Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Core Drivers Shaping the Dry Chilies Market in 2025 Through an In-Depth Exploration of Industry Fundamentals and Context

In an era defined by evolving culinary trends and shifting consumer preferences, dry chilies have emerged as a pivotal ingredient across global kitchens. From traditional spice bazaars to modern retail outlets, the journey of these dehydrated pods reflects a fascinating interplay of heritage, technology, and market dynamics. Dry chilies are no longer a niche commodity; they have transcended cultural boundaries to become a centerpiece in the portfolios of food manufacturers, distributors, and premium ingredient suppliers worldwide.

Throughout this executive summary, readers will embark on a guided exploration of the market’s foundational forces. We begin by uncovering the fundamental supply and demand drivers that set the stage for growth and innovation. Attention then turns to the transformative shifts in sourcing strategies, consumer taste profiles, and regulatory frameworks. Interwoven with these developments is an assessment of trade policies that are poised to reshape competitive landscapes, particularly in the context of newly imposed tariff measures.

This introduction establishes the context for subsequent insights, ensuring decision makers and industry leaders can ground their strategic planning in a thorough understanding of both historical trajectories and emerging opportunities. By the end of this journey, readers will be equipped with a holistic perspective from which to navigate the complexities of the dry chilies sector with confidence and foresight.

Examining the Transformational Influences Redefining Supply Chains and Consumer Demand Patterns in the Global Dry Chilies Sector Amid evolving Dynamics

The dry chilies sector has entered a phase of profound transformation fueled by innovative processing technologies, evolving consumer palates, and sustainability imperatives. Traditional sun-drying and manual sorting are increasingly complemented by advanced dehydration systems that ensure consistent quality and enhanced flavor retention. These technological advancements are expanding product portfolios and enabling manufacturers to cater to premium culinary and nutraceutical applications.

At the same time, consumer demand is shifting toward spiciness coupled with authenticity and clean-label credentials. As a result, chili processors are integrating traceability platforms and sustainable sourcing certifications to align with stringent quality standards and consumer expectations. Simultaneously, collaborative partnerships between growers and processors are driving transparency, ensuring that every stage-from farm to shelf-is monitored for quality and ethical practices.

Moreover, the rise of digital platforms has redefined distribution models, allowing direct-to-consumer channels to coexist alongside established retail networks. This convergence of traditional and modern pathways is challenging incumbents to innovate in packaging, branding, and supply chain visibility. As these transformative shifts continue to unfold, stakeholders who embrace agility and invest in strategic collaborations will be best positioned to capitalize on emerging growth vectors within the global dry chilies market.

Assessing the Cumulative Effects of 2025 United States Tariff Measures on Import Flows Pricing Strategies and Competitive Equilibrium in Dry Chilies

In 2025, the implementation of new trade levies by the United States has introduced significant complexities into the dry chilies supply chain. These cumulative tariff measures have affected landed costs for key import origins, prompting a realignment of supplier relationships and procurement strategies. Many importers have responded by seeking alternative sourcing regions to mitigate cost pressures, while some have explored direct partnerships with coastal growers to bypass intermediaries and optimize margins.

The ripple effects of these tariffs are also evident in pricing negotiations between wholesalers and retailers. Retailers have had to carefully balance the need to maintain competitive shelf prices with the imperative to preserve profitability. Certain high-volume distributors have negotiated long-term contracts with fixed-rate agreements to shield themselves from short-term volatility, whereas smaller players have opted for more flexible, spot-based purchasing to capture cost savings when duties fluctuate.

Furthermore, the tariff environment has spurred innovation in value-added offerings, such as pre-mixed seasoning blends and gourmet chili-infused oils. These premium products carry higher margins, allowing manufacturers to absorb duty impacts more effectively. As policy landscapes continue to evolve, market participants who adopt dynamic pricing models and diversify their product portfolios will be better equipped to sustain growth and manage supply chain risks.

Deriving Actionable Insights from Key Market Segmentation across Product Formulations Chilies Varieties Sourcing Methods and Distribution Pathways

The dry chilies landscape reveals striking variations when examined through multiple segmentation lenses. By product form, the market encompasses delicate flakes prized for their rapid infusion of heat, fine powders favored for seamless integration into spice blends, and whole chilies valued for artisanal applications. Each form addresses distinct culinary and industrial needs, driving innovation in packaging formats and value propositions.

Diversity in chili varieties further enriches the sector’s complexity. Varietals such as ancho, chipotle, guajillo, mulato, pasilla, and árbol each bring unique flavor profiles that cater to regional taste preferences and specialty applications. Processors are tailoring their supply chains to secure consistent year-round availability of these premium chilies, often leveraging contract farming models to ensure crop quality and minimize seasonal volatility.

Sourcing origin also plays a pivotal role, as conventional cultivars continue to dominate mainstream channels while organic chilies gain traction among health-conscious consumers and premium foodservice operators. The premium attached to certified organic produce underscores the importance of transparent cultivation practices and third-party accreditation.

Distribution pathways further differentiate market dynamics. Offline channels such as convenience outlets, specialty provisioners, and large-format supermarkets and hypermarkets offer broad reach and experiential merchandising, whereas online platforms enable curated selections and direct-to-consumer engagement. The interplay among these channels influences promotional strategies, inventory management, and brand positioning across the entire supply network.

Dissecting Regional Demand Variations and Growth Perspectives across Americas Europe Middle East Africa and Asia-Pacific Dry Chilies Markets

Regional landscapes exhibit distinct demand patterns shaped by culinary preferences, regulatory environments, and supply chain infrastructures. In the Americas, diverse connection to Latin American cuisines drives robust appetites for both traditional and novel chili presentations. The emphasis on functional foods and clean-label ingredients further bolsters interest in organic and specialty chili products, prompting suppliers to cultivate deeper ties with local growers.

Across Europe, the Middle East, and Africa, a fusion of Mediterranean, North African, and Middle Eastern spice traditions fuels demand for varied chili intensities and flavor nuances. Regulatory standards, particularly around pesticide residues and import hygiene, necessitate rigorous quality protocols. Producers who invest in compliant cultivation and comprehensive traceability systems are meeting the exacting requirements of regional importers and retail chains.

In the Asia-Pacific region, rapid urbanization and shifting consumption patterns are accelerating demand for convenient, shelf-stable spice solutions. E-commerce penetration and modern retail expansion are providing fresh avenues for chili processors, while collaborations with local foodservice operators are introducing innovation in ready-to-cook meal kits and DIY seasoning packs. As regional dynamics continue to evolve, market participants must align their growth strategies with local tastes, regulatory nuances, and distribution infrastructures to capture emerging opportunities.

Profiling Leading Industry Participants Strategic Initiatives Innovation Focus and Collaborative Ventures Driving Advancements in the Dry Chilies Supply Chain

A cadre of prominent companies is driving innovation, vertical integration, and market expansion within the dry chilies sector. Established global spice conglomerates have leveraged advanced processing capabilities and expansive distribution networks to introduce consistent, high-quality products across multiple geographies. Their investments in research and development are yielding new chili derivatives tailored for functional and convenience-driven applications.

Simultaneously, specialty-focused processors have differentiated through deep expertise in heritage chili varieties and value-added offerings. Strategic alliances with contract growers and co-packers are enhancing supply flexibility, enabling these firms to respond swiftly to niche market demands. Additionally, select participants have forged partnerships with technology providers to deploy blockchain-based traceability and quality assurance protocols, further elevating product transparency.

Emerging players are also reshaping the landscape by capitalizing on digital marketing channels, direct-to-consumer engagement, and curated e-commerce platforms. These innovators are enhancing customer experiences through tailored storytelling, subscription models, and experiential packaging. By striking the right balance between scale-driven efficiencies and differentiated brand propositions, leading enterprises are solidifying their competitive positioning and unlocking sustainable growth trajectories.

Formulating Practical Strategic Directives to Optimize Operational Efficiencies Strengthen Market Position and Enhance Supply Resilience in Dry Chilies Industry

To thrive in the dynamic dry chilies arena, industry leaders must embrace a suite of targeted, actionable strategies. First, optimizing end-to-end traceability through advanced digital platforms will reinforce quality assurance, regulatory compliance, and consumer trust. Investing in blockchain or IoT-enabled monitoring systems can streamline certification processes and differentiate premium offerings in a crowded market.

Second, diversifying sourcing portfolios to include both conventional and organic origins will help mitigate supply disruptions and cater to varying consumer segments. Establishing strategic alliances with regional growers and cooperatives can secure preferential access to high-demand chili varieties, while contract-farming frameworks can instill supply chain resilience.

Third, leveraging data-driven insights to refine product portfolios and promotional tactics will sharpen competitive edge. Integrating customer analytics from both online and offline channels enables more nuanced segmentation, personalized marketing, and dynamic pricing models. Finally, forging cross-industry collaborations-such as co-development agreements with flavor houses or partnerships with culinary innovators-can accelerate product innovation and expand market reach through complementary value propositions.

Detailing a Comprehensive Mixed-Method Research Framework Employing Qualitative Interviews Secondary Data Triangulation and Rigorous Analytical Techniques

This comprehensive study is built upon a rigorous mixed-method research framework designed to deliver robust and actionable insights. Primary data was gathered through direct interviews with growers, processors, distributors, and end users across key markets. These qualitative inputs were triangulated with secondary sources, including trade journals, industry publications, and regulatory filings, to ensure comprehensive contextual understanding.

Quantitative analysis was conducted using standardized data segmentation protocols, enabling cross-comparison of product forms, varietal types, sourcing origins, and distribution pathways. Advanced statistical tools were employed to detect emerging patterns, validate correlations, and highlight outlier dynamics. Throughout the research lifecycle, data integrity was maintained via multiple validation checkpoints and expert reviews conducted by seasoned analysts.

Geographic perspectives were enriched through region-specific case studies, illuminating local regulatory frameworks, distribution infrastructures, and consumer preferences. The integration of these methodologies ensures that the findings are both empirically grounded and strategically relevant, empowering stakeholders to make informed decisions based on a blend of qualitative insights and quantitative rigor.

Summarizing Core Takeaways Highlighting Strategic Implications and Emerging Trends to Inform High-Impact Decision Making for Dry Chilies Stakeholders

In summary, the dry chilies market is undergoing a period of significant transformation driven by technological innovations, shifting consumer preferences, and evolving trade policies. The integration of advanced dehydration processes, traceability solutions, and diversified distribution channels is fostering greater operational efficiency and market penetration. At the same time, the cumulative impact of newly introduced tariff measures underscores the importance of dynamic sourcing strategies and value-added product offerings.

Through careful segmentation analysis, stakeholders can identify growth pockets within flakes, powders, and whole chilies as well as across a rich array of varietal profiles. Regional nuances further highlight opportunities in key markets, with the Americas, Europe Middle East Africa, and Asia-Pacific each presenting unique drivers and constraints. Leading companies are differentiating through strategic alliances, product innovation, and digital engagement, setting new benchmarks for quality and consumer connectivity.

Going forward, industry participants who prioritize supply chain resilience, embrace data-driven decision making, and foster collaborative partnerships will be best positioned to capture the full potential of this dynamic sector. By aligning strategic priorities with emerging trends, stakeholders can shape a sustainable growth trajectory and secure a competitive foothold in the vibrant dry chilies landscape.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Dry Chilies Market

Companies Mentioned

The key companies profiled in this Dry Chilies market report include:- AIT Ingredients

- All Seasonings Ingredients, Inc.

- B&G Foods, Inc

- Badia Spices Inc.

- Baghel Agro Industries

- deSIAMCuisine Thailand Co Ltd

- DS Group

- EVEREST Food Products Pvt. Ltd.

- Frontier Co-op

- General Mills, Inc.

- Goya Foods

- Great American Spice Co.

- Kalsec Inc.

- McCormick & Company, Inc

- MDH Spices

- Morton & Bassett Spices

- NIKOSI EXPORTS

- Nitin Export & Trading Company

- OLAM INTERNATIONAL LIMITED

- Qingdao Fumanxin Foods Co., Ltd.

- S&B Foods Inc.

- Spice World, Inc.

- Veerkrupa Global Enterprise

- Watkins Incorporated

- Xinghua Lianfu Food Co.,Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2026 |

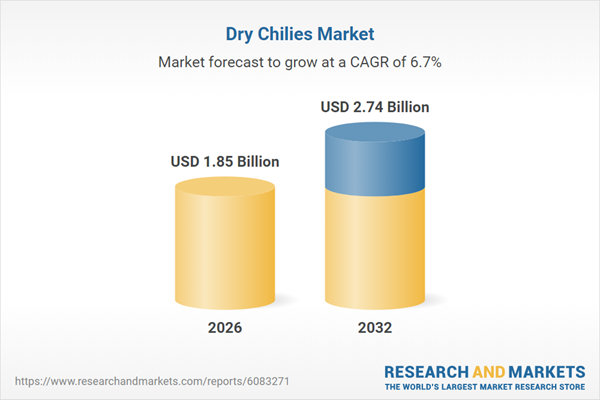

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.85 Billion |

| Forecasted Market Value ( USD | $ 2.74 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |