Speak directly to the analyst to clarify any post sales queries you may have.

The tracking telemetry and command (TT&C) transponder market is undergoing substantial transformation as mission requirements evolve and the demand for robust, advanced space communications intensifies. Senior decision-makers must navigate a landscape characterized by shifting technologies, regulatory updates, and the growing integration of ground and space systems.

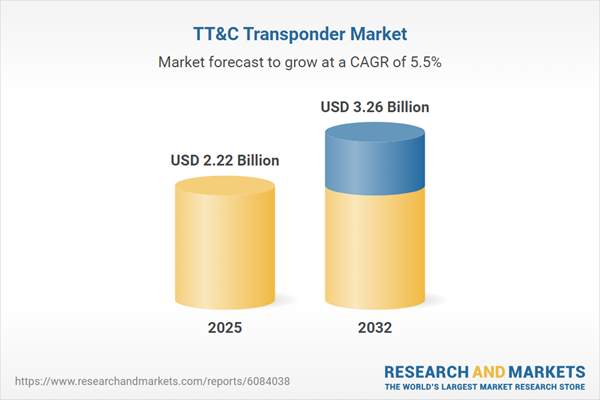

Market Snapshot: Growth Trajectory of the TT&C Transponder Market

The TT&C transponder market increased in value from USD 2.12 billion in 2024 to USD 2.22 billion in 2025, maintaining a compound annual growth rate of 5.52% with projections reaching USD 3.26 billion by 2032. Expansion is being fueled by increased investment in satellite networks, a surge in mission diversity, and rising demand in commercial, defense, and governmental segments. Shifts in architecture and increasing integration between ground and orbital assets are affecting value chains across major geographies such as the Americas, EMEA, and Asia-Pacific. This momentum underscores the importance of tracking telemetry and command transponders as enablers of resilient and secure communications.

Scope & Segmentation: Mapping Demand, Platforms & Technologies

- Offering: Market coverage spans complete TT&C systems, sub-systems and components, as well as complementary software and services, reflecting the ecosystem’s hardware and digital requirements.

- Type: The primary service categories center on command, telemetry, and tracking, serving varied satellite operations and mission profiles.

- Platform Type: GEO, LEO, and MEO satellites comprise the core operational platforms, highlighting coverage from fixed-orbit communications to agile, lower altitude missions.

- Vehicle Type: Solutions address both autonomous satellites and crewed spacecraft, aligning with current trends toward unmanned systems and human spaceflight support.

- Frequency Band: Capabilities span C, Ka, Ku, and X bands to ensure compatibility with a range of mission requirements and to meet spectrum allocation constraints.

- Transponder Type: Support for both multiple access and single access architectures accommodates diverse user scales and application needs.

- Deployment: The market includes deployments on both ground stations and spacecraft, allowing for comprehensive network coverage and redundancy.

- Application: Use cases cover commercial services (including broadcast, internet, telecom), defense applications (such as communications, radar, reconnaissance), and dedicated space operations (ranging from earth observation to meteorological and research missions).

- Regions: Geographic scope includes the Americas, EMEA, and Asia-Pacific, encompassing major economies such as the United States, China, Germany, India, and others, which collectively drive market leadership and innovation.

- Companies Covered: The sector features established players and emerging innovators such as Honeywell International Inc., L3Harris Technologies, Thales Alenia Space, Antwerp Space, Anywaves, Asia Satellite Telecommunications, Calian Group, Celestia STS, Communications & Power Industries, ETMC Technologies, General Dynamics Mission Systems, Kongsberg Defence & Aerospace, Kratos Defense & Security Solutions, Lockheed Martin, METRACOM, Motorola Solutions, Orbit Communications Systems, Safran, SatCatalog, and Tesat-Spacecom.

Key Takeaways: Strategic and Technical Insights for TT&C Transponders

- Tracking telemetry and command transponders underpin resilient satellite operations, supporting secure communications for both established and next-generation mission architectures.

- Industry emphasis is shifting to modular and software-defined radio solutions, enabling mission-specific bandwidth allocation and dynamic spectrum management across diverse satellite platforms.

- Collaborations and standards-setting are gaining importance, accelerating integration rates and reducing technical and compliance risks, particularly relevant for agile constellations and rapidly configurable assets.

- Adoption of AI-powered link optimization and real-time, adaptive configuration is driving up data integrity, predictive maintenance capabilities, and network reliability in increasingly contested environments.

- Regional differentiation shapes offerings: North America leads in defense-centric technologies, Europe advances interoperability and standards, while Asia-Pacific rapidly scales commercial deployments, reflecting distinct customer and regulatory priorities.

- The supplier landscape is diversifying, with established aerospace corporations and nimble start-ups introducing more competitive and expanded service models to address evolving mission demands.

Tariff Impact: Supply Chain and Sourcing Adjustments

Forthcoming U.S. tariff revisions planned for 2025 are prompting re-evaluations of global supply strategies in TT&C hardware and semiconductor sourcing. Market participants are responding through diversified supply chains, formation of regional supplier partnerships, and investment in domestic manufacturing. Contractual mechanisms such as pass-through clauses and joint ventures are gaining traction, enabling budget containment and flexibility amid evolving policy frameworks. These strategies help organizations mitigate operational risks and ensure continuous access to critical transponder components.

Methodology & Data Sources

This analysis integrates comprehensive secondary research encompassing technical, regulatory, and financial documentation with insights from direct industry expert interviews. Quantitative findings are validated with qualitative observations from the broader satellite ecosystem, ensuring reliable and actionable intelligence on technology shifts and market dynamics.

Why This Report Matters for Senior Decision-Makers

- Facilitates better allocation of resources across platforms, suppliers, and technologies through detailed segmentation and up-to-date competitive tracking.

- Strengthens risk management by providing scenario-driven analysis on tariffs, supply chains, and new partnership structures.

- Enables clear positioning for growth by distilling impactful technical, regional, and customer-specific drivers of future demand in space communications.

Conclusion

The TT&C transponder market is advancing through increased collaboration and purposeful differentiation. Decision-makers who combine adaptive technology integration with robust partnerships and sourcing flexibility can position their organizations to capture new opportunities arising from dynamic space communication environments.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this TT&C Transponder Market report include:- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Thales Alenia Space S.A.S.

- Antwerp Space N.V.

- Anywaves

- Asia Satellite Telecommunications Company Limited

- Calian Group Ltd.

- Celestia STS B.V.

- Communications & Power Industries LLC

- ETMC Technologies Pty Ltd

- General Dynamics Mission Systems, Inc.

- Kongsberg Defence & Aerospace AS

- Kratos Defense & Security Solutions, Inc.

- Lockheed Martin Corporation

- METRACOM

- Motorola Solutions Inc

- Orbit Communications Systems Ltd.

- Safran S.A.

- SatCatalog LLC.

- Tesat-Spacecom GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.22 Billion |

| Forecasted Market Value ( USD | $ 3.26 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |