Speak directly to the analyst to clarify any post sales queries you may have.

Opening Perspectives on the Rapid Evolution and Strategic Importance of Sensor Bottle Technologies in Modern Industrial and Consumer Applications

Sensor bottle technology has emerged as a cornerstone of proactive monitoring across a spectrum of industrial, medical, and consumer use cases. By embedding advanced sensing elements within conventional containment vessels, organizations can capture real-time data on chemical concentrations, mechanical stress, optical clarity, pressure differentials, and temperature fluctuations. This paradigm shift in data acquisition empowers stakeholders to move beyond reactive interventions toward predictive maintenance, optimized resource management, and enhanced user safety protocols.As market participants strive to differentiate their offerings, the fusion of miniaturized sensing hardware with cloud-enabled analytics has accelerated time-to-insight. Moreover, the proliferation of wireless communication standards has enabled seamless integration with existing Internet of Things platforms, unlocking novel value-added services. From pharmaceuticals requiring stringent stability monitoring to athletes seeking performance feedback, sensor bottles are redefining expectations around transparency and traceability.

In this executive summary, we explore key inflection points driving growth, assess the implications of recent policy adjustments, and distill critical segmentation and regional observations. Additionally, we highlight strategic recommendations for industry leaders, outline our rigorous research methodology, and conclude with a call-to-action that underscores the importance of informed decision-making in this dynamic landscape.

Analyzing the Transformative Technological and Market Shifts Redefining the Sensor Bottle Landscape Across Sensing Modalities and Connectivity Innovations

The sensor bottle domain is experiencing transformative upheaval driven by converging technological breakthroughs and shifting market imperatives. Innovations in microelectromechanical systems have enabled ultra-compact chemical and pressure detectors to coexist alongside optical and thermal sensors within a single form factor. At the same time, motion sensing capabilities have broadened the scope of applications to include impact monitoring and theft prevention. These developments are underpinned by advances in power management and energy harvesting, extending operational lifespans and reducing maintenance overhead.Simultaneously, the adoption of Bluetooth and Wi-Fi connectivity has matured from novelty to necessity, facilitating real-time data streams directly to enterprise platforms and consumer devices. This shift is reinforcing expectations for seamless user interfaces and holistic monitoring solutions. Furthermore, material science breakthroughs are yielding composite housings and sustainable plastics that strike an optimal balance between durability, cost efficiency, and environmental impact. Consequently, market participants must navigate an accelerating pace of innovation while addressing evolving regulatory standards and user preferences.

Through this lens, the sensor bottle landscape is being redefined by a synergy of functional integration, digital connectivity, and sustainable material adoption. Organizations that anticipate these currents and align their development roadmaps accordingly will command significant competitive advantage.

Assessing the Multifaceted Consequences of Revised United States Tariffs in 2025 on Supply Chains Manufacturing Cost Structures and Market Dynamics Worldwide

The introduction of revised United States tariffs in 2025 has precipitated a multifaceted impact on the global sensor bottle ecosystem. Heightened duties on imported sensing modules and raw material inputs have produced immediate cost pressures for original equipment manufacturers, compelling many to reevaluate supplier relationships and explore alternative sourcing strategies. Concurrently, domestic production facilities are experiencing increased demand as companies seek to mitigate tariff-induced uncertainties and streamline logistics.This regulatory environment has also prompted renewed interest in localizing key stages of the value chain, from component fabrication to final assembly. While nearshoring initiatives offer resilience against external shocks, they demand significant capital investment and supply chain reengineering. In parallel, the reallocation of procurement spend has altered competitive dynamics, as smaller regional players gain traction by fulfilling short-lead-time requirements and offering greater contractual flexibility.

Looking ahead, businesses must adopt agile procurement frameworks and leverage strategic partnerships to absorb tariff volatility. Scenario planning and dynamic cost modeling will be essential to quantify risk exposures and identify opportunities for process optimization. Ultimately, the cumulative effect of these tariff adjustments will shape market entry strategies, pricing models, and collaborative ventures for years to come.

Extracting Key Segmentation Insights from Diverse Sensing Modalities Material Compositions Connectivity Configurations End User Profiles and Distribution Channel Strategies

A nuanced segmentation analysis reveals how sensor bottle vendors and end users engage with diverse technological, material, connectivity, user, and distribution dimensions. The market’s sensing technology spectrum spans chemical, motion, optical, pressure, and temperature detection, each addressing specific performance and compliance requirements. Simultaneously, material composition choices range from composite and glass casings to stainless steel enclosures and various plastics; within the plastic category, both reusable and single-use options cater to sustainability and cost efficiency concerns. Connectivity configurations further differentiate offerings, as integration with Bluetooth protocols supports low-power personal monitoring while Wi-Fi compatibility enables high-bandwidth data transfer for enterprise systems.End users themselves encompass athletes seeking granular performance insights, healthcare professionals demanding stringent reliability, and individual consumers valuing convenience and safety. Lastly, distribution channel strategies include traditional brick-and-mortar retailers alongside digital storefronts; within online sales, both brand websites and major e-commerce platforms serve as critical gateways for market access.

This multi-dimensional segmentation underscores the importance of tailored value propositions. Vendors that strategically align sensing modalities, materials, connectivity, user focus, and distribution pathways will be best positioned to capture targeted growth opportunities and foster long-term customer loyalty.

Unveiling Critical Regional Performance Drivers Influencing Sensor Bottle Adoption Across the Americas Europe Middle East Africa and Asia-Pacific Market Ecosystems

Regional dynamics play a pivotal role in steering the trajectory of sensor bottle adoption and innovation. In the Americas, strong investment in digital health solutions and smart manufacturing initiatives is driving demand for multifunctional devices that seamlessly integrate into IoT frameworks. Collaborative public-private partnerships are accelerating pilot programs in pharmaceutical packaging and industrial asset maintenance, creating fertile ground for sensor bottle deployment.Across Europe, the Middle East, and Africa, stringent regulatory standards around product safety and environmental impact are elevating the importance of advanced sensing capabilities and sustainable material choices. Markets in Western Europe are characterized by early technology adoption and rigorous certification protocols, while emerging economies in the Middle East and Africa are showing growing appetite for cost-effective monitoring solutions that address water quality, food safety, and energy management.

In the Asia-Pacific region, manufacturing hubs are leveraging scale efficiencies to produce sensor bottles at competitive price points, fueling rapid penetration in both domestic and export markets. Governments across the region are also championing smart city and smart agriculture initiatives, further broadening potential use cases. Divergent infrastructural maturity levels require vendors to calibrate their offerings to local connectivity ecosystems and distribution networks.

Understanding these varied regional drivers and constraints is essential for crafting market entry and expansion strategies that resonate with local stakeholder needs and regulatory landscapes.

Profiling Leading Industry Players and Collaborative Innovators Shaping Competitive Dynamics and Technological Advancements in the Sensor Bottle Market Landscape

The competitive terrain of the sensor bottle market is defined by a blend of established multinational manufacturers and specialized technology pioneers. Leading players are intensifying R&D efforts to deliver sensor fusion platforms that combine multiple detection modalities within a single package, thereby enhancing data fidelity and user convenience. At the same time, mid-sized innovators are cultivating niche applications-such as athlete performance monitoring or remote patient care-to carve out defensible market positions.Collaborative ecosystems are also taking shape, as component suppliers, software vendors, and service integrators join forces to offer end-to-end solutions. Strategic alliances have emerged around cloud-based analytics, enabling rapid deployment of data visualization tools and predictive algorithms. Meanwhile, patent filings indicate a surge in proprietary materials and energy harvesting techniques designed to extend device lifecycles.

Mergers and acquisitions activity has further accelerated consolidation, with larger organizations acquiring startups to secure novel sensing technologies and talent. Alongside this consolidation, strategic partnerships with academic institutions and standards bodies are helping to shape industry norms around sensor accuracy, interoperability, and cybersecurity. The result is a dynamic competitive landscape in which differentiation hinges on continuous innovation, strategic collaboration, and uncompromising quality assurance.

Actionable Strategic Recommendations Enabling Industry Leaders to Capitalize on Emerging Sensor Bottle Trends Regulatory Shifts and Customer Demand Patterns

To navigate the evolving sensor bottle market, industry leaders should prioritize modular platform architectures that enable rapid integration of emerging sensor types and connectivity options. By adopting a plug-and-play design philosophy, organizations can accelerate time-to-market and respond swiftly to shifting regulatory requirements. Equally important is the diversification of supply chains to balance cost optimization with geopolitical risk mitigation; cultivating relationships with both domestic and international component manufacturers will safeguard against future tariff disruptions and logistical bottlenecks.Investment in sustainable materials, such as eco-friendly plastics and composite blends, can differentiate product lines while meeting growing consumer and regulatory expectations for environmental stewardship. Concurrently, partnerships with healthcare providers, sports institutions, and industrial consortia offer valuable opportunities for co-creation and field validation of novel applications. Leaders should also enhance digital service capabilities by integrating advanced analytics, machine learning algorithms, and secure cloud ecosystems to transform raw sensor outputs into actionable insights.

Finally, a customer-centric go-to-market approach-leveraging targeted distribution channels, personalized digital experiences, and ongoing support services-will build loyalty and unlock recurring revenue streams. By aligning product innovation with strategic partnerships and operational resilience measures, companies can seize emerging opportunities and establish long-term market leadership.

Comprehensive Research Methodology Framework Combining Mixed Methods Data Validation and Triangulation Approaches for Robust Sensor Bottle Market Analysis

This analysis combines a structured research methodology that integrates both primary and secondary data sources to ensure comprehensive coverage and actionable accuracy. The secondary research phase encompassed a review of industry publications, regulatory filings, patent registries, and publicly available corporate disclosures to map technology trends and competitive movements. This desk-based work laid the foundation for targeted deep dives into innovation hotspots and emerging use cases.In the primary research phase, we conducted in-depth interviews with executives, product managers, and domain experts spanning sensor hardware developers, material scientists, connectivity providers, and end users. These conversations provided firsthand perspectives on strategic priorities, adoption barriers, and future roadmaps. Additionally, we engaged with regional distributors and system integrators to capture nuances in market access and channel dynamics.

Data validation and triangulation processes were applied throughout to reconcile insights across multiple sources, ensuring that findings reflect current market realities. Qualitative insights were supplemented by scenario analysis and trend extrapolation, enabling robust interpretation without reliance on singular data points. The combined approach delivers a nuanced understanding of the sensor bottle landscape, positioning decision-makers to leverage opportunities and mitigate risks with confidence.

Conclusive Insights Highlighting the Strategic Imperatives Growth Trajectories and Innovation Imperatives Driving the Future of the Sensor Bottle Ecosystem

In conclusion, the sensor bottle market is poised for significant transformation driven by convergent advancements in sensing technologies, connectivity standards, and materials engineering. The ripple effects of revised tariff policies underscore the importance of agile supply chain strategies and localized manufacturing partnerships. Simultaneously, segmentation insights reveal that success hinges on harmonizing chemical, motion, optical, pressure, and temperature detection with sustainable material choices, diverse connectivity configurations, targeted end-user engagement, and optimized distribution pathways.Regional variations further emphasize that growth strategies must be tailored to unique regulatory schemas, infrastructural capabilities, and consumer expectations across the Americas, Europe Middle East & Africa, and Asia-Pacific markets. Competitive dynamics are intensifying as leading players and innovative startups vie for leadership through platform modularity, strategic alliances, and advanced analytics integration. To thrive, organizations must embrace modular design, sustainable practices, resilient supply networks, and customer-centric go-to-market models.

The outlined recommendations and methodological rigor presented herein offer a strategic blueprint for capitalizing on growth opportunities and anticipating future disruptions. As the ecosystem continues to evolve, stakeholders equipped with these insights will be well positioned to drive innovation, unlock value, and secure lasting market advantage.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Sensing Technology

- Chemical

- Motion

- Optical

- Pressure

- Temperature

- Material Composition

- Composite

- Glass

- Plastic

- Reusable

- Single Use

- Stainless Steel

- Connectivity

- Bluetooth

- Wi-Fi

- End Users

- Athletes

- Healthcare Professionals

- Individual Consumers

- Distribution Channels

- Offline

- Online

- Brand Website

- E-Commerce Platforms

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- SENS Life

- 8bottle Inc.

- Waterh Inc

- AQUAMINDER

- Banner Engineering Corp.

- BrandSTIK

- Ecoop

- G3 Enterprises Inc

- Gatorade

- Guangzhou Diller Daily Necessities Co., Ltd

- Hamilton Housewares Pvt. Ltd.

- HidrateSmart LLC

- Leuze Group

- Pepperl+Fuchs Pvt. Ltd.

- RE-COMPANY S.A.

- Shital Corporation

- Smartbottle Inc.

- SUNSUM HOUSEHOLD CO.,LTD

- Ulla Technologies, Inc.

- wenglor sensoric GmbH

- Yongkang Lance Industry & Trade Co., Ltd.

- ZHE JIANG HAERS VACUUM CONTAINERS CO.,LTD

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Sensor Bottle market report include:- SENS Life

- 8bottle Inc.

- Waterh Inc

- AQUAMINDER

- Banner Engineering Corp.

- BrandSTIK

- Ecoop

- G3 Enterprises Inc

- Gatorade

- Guangzhou Diller Daily Necessities Co., Ltd

- Hamilton Housewares Pvt. Ltd.

- HidrateSmart LLC

- Leuze Group

- Pepperl+Fuchs Pvt. Ltd.

- RE-COMPANY S.A.

- Shital Corporation

- Smartbottle Inc.

- SUNSUM HOUSEHOLD CO.,LTD

- Ulla Technologies, Inc.

- wenglor sensoric GmbH

- Yongkang Lance Industry & Trade Co., Ltd.

- ZHE JIANG HAERS VACUUM CONTAINERS CO.,LTD

Table Information

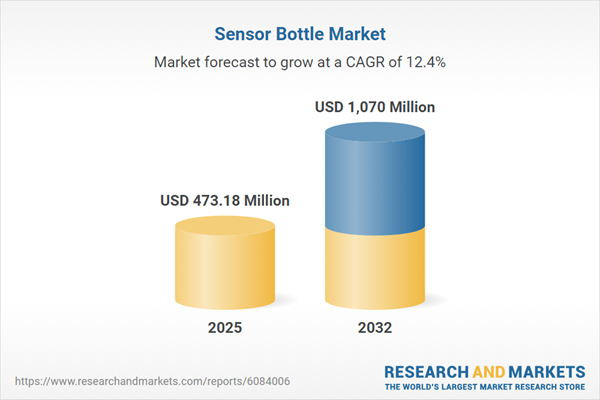

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 473.18 Million |

| Forecasted Market Value ( USD | $ 1070 Million |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |