Speak directly to the analyst to clarify any post sales queries you may have.

The bunion surgery market is navigating a rapidly transforming healthcare environment, where continuous innovation, digital integration, and shifting operational standards drive new opportunities for growth, differentiation, and risk management for industry leaders.

Bunion Surgery Market Snapshot: Current Growth and Opportunity

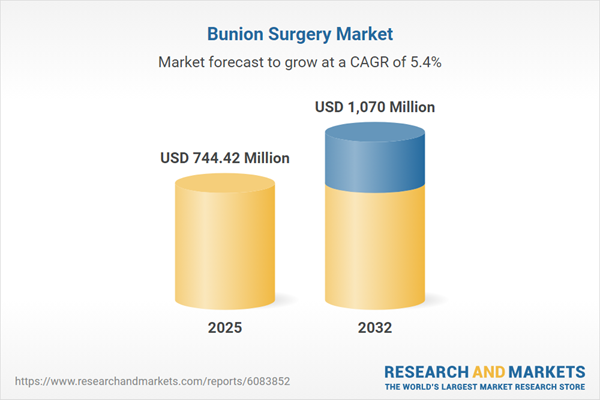

The global bunion surgery market expanded from USD 708.50 million in 2024 to USD 744.42 million in 2025, advancing at a CAGR of 5.36% and projected to reach USD 1.07 billion by 2032. Momentum in the sector reflects advances in technology-led surgical approaches, a broader embrace of patient-centric care pathways, and increasing procedural adoption across clinical environments. Senior executives, particularly those focused on capital efficiency or innovation, will benefit from a clear understanding of macro trends, regulatory climate, and the evolving standards influencing both competitive advantage and procurement strategy. This comprehensive analysis delivers actionable, data-driven guidance essential for investment, product development, and strategic positioning in the surgical solutions landscape.

Scope & Segmentation

- Procedure Types: Arthrodesis, Exostectomy, Lapidus Procedure, Minimally Invasive Surgery (MIS), and various forms of Osteotomy, such as Akin, Chevron, and Scarf, each addressing unique anatomical and patient needs.

- Product Types: Accessories, correction systems, and implants, supporting a spectrum of workflow and anatomical requirements for surgical teams and care centers.

- Technologies: 3D bunion correction, laser platforms, navigation and imaging technologies, robotic-assisted systems, and digital monitoring tools, which are advancing precision and integration within perioperative care.

- Age Groups: Adult and pediatric segments, enabling clinically tailored interventions for age-specific patient populations and expanding the addressable market.

- End-User Environments: Ambulatory surgery centers, hospitals, and specialty clinics are key settings, highlighting change in care delivery dynamics and the rise of outpatient surgery trends.

- Regions: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland), Middle East (United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel), Africa (South Africa, Nigeria, Egypt, Kenya), and Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan) represent varied growth profiles, policy environments, and adoption patterns.

- Key Companies: Arthrex, BioPro, Breg, ConMed, CrossRoads Extremity Systems, DePuy Synthes, Extremity Medical, Globus Medical, KLS Martin, Medartis, Orthofix, RTI Surgical, Smith & Nephew, Stryker, Tornier, Wright Medical, and Zimmer Biomet are leading industry stakeholders driving competitive benchmarks and technology advancement.

Key Takeaways for Senior Decision-Makers

- Minimally invasive techniques and enhanced imaging are shifting care standards, resulting in consistent patient outcomes and shorter recovery periods.

- Modular device systems and advanced biomaterials are leading to improved durability and therapeutic results, with ongoing innovation in both established and emerging product lines.

- Digital monitoring and robotic platforms are making significant impacts on surgical precision, promoting consistency of care across high- and mid-volume centers worldwide.

- Outpatient and ambulatory settings increasingly dominate surgical volumes, reflecting systemic drives toward value-based care and operational flexibility for both providers and payers.

- Regional production approaches, strategic partnerships, and market localization offer companies resilience in the face of regulatory and policy shifts.

- Segment-specific strategies, such as age-focused solutions and adoption of niche technologies, allow for greater product differentiation and targeted expansion in diverse care environments.

Tariff Impact: Evolving Policy and Supply Chains

The 2025 United States tariff on surgical devices has initiated adjustments throughout global bunion surgery supply chains. Manufacturing leaders are reconfiguring sourcing and assembly models to mitigate increased costs, often emphasizing regional manufacturing and local partnerships. Health systems and providers are responding with rigorous inventory management and supplier reevaluation to reduce device expense volatility. These supply chain adaptations position organizations to maintain operational continuity and manage procurement risk despite changing international trade and tariff landscapes.

Methodology & Data Sources

This report’s findings are driven by secondary research, primary interviews with surgeons, engineers, executives, and payers, and rigorous data triangulation. Validation with subject-matter experts ensures reliability for market segmentation, technology trend analysis, and competitive strategy insights.

Why This Report Matters

- Presents clear, actionable intelligence to guide capital allocation, assess technology partnerships, and inform procurement strategies amid evolving surgical marketplace conditions.

- Delivers robust segmentation and technology adoption data to enable precise go-to-market and product roadmap planning for multinational and regional stakeholders.

- Equips executives with contextual risk analysis on supply chain, reimbursement, and regulatory changes affecting device sourcing and clinical adoption pathways.

Conclusion

This analysis empowers decision-makers to identify growth prospects, mitigate operational risks, and strengthen long-term positioning in the bunion surgery sector. Rigorous insight and actionable guidance support confident strategy and sustainable performance.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Bunion Surgery Market report include:- Arthrex, Inc.

- BioPro, Inc.

- Breg, Inc.

- ConMed Corporation

- CrossRoads Extremity Systems, LLC

- DePuy Synthes Products, Inc

- Extremity Medical, LLC.

- Globus Medical, Inc.

- KLS Martin SE & Co. KG

- Medartis AG

- Orthofix Holdings Inc.

- RTI Surgical, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Tornier, Inc.

- Wright Medical Technology, Inc.

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 744.42 Million |

| Forecasted Market Value ( USD | $ 1070 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |