Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Critical Role of Data Fabric as the Cornerstone of Modern Data Management and Enterprise Digital Transformation Strategies

Enterprises today are inundated with disparate data sources, complex integration requirements, and evolving regulatory mandates. Against this backdrop, a robust data fabric architecture emerges as both a strategic imperative and a technological lifeline. By seamlessly weaving together data from on-premise systems, cloud platforms, and edge environments, data fabric solutions enable real-time access and governance across the enterprise.

This introduction sets the stage for exploring how organizations can harness data fabric to deliver consistent, secure, and scalable insights. It underscores the importance of a unified data layer that not only integrates structured and unstructured information but also supports advanced analytics and machine learning initiatives. As digital transformation accelerates, leaders must recognize that effective data management is no longer a back-office concern-it is the foundation of innovation, risk management, and customer value creation.

By understanding the core principles and capabilities of data fabric, decision-makers can align their technology investments with business goals. This section aims to provide a clear, concise overview of the critical role data fabric plays in modern enterprises. It frames the subsequent analysis, highlighting why an agile, intelligence-driven data infrastructure is essential for driving operational efficiency and sustaining competitive differentiation.

Identifying the Key Technological and Organizational Shifts Driving Evolution in Data Fabric Solutions Across Diverse Industry Environments

A wave of transformative forces is reshaping the data fabric landscape, driven by the convergence of digital transformation, artificial intelligence, and evolving infrastructure paradigms. As organizations embark on hybrid and multi-cloud journeys, the demand for seamless data mobility and unified governance has intensified. Legacy architectures are giving way to flexible fabrics that leverage automation, metadata-driven orchestration, and embedded security to streamline data flow.

Concurrently, the proliferation of edge computing has extended data fabric capabilities closer to devices and sensors, reducing latency and enabling real-time analytics in sectors such as manufacturing and logistics. This shift underscores the importance of adaptive data pipelines that can accommodate both centralized and decentralized environments. Furthermore, the integration of AI and machine learning workloads within the fabric is unlocking predictive insights and driving strategic decision-making at scale.

In parallel, regulatory pressures around data privacy and sovereignty have catalyzed the development of more granular policy enforcement and audit capabilities within fabric platforms. Organizations must now balance agility with compliance, ensuring that data remains both accessible and protected. Taken together, these technological and organizational shifts are redefining how enterprises approach data management, positioning data fabric as the linchpin for sustained innovation and resilience in a dynamic market environment.

Assessing the Far-Reaching Implications of 2025 United States Tariffs on Data Fabric Supply Chains Service Costs and Strategic Deployment

The imposition of the 2025 United States tariffs has triggered a ripple effect across global supply chains, driving up the cost of hardware components, data center infrastructure, and supporting services. As tariff rates increase on imported servers, networking gear, and storage devices critical to data fabric deployments, organizations are reassessing sourcing strategies and vendor partnerships to mitigate cost pressures.

This tariff landscape has accelerated trends toward nearshoring data center operations, with enterprises exploring domestic manufacturing and local assembly to reduce exposure to cross-border levies. Strategic alliances have emerged as organizations seek to negotiate volume discounts and develop tariff-resilient procurement practices. Moreover, rising import costs are influencing service providers to adjust managed services pricing models and prioritize cloud-native architectures that can sidestep hardware dependencies.

In response, technology vendors are investing in alternative component sourcing channels and reinforcing supply chain resilience through diversified manufacturing footprints. This enables them to maintain competitive pricing while safeguarding delivery timelines. Ultimately, the cumulative impact of the tariff environment is shaping both the economic calculus and the architectural decisions around data fabric adoption, compelling enterprises to adopt more flexible deployment strategies and long-term cost optimization measures.

Unveiling Comprehensive Insights into Data Fabric Market Segmentation by Component Data Type Deployment Mode Organization Size Application and Vertical

A nuanced understanding of market segmentation reveals crucial insights into the varied drivers and requirements for data fabric solutions. By component, enterprises split their investments between services and software, with managed services and professional services catering to integration, customization, and ongoing support. Software modules encompass a spectrum of capabilities, including robust data governance, seamless integration across sources, traceable data lineage, dynamic data orchestration, stringent data security, master data management, and comprehensive metadata management.

Examining data type segmentation highlights distinct use cases for structured data residing in relational databases versus unstructured data generated by sensors, text, and multimedia. Deployment mode considerations further differentiate organizations opting for public and private cloud environments from those maintaining on-premise infrastructures. Moreover, the contrast between large enterprises and small to medium enterprises underscores varying scales of data complexity, budgetary constraints, and governance maturity.

Diverse application areas also shape solution priorities, ranging from AI and machine learning model training support to customer experience management, business process optimization, fraud detection and security management, governance risk and compliance, operational intelligence, real-time analytics, IoT data management, data discovery and cataloging, and data warehousing alongside data lake management. Finally, vertical-specific demands span banking financial services and insurance, education, energy and utilities, government and public sector, healthcare and life sciences, information technology and telecommunications, manufacturing, media and entertainment, retail and eCommerce, as well as transportation and logistics. This segmentation framework illuminates targeted strategies for delivering tailored data fabric outcomes.

Revealing Regional Dynamics Shaping Data Fabric Adoption Trends and Investment Priorities Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on data fabric adoption patterns and investment priorities. In the Americas, organizations are driving rapid cloud migrations and pursuing advanced analytics initiatives fueled by a strong technology ecosystem. The presence of major hyperscale providers and a mature professional services landscape has accelerated large-scale deployments and fostering innovation in areas such as real-time analytics and operational intelligence.

Within Europe, the Middle East, and Africa, regulatory compliance and data sovereignty considerations are paramount. Enterprises are navigating complex cross-border data flows under stringent privacy regulations, prompting an emphasis on robust governance frameworks and secure orchestration. Investments in localized data centers and edge computing infrastructures are gaining traction to address latency and compliance requirements simultaneously.

Asia-Pacific markets exhibit diverse maturity levels, with advanced economies leading in AI-powered data fabric implementations while emerging markets prioritize cost-effective solutions and hybrid deployment strategies. Rapid digital transformation initiatives in sectors such as telecommunications, manufacturing, and financial services are driving demand for integrated data management platforms that can support both centralized and distributed architectures. This regional mosaic underscores the necessity for flexible, culturally attuned solutions and strategic partnerships.

Analyzing Competitive Positioning and Strategic Initiatives of Leading Data Fabric Providers to Understand Innovation and Market Differentiation

Leading data fabric providers are leveraging differentiated strategies to capture market traction and drive innovation. Major technology incumbents are expanding their portfolios through targeted acquisitions, integrating best-of-breed solutions into cohesive platforms that deliver end-to-end governance, security, and orchestration capabilities. Their global partner ecosystems and professional services arms ensure rapid deployment and ongoing optimization for enterprise clients.

Conversely, agile pure-play specialists are gaining share by focusing on niche functional strengths such as metadata-driven analytics, zero-trust security, or real-time streaming integration. These providers often offer modular architectures that can be rapidly assembled and customized to meet unique organizational requirements. They also foster vibrant developer communities to accelerate feature enhancements and foster interoperability with third-party tools.

Strategic alliances between hyperscale cloud providers and platform innovators are further intensifying competitive dynamics. By embedding data fabric services directly into cloud marketplaces, hyperscalers are lowering adoption barriers and simplifying licensing models. This convergence of ecosystem players is driving the next wave of product enhancements, as vendors prioritize open standards, API-driven extensibility, and embedded AI capabilities to meet evolving enterprise demands.

Providing Strategic Recommendations for Industry Leaders to Enhance Data Fabric Adoption Governance Scalability and Competitive Advantage in Dynamic Environments

Industry leaders must adopt a multifaceted approach to maximize the value of data fabric investments and maintain a competitive edge. It is essential to establish a centralized data governance framework that enforces consistent policies and security controls across distributed environments. By embedding governance early in the data fabric design, organizations can reduce compliance risks while fostering data democratization.

Additionally, aligning technology initiatives with clear business outcomes, such as improved time to insight, operational efficiency gains, and enhanced customer experiences, creates a measurable roadmap for success. Investing in skill development and cross-functional collaboration is equally critical; data engineers, architects, and business analysts must share a common understanding of architecture principles and data quality standards.

Leaders should also pursue hybrid and multi-cloud deployment strategies to balance performance, cost, and compliance requirements. By embracing automated orchestration and infrastructure abstraction, they can achieve greater agility in workload placement and scalability. Finally, continuous monitoring and iterative optimization of data pipelines will ensure that the fabric remains resilient, adaptive, and aligned with evolving organizational goals.

Detailing the Rigorous Research Methodology Underpinning This Data Fabric Analysis Including Data Collection Validation and Analytical Frameworks

The research methodology underpinning this analysis blends rigorous qualitative and quantitative techniques to ensure comprehensive coverage and accuracy. We conducted in-depth interviews with senior executives, data architects, and industry experts to capture evolving requirements and implementation challenges. These primary insights were complemented by extensive secondary research, encompassing thought leadership papers, vendor documentation, and regulatory filings.

Data triangulation techniques were employed to validate findings across multiple sources, ensuring robustness and credibility. We analyzed case studies of real-world deployments to identify best practices, common pitfalls, and measurable outcomes. Additionally, a detailed review of technology roadmaps and partnership announcements provided forward-looking perspectives on innovation trajectories.

Quality assurance protocols included cross-functional expert reviews and iterative validation cycles. This approach ensured that all strategic imperatives, market dynamics, and technological trends were accurately represented. The resulting framework offers a holistic view of the data fabric landscape, designed to inform both tactical decisions and long-term strategy development.

Summarizing the Core Findings on Data Fabric Industry Trends Challenges and Opportunities to Inform Decision Making and Strategic Planning

The cumulative insights from this executive summary underscore the transformative potential of data fabric in today’s data-driven enterprises. By unifying disparate sources and embedding governance throughout the architecture, organizations can accelerate analytics, enhance security, and support advanced AI initiatives. The landscape is shaped by technological shifts such as edge computing, AI integration, and evolving compliance requirements.

Key industry drivers include the need for real-time insights, supply chain resilience in the face of tariff pressures, and tailored solutions across segments defined by component, data type, deployment mode, organization size, application focus, and vertical dynamics. Regionally, markets vary from cloud-first approaches in the Americas to compliance-driven investments in EMEA and hybrid strategies in Asia-Pacific.

Competitive differentiation is increasingly defined by platform extensibility, service excellence, and ecosystem partnerships. To stay ahead, leaders must adopt proactive governance, build cross-disciplinary teams, and pursue hybrid deployment models. By following a structured yet adaptive strategy, enterprises can fully harness the strategic value of data fabric to drive sustainable growth and innovation.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Data Fabric Market

Companies Mentioned

The key companies profiled in this Data Fabric market report include:- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Cloud Software Group, Inc.

- Cloudera, Inc.

- Dell Inc.

- Denodo Technologies, Inc.

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- HEXstream Inc.

- Hitachi, Ltd.

- IDERA, Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Netapp, Inc.

- Nexla, Inc.

- Oracle Corporation

- Precisely Holdings, LLC

- QlikTech International AB

- Salesforce, Inc.

- SAP SE

- SCIKIQ

- Starburst Data, Inc.

- Stardog Union, Inc.

- Teradata Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

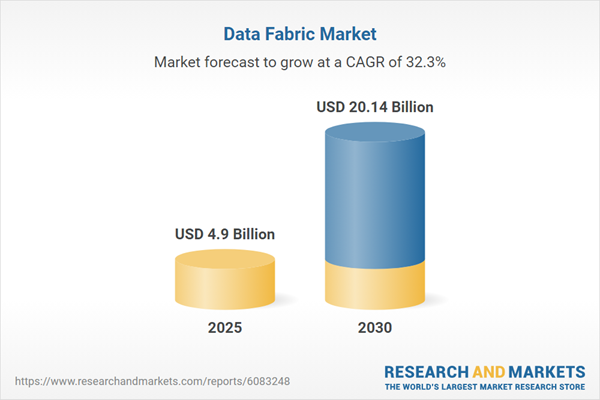

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 4.9 Billion |

| Forecasted Market Value ( USD | $ 20.14 Billion |

| Compound Annual Growth Rate | 32.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |