Speak directly to the analyst to clarify any post sales queries you may have.

The sleep software market is rapidly evolving as organizations across healthcare and corporate sectors seek digital solutions to support operations, improve health outcomes, and drive strategic growth. Senior decision-makers now require actionable insights to navigate this complex ecosystem and capitalize on emerging opportunities.

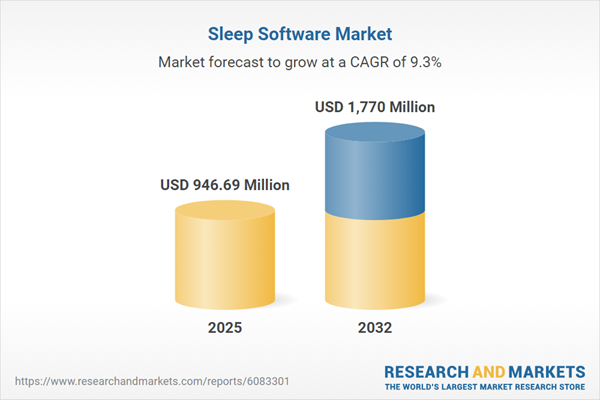

Market Snapshot: Sleep Software Market Size, Growth, and Outlook

The sleep software market reached USD 870.52 million in 2024 and is projected to increase to USD 946.69 million in 2025, tracking a compound annual growth rate (CAGR) of 9.28%. Forward momentum is strong, with forecasts signaling a market size approaching USD 1.77 billion by 2032. This expansion is fueled by swift integration of AI-powered solutions, cloud-enabled monitoring, and seamless interoperability with broader digital health platforms. Attractive growth is present across varied geographies, benefiting from ongoing infrastructure upgrades and the increasing prioritization of scalable innovation for holistic health management.

Scope & Segmentation: Sleep Software Market Analysis

- Product Types: Includes sleep education software integrating behavioral tools, sleep therapy software supporting targeted interventions, and sleep tracking software utilizing advanced biometric analytics.

- Integration Models: Encompasses desktop applications for clinical workflows and mobile applications that increase patient and consumer engagement through convenience and accessibility.

- Pricing Structures: Covers both one-time license options and subscription-based models, offering buyers flexibility and ongoing platform enhancements.

- Deployment Models: Features cloud-based multi-tenant systems suited for remote access, alongside on-premise configurations that address enterprise security and data sovereignty requirements.

- Applications: Serves sleeping disorder management, such as addressing insomnia and sleep apnea, in addition to supporting proactive wellness and lifestyle improvement initiatives.

- End Users: Targets corporate wellness leaders, healthcare providers, and individuals focused on sleep and overall wellness objectives.

- Regional Coverage: Offers localized relevance in the Americas (including the US, Canada, and prominent Latin American economies), Europe, Middle East & Africa (covering the UK, Germany, UAE, and key African markets such as South Africa), and Asia-Pacific (with focus on China, India, Japan, Australia, and Southeast Asia).

- Technology Players: Companies shaping this market include Cadwell Industries, Koninklijke Philips, Apple, BetterSleep, Calm.com, Compumedics Limited, Eight Sleep, Fitbit (Google), Garmin, Headspace, Insight Network, Marcomit Design, Motion Pillow, Natus Medical, Nihon Kohden, Nox Medical, Ōura Health, Pzizz, ResMed, Reviva Softworks, and RXNT.

Key Takeaways: Strategic Insights for Decision-Makers

- Digital-first offerings harness advanced sensors and virtual care platforms, enhancing engagement and enabling insightful data-driven decision-making for patient care and organizational wellness.

- Artificial intelligence and machine learning are increasingly central, allowing platforms to anticipate and respond to complex sleep and wellness needs through dynamic personalization.

- Robust interoperability and smart home integrations support seamless data flow, building the groundwork for comprehensive digital health ecosystems and improved coordination among stakeholders.

- Strategic partnerships with hardware manufacturers, cloud providers, and compliance consultancies ensure solutions meet reliability, usability, and regulatory standards across target markets.

- Market participants are investing significantly in data privacy and security, incorporating advanced encryption and strict protocols to satisfy evolving compliance and governance demands.

- Vendors stand out by offering modular and customizable approaches, supporting enterprises, wellness program leaders, and individual users in achieving their precise objectives.

Tariff Impact: Navigating Hardware Costs and Data Regulations

Recently proposed and ongoing tariffs in the United States on imported sleep hardware have driven software vendors to reassess international supply lines and localize partnerships. Close collaboration with regional manufacturers and distributors helps alleviate additional hardware-related expenses. As providers increasingly shift toward cloud-based deployments, reliance on imported hardware is reduced, but this pivot requires robust digital infrastructure and careful management of evolving international data laws. These circumstances prompt organizations to prioritize agile deployment, proactive procurement strategies, and comprehensive data protection frameworks for global operations.

Methodology & Data Sources

This analysis combines qualitative insights from leading industry experts with quantitative data from targeted surveys. Peer review and benchmark triangulation underpin findings, supporting decision-makers with dependable and accurate intelligence for strategic planning.

Why This Report Matters: Actionable Value for Senior Leaders

- Clarifies technology investment priorities by identifying high-impact product features, deployment methods, and industry integration trends matched to organizational goals.

- Enables risk mitigation by providing a comprehensive review of regulatory, tariff, and supply chain variables that influence the competitive landscape in sleep software.

- Equips senior leaders with in-depth segmentation and regional mapping, supporting identification and exploitation of new commercial growth avenues.

Conclusion

With rapid digital innovation and evolving stakeholder expectations, the sleep software sector requires decisive, flexible leadership. Focusing on tailored solutions and regulatory compliance positions organizations to capture sustainable value as the market progresses.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Sleep Software Market report include:- Cadwell Industries Inc.

- Koninklijke Philips N.V.

- Apple Inc.

- BetterSleep

- Calm.com, Inc.

- Compumedics Limited

- Eight Sleep, Inc.

- Fitbit, Inc. by Google LLC

- Garmin Ltd.

- Headspace Inc.

- Insight Network Inc.

- Marcomit Design, Inc.

- Motion Pillow

- Natus Medical Incorporated

- Nihon Kohden Corporation

- Nox Medical

- Ōura Health Oy

- Pzizz, Inc.

- ResMed Corp.

- Reviva Softworks Ltd

- RXNT

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 946.69 Million |

| Forecasted Market Value ( USD | $ 1770 Million |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |