact duplex and triplex designs that streamline residential drop lines to robust quadruplex and single conductor variants optimized for higher load capacities. Installation approaches span direct burial solutions that minimize conduit infrastructure with duct installation options suited for areas requiring straightforward maintenance access.Voltage rating criteria delineate applications across low-voltage runs up to 1 kV for standard residential feeders, medium-voltage spans from 1 kV to 15 kV for neighborhood distribution, and high-voltage segments between 16 kV and 35 kV for more extensive feeder networks. Conductor material preferences split between aluminum alloys prized for cost efficiency and copper formulations valued for superior conductivity and durability. Sales channels continue to evolve, with offline engagement through direct sales teams and distributor networks coexisting alongside emerging online platforms that simplify procurement and product customization. Finally, usage scenarios encompass residential neighborhoods outfitting single-family homes and commercial installations serving multi-unit complexes or mixed-use developments. Together these segmentation insights offer a nuanced understanding of how technical, logistical, and application-driven factors converge to guide product development and market strategies.

Revealing Key Regional Dynamics Demonstrating How Americas, EMEA, and Asia-Pacific Regions Drive Growth Trajectories, Regulatory Evolution, and Infrastructure Development in URD Cables

Regional analysis highlights contrasting dynamics across the Americas, Europe Middle East and Africa, and Asia-Pacific geographies that drive strategic priorities. In the Americas, aging underground networks are being revitalized through large-scale infrastructure renewal programs funded by public and private partnerships. Regulatory focus on grid resilience and renewable integration has fostered demand for cables that support distributed energy resources and rapid restoration capabilities following extreme weather events.Within Europe Middle East and Africa, regulatory harmonization initiatives are advancing safety and environmental standards, while cross-border grid interconnectivity projects in Europe and infrastructure expansion in the Middle East fuel interest in medium- and high-voltage URD solutions. African electrification efforts further create opportunities for rugged, cost-effective cable systems. Meanwhile, the Asia-Pacific region is characterized by rapid urbanization and robust investments in smart city developments. National initiatives targeting rural electrification, transportation electrification, and renewable energy generation have driven substantial expansions of underground distribution networks, underscoring the need for cables that combine scalability, durability, and digital monitoring capabilities.

Profiling Leading Companies and Their Strategic Initiatives Highlighting Innovation, Partnership Models, and Competitive Strategies Driving the URD Cable Industry Forward

Leading URD cable manufacturers are deploying a range of strategic initiatives to strengthen market positions and capture new opportunities. Global players have accelerated research into advanced conductor alloys and next-generation insulation materials, aiming to boost energy efficiency and expand operational lifecycles. Collaborative R&D partnerships with academic institutions and technology developers have yielded modular cable platforms that streamline installation and reduce onsite customization.At the same time, multinational firms have broadened their geographic reach through targeted plant expansions, acquisitions, and joint ventures in emerging markets. Digital service offerings, including remote monitoring dashboards and predictive analytics tools, have become differentiators in customer engagement. Service providers and utilities are forging alliances with cable producers to pilot grid digitization trials, reinforcing the shift toward integrated ecosystem models. These corporate strategies underscore an industry focus on innovation, sustainability, and end-to-end value delivery.

Formulating Actionable Recommendations to Enable Industry Leaders to Navigate Disruption, Enhance Operational Efficiency, Adopt Best Practices, and Capitalize on Emerging Opportunities

Industry leaders should prioritize the development of advanced conductor and insulation technologies that balance performance with lifecycle sustainability. By investing in materials research and establishing collaborative alliances with specialty chemical and metallurgical experts, organizations can deliver differentiated products that meet stricter environmental and performance criteria.Strengthening supply chain resilience through dual-sourcing agreements, regional distribution centers, and digital traceability platforms will help mitigate the impact of trade disruptions and raw material volatility. Furthermore, embracing digital transformation initiatives-such as deploying digital twins for network planning, integrating IoT-enabled fault detection, and leveraging predictive maintenance algorithms-will enhance grid reliability and optimize total cost of ownership. Cultivating partnerships across utilities, technology vendors, and regulatory bodies can foster ecosystem innovation, accelerate standards development, and unlock new value streams in smart infrastructure projects.

Detailing a Robust Research Methodology Integrating Qualitative and Quantitative Approaches to Ensure Comprehensive Analysis and Unbiased Insights into the URD Cable Sector

This analysis combines qualitative insights from in-depth interviews with utility executives, engineering consultants, and cable manufacturers alongside quantitative assessments of industry data. Primary research involved structured discussions with key stakeholders across North America, Europe, and Asia-Pacific, focusing on technology adoption, procurement strategies, and regulatory compliance practices.Secondary research drew on technical standards published by international and regional bodies, government infrastructure investment reports, patent filings, and trade association publications. Data triangulation techniques ensured that findings were cross-verified and that divergent perspectives were reconciled to produce balanced insights. Specialty databases provided historical trend analysis on raw material pricing and trade policy developments, while site visits and field observations complemented desk research to ground conclusions in real-world operational contexts.

Drawing Conclusive Perspectives on Market Trajectories, Strategic Imperatives, and Future Outlook to Equip Stakeholders with a Clear Vision for URD Cable Industry Evolution

The underground residential distribution cable sector stands at the confluence of technological innovation, policy evolution, and shifting market demands. Integrating digital monitoring platforms with novel conductor and insulation technologies is redefining reliability and maintenance paradigms. Concurrently, tariff adjustments and evolving trade policies underscore the need for agile supply chain strategies that can withstand external shocks.As regional infrastructure investments surge amidst urbanization and grid modernization mandates, segmentation dynamics-from cable type and installation methods to voltage requirements, conductor material choices, and end-use applications-serve as critical lenses for shaping product roadmaps and market approaches. Leading companies are responding with targeted R&D, strategic partnerships, and digital service models that promise to elevate performance and sustainability benchmarks. Moving forward, organizations that align innovation with operational resilience and collaborative ecosystems will be best positioned to capitalize on the multifaceted opportunities within the URD cable landscape.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Type

- Duplex

- Quadruplex

- Single Conductor

- Triplex

- Installation Type

- Direct Burial

- Duct Installation

- Voltage Rating

- High(16 kv - 35kv)

- Low (Upto 1kv)

- Medium (1kv- 15kv)

- Conductor Material

- Aluminum

- Copper

- Sales Channel

- Offline

- Direct Sales

- Distributor

- Online

- Offline

- Application

- Commercial

- Residential

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- 1X Technologies LLC

- CME Wire and Cable, Inc. by Viakable S.A. de C.V.

- Copperweld Bimetallics, LLC

- Eastful Group Co., Ltd.

- Encore Wire Corporation

- Furukawa Electric Co., Ltd.

- Henan Jiapu Cable by Zhengzhou Quansu Power Cable

- HFCL Limited

- Houston Wire & Cable Co.

- HuaDong Cable Group

- Marmon Utility

- Nexans SA

- Okonite Company

- Prysmian S.p.A

- Scott Electric Corporation

- Southwire Company, LLC

- TF Kable Group

- Tratos Group

- Zhengzhou Jinyuan Wire and Cable Group

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this URD Cable market report include:- 1X Technologies LLC

- CME Wire and Cable, Inc. by Viakable S.A. de C.V.

- Copperweld Bimetallics, LLC

- Eastful Group Co., Ltd.

- Encore Wire Corporation

- Furukawa Electric Co., Ltd.

- Henan Jiapu Cable by Zhengzhou Quansu Power Cable

- HFCL Limited

- Houston Wire & Cable Co.

- HuaDong Cable Group

- Marmon Utility

- Nexans SA

- Okonite Company

- Prysmian S.p.A

- Scott Electric Corporation

- Southwire Company, LLC

- TF Kable Group

- Tratos Group

- Zhengzhou Jinyuan Wire and Cable Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

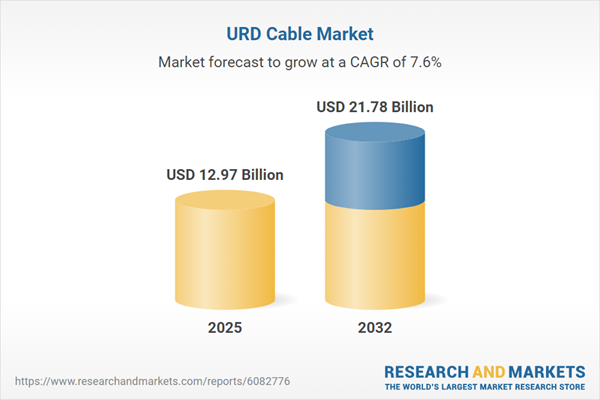

| Estimated Market Value ( USD | $ 12.97 Billion |

| Forecasted Market Value ( USD | $ 21.78 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |