Speak directly to the analyst to clarify any post sales queries you may have.

A clear and authoritative primer on why relay technology underpins safety reliability and lifecycle performance across diverse electric vehicle charging applications

The relay is a deceptively simple electromechanical or semiconductor device that performs a pivotal role in electric vehicle charging systems, controlling high currents, isolating circuits, and enabling safe switching across diverse charging scenarios. As charging networks densify and charging sessions become more complex, relays must meet rising expectations for durability, electrical performance, and integration with intelligent charging controls. This introduction lays out the functional foundations and the strategic importance of relay selection for manufacturers, charging operators, and integrators who must balance reliability, safety, and lifecycle costs.Modern charging topologies demand a careful alignment between relay technology and application context. For instance, residential charging often prioritizes cost-effectiveness and compact form factors, whereas commercial and industrial deployments emphasize continuous duty cycles, rapid switching, and rigorous protection against electrical transients. In turn, product designers and procurement specialists must reconcile trade-offs between legacy electromechanical solutions and emerging solid-state approaches, considering factors such as thermal management, electromagnetic compatibility, and maintenance regimes. Consequently, stakeholders who understand the underlying physics and systems requirements can make choices that reduce downtime, improve user experience, and support scalable infrastructure growth.

How technological convergence digital controls and evolving operational demands are reshaping relay product design reliability requirements and integration strategies

The landscape for relays in EV charging is undergoing transformative shifts driven by expectations for faster charging, higher throughput, and stronger integration with energy management systems. One major vector of change is the transition from traditional electromechanical relays to solid-state and hybrid variants that offer faster switching, longer operational lifetimes, and reduced arcing. As charging power levels and control sophistication increase, designers are reconsidering electromagnetic architectures and embracing semiconductor-based switching where thermal design and control electronics mitigate previous cost penalties.In parallel, protocol convergence and digitalization are reshaping product requirements. Relays now interface with vehicle-to-grid systems, load-balancing algorithms, and remote diagnostics, which place a premium on repeatable behavior, low contact resistance, and predictable failure modes. Regulatory emphasis on safety and interoperability has further raised the bar, prompting manufacturers to invest in higher test standards, certification pathways, and improved traceability. As a result, the competitive landscape rewards firms that combine robust hardware with embedded intelligence and supply-chain transparency, while operators benefit from lower maintenance needs and enhanced uptime through predictive maintenance and telemetry-driven service models.

Understanding the practical effects of tariff-driven trade realignments on component sourcing manufacturing footprints and the resilience of EV charging supply chains

Recent tariff developments in the United States have introduced a complex overlay of cost considerations and supply-chain recalibrations for component manufacturers and systems integrators. Tariff measures that affect imported electrical components have obliged buyers to revisit sourcing strategies, evaluate alternative manufacturing locations, and reassess long-term supplier relationships. These policy shifts create incentives for nearshoring, capacity investment in local production, and closer collaboration with tier-1 suppliers to secure parts continuity and reduce exposure to trade volatility.Consequently, procurement teams are increasing focus on supplier resilience, dual sourcing, and inventory planning to maintain availability for critical charging deployments. At the same time, engineering teams are exploring component standardization and modular approaches that simplify qualification of alternative parts. Regulatory and tariff uncertainty also elevates the importance of contractual flexibility and total cost analyses that factor in logistics, duties, and certification costs. As stakeholders adapt, those who proactively redesign supply chains and invest in adaptable manufacturing footprints stand to mitigate disruption and sustain deployment schedules despite external policy pressures.

Detailed segmentation-driven insights that map relay types current ratings end-user requirements coil voltages and configurations to practical design and procurement choices

Segmentation nuance reveals divergent technical pathways and procurement choices across relay types, current ratings, end-use applications, coil voltages, and configurations, each of which imposes distinct performance and certification requirements. For relay type, electromechanical relays remain prevalent where cost and simplicity are paramount, hybrid designs combine mechanical and solid-state elements to achieve better endurance and switching characteristics, reed relays excel in compact low-current scenarios, and solid-state relays provide high-speed switching and immunity to contact wear for demanding applications. These type distinctions influence system-level trade-offs between capital expenditure and lifecycle serviceability.Current rating segmentation further stratifies applications: 30-60 Amp relays are often used in medium-power commercial chargers where balance between size and throughput matters, devices rated above 60 Amp address heavy-duty and fast-charging installations that demand rigorous thermal management, and up to 30 Amp relays are suitable for residential and light commercial circuits with more constrained power envelopes. End-user segmentation shows that commercial charging prioritizes continuous duty, networked management features, and vandal-resistant enclosures, industrial charging demands ruggedized designs that integrate safety interlocks and environmental protections, and residential charging emphasizes space efficiency, quiet operation, and cost-sensitive reliability. Coil voltage options also shape control architectures: 12 Volt systems remain common for automotive-aligned controllers, 24 Volt and 48 Volt options cater to different industrial control ecosystems and telecom-aligned installations, while above 48 Volt coils support emerging higher-voltage auxiliary architectures. Finally, configuration choices-double pole double throw, double pole single throw, single pole double throw, and single pole single throw-determine circuit topology, redundancy capabilities, and how fail-safe behavior is implemented within charger designs. Together, these segmentation lenses provide a structured framework for selecting relays that meet electrical, mechanical, and lifecycle criteria within specific charging contexts.

How geographic variations in regulation infrastructure and industrial capabilities are defining relay product development procurement and after-sales strategies across global regions

Regional dynamics are shaping investment patterns, regulatory priorities, and technology adoption curves in ways that affect relay demand and innovation. In the Americas, electrification initiatives and vehicle fleet transitions are driving investments in public and fleet charging networks, prompting suppliers to offer solutions compatible with North American electrical standards, robust grid-interaction features, and service models tailored to large-scale deployments. Suppliers and integrators are also responding to local content preferences and procurement rules, which influence decisions around manufacturing location and supplier partnerships.Meanwhile, Europe, Middle East & Africa exhibits a heterogeneous set of drivers: stringent safety and environmental regulations in parts of Europe elevate compliance needs and certification burdens, while infrastructure growth in the Middle East leans toward high-power, strategically located charging hubs. Africa’s nascent but accelerating interest in electrification emphasizes cost-effective, resilient designs that tolerate challenging environmental conditions. In Asia-Pacific, rapid urbanization, diverse regulatory regimes, and strong manufacturing ecosystems sustain innovation across both hardware and software domains. Manufacturers leverage regional supply-chain strengths, localized testing capabilities, and partnerships to meet varying requirements for performance, certification, and after-sales support. These geographic trends underscore the need for adaptive commercial strategies that account for regulatory complexity, local market preferences, and logistical considerations.

An authoritative examination of competitive positioning supplier differentiation and partnership patterns that shape reliability innovation and service-led differentiation in relay supply chains

Competitive dynamics in the relay supply chain reflect a mix of established component specialists, emerging semiconductor firms, and systems integrators that bundle hardware with diagnostics and services. Leading component manufacturers differentiate through engineering depth in contact materials, thermal design, and magnetic or semiconductor switching technologies, while other players compete on customization, rapid prototyping, and certification support. System integrators and charger OEMs increasingly prioritize suppliers that provide comprehensive validation data, life-cycle testing, and support for interoperability with charging protocols and energy management platforms.Partnerships between component firms and larger charging-system vendors are becoming more common as the industry converges on standardized interfaces and service-driven commercial models. At the same time, firms that invest in manufacturing flexibility, automated test equipment, and global quality systems gain an edge when operators demand consistent performance across geographically distributed deployments. Additionally, aftermarket services such as predictive maintenance analytics, spares provisioning, and field support differentiate suppliers by reducing total lifecycle disruption for charging network operators. These dynamics favor manufacturers that can demonstrate reliability through rigorous testing, rapid responsiveness via global support networks, and forward compatibility with evolving control and communication standards.

Clear actionable steps engineering procurement and operations can take to enhance relay reliability shorten qualification cycles and secure supply-chain resilience for charging deployments

Industry leaders can take immediate, concrete actions to strengthen resilience, accelerate product maturation, and secure commercial advantage in the relay segment for EV charging. First, engineering and procurement teams should collaborate closely to establish modular specifications that permit validated substitution of functionally equivalent relays, thereby reducing single-supplier risk and easing qualification of alternate sources. Second, investing in enhanced testing protocols and accelerated life-cycle validation-focused on contact wear, thermal cycling, and electromagnetic compatibility-will shorten time to reliable deployment and reduce field failures. These steps will lower operational disruption and improve end-user satisfaction.Third, manufacturers should accelerate development of hybrid and solid-state relay variants where appropriate, prioritizing thermal management innovation and embedded diagnostics to meet the needs of higher-power chargers and networked control architectures. Fourth, supply-chain leaders must pursue regional diversification and nearshoring options while negotiating long-term agreements that include capacity commitments and quality-assurance milestones. Finally, operators should adopt telemetry-driven maintenance practices to move from reactive to predictive servicing, while procurement teams incorporate total lifecycle performance metrics into supplier evaluations. Collectively, these actions will foster robust implementations, reduce downtime, and align product roadmaps with the accelerating demands of charging networks.

A transparent blended methodology combining expert interviews technical validation and standards-based analysis to ensure actionable and verifiable relay insights for EV charging

This research synthesized primary interviews with engineering decision-makers, procurement leaders, and systems integrators, augmented by a structured review of technical specifications, certification standards, and publicly available product and patent filings. The approach combined qualitative insights from subject-matter experts with systematic analysis of product features, test reports, and application notes to identify practical performance differentials and integration challenges. Where possible, findings were corroborated against vendor white papers and independent laboratory test outcomes to ensure technical accuracy and relevance.Analytical rigor was maintained through cross-validation of supplier claims with observed performance characteristics and by mapping component attributes to real-world charging topologies. In addition, scenario analysis was used to explore how technology choices interact with operational constraints such as duty cycle, ambient conditions, and control system architectures. Throughout the methodology, careful attention was given to regulatory frameworks and safety standards that influence qualification timelines and certification requirements. This blended method ensures that the recommendations and insights are grounded in operational realities and engineering evidence rather than speculative projections.

A conclusive synthesis highlighting the critical role of relay selection in safety uptime and scalable deployment strategies across evolving EV charging ecosystems

Relays remain a foundational yet evolving element of electric vehicle charging systems, and their selection materially influences system safety, uptime, and total lifecycle performance. As charging power levels and system intelligence increase, stakeholders must navigate a complex set of technical trade-offs informed by relay type, current rating, coil voltage, and configuration. Moreover, regional regulatory differences and supply-chain dynamics necessitate adaptive sourcing strategies and closer coordination between engineering and procurement functions. The path forward favors manufacturers and operators who invest in validated designs, diversified supply footprints, and data-driven maintenance regimes.In conclusion, the industry is moving towards solutions that blend mechanical reliability with semiconductor advantages, while also emphasizing certification, interoperability, and serviceability. Leaders who adopt modular specifications, rigorous testing, and telemetry-enabled maintenance will reduce operational risk and better position themselves to serve diverse charging environments. By aligning product development and sourcing strategies to operational realities, organizations can ensure that relay choices support scalable, reliable, and safe electrification initiatives.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Relays for EV Charging Stations Market

Companies Mentioned

- ABB Ltd.

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Omron Corporation

- Panasonic Holdings Corporation

- Phoenix Contact GmbH & Co. KG

- Schneider Electric SE

- Siemens AG

- TE Connectivity Ltd.

- Webasto

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

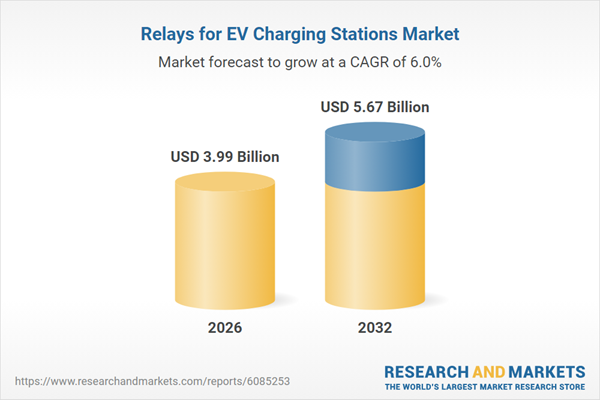

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.99 Billion |

| Forecasted Market Value ( USD | $ 5.67 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |