Speak directly to the analyst to clarify any post sales queries you may have.

Revealing the Foundational Dynamics Driving the Adoption of Small Horizontal Wind Turbine Technology in Modern Decentralized and Industrial Energy Systems Worldwide

The evolution of small horizontal wind turbines reflects a broader commitment to decentralized renewable energy solutions that can meet diverse power needs with minimal environmental impact. As local and regional energy planners look to complement larger wind installations, small horizontal turbines have emerged as versatile assets capable of serving remote communities, agricultural operations, and off-grid industrial sites. This introduction explores how advances in aerodynamics, smart controls, and modular manufacturing techniques have converged to lower entry barriers and broaden adoption across end-use segments.Building on decades of research and field experience, the small horizontal wind turbine sector now benefits from integrated digital monitoring systems and predictive maintenance platforms. Coupled with supportive policy frameworks and sustainability mandates, these developments are transforming what was once a niche offering into a robust component of diversified energy portfolios. In this context, stakeholders are seeking clear insights into technology optimization, cost-effective operation, and seamless integration with existing energy infrastructures.

Understanding Pivotal Transformations Shaping the Small Horizontal Wind Turbine Landscape Across Regulatory Technological and Market Dimensions

Over the past few years, the small horizontal wind turbine market has undergone pivotal transformations that redefine competitive positioning and investment priorities. Regulatory shifts, such as enhanced renewable portfolio standards and targeted tax incentives, have accelerated procurement cycles for community energy projects and commercial farms. At the same time, research breakthroughs in composite materials and rotor design have unlocked higher efficiency thresholds, enabling smaller units to deliver outputs once achievable only by medium-scale turbines.Simultaneously, the integration of Internet of Things platforms and advanced data analytics has fueled a move toward condition-based maintenance and performance optimization. This convergence of policy, technology, and business model innovation has reshaped market dynamics, paving the way for novel financing structures such as energy-as-a-service and crowd-funded wind farms. Consequently, early adopters are witnessing enhanced system reliability, reduced lifecycle costs, and more agile responses to shifting energy demand patterns.

Assessing How the Introduction of 2025 United States Tariffs on Key Components Alters the Supply Chain and Cost Structures for Small Horizontal Wind Turbines

The imposition of new United States tariffs in 2025 on key turbine components has sent ripple effects through the global supply chain. Import duties on critical raw materials and subassemblies have led manufacturers and integrators to reevaluate cost structures and supplier relationships. In response, several producers have accelerated plans to onshore production of generators and control electronics or to secure long-term agreements with domestic steel and composite suppliers.In parallel, downstream developers are weighing the trade-offs between higher upfront costs and the value of localized sourcing, including reduced lead times and lower transportation risk. To mitigate uncertainty, strategic alliances are emerging between turbine OEMs and component fabricators, enabling shared investments in production capacity. As a result, while short-term project budgets may require adjustment, the move toward a more resilient and diversified supply chain is expected to yield sustained benefits in reliability and total cost of ownership.

Deriving Actionable Insights from Component Capacity Connectivity Blade Material and Application Segments to Refine Small Horizontal Wind Turbine Strategies

An in-depth examination of component segments such as control systems, generators, rotor blades, and towers reveals differentiated growth trajectories and investment requirements. Control platforms with integrated predictive diagnostics are commanding premium pricing, while established generator designs continue to benefit from economies of scale. High-performance rotor blades manufactured with varying degrees of aluminum alloy, carbon fiber composite, and fiberglass reinforced plastic illustrate trade-offs between durability and weight optimization. Meanwhile, modular tower designs facilitate rapid field assembly for remote installations.Further insights emerge when exploring grid connectivity modalities, where off-grid configurations are favored in rural electrification and agricultural contexts, while on-grid tie-ins dominate urban and utility-scale applications. Capacity bands spanning 0-5 kW, 5-20 kW, and 20-100 kW exhibit distinct adoption patterns: micro-turbines serve residential and small farm use cases, mid-range systems support commercial and light industrial needs, and larger units feed distributed utility networks. The interplay of material innovations and capacity requirements underscores the importance of tailored system design aligned with each application's performance and reliability criteria.

Uncovering Strategic Regional Variations from the Americas Through EMEA and Asia-Pacific That Influence Small Horizontal Wind Turbine Deployment Patterns

Regional dynamics underscore how geographic, policy, and infrastructure factors shape deployment pathways for small horizontal wind turbines. In the Americas, growth is anchored by renewable energy mandates and distributed generation incentives, driving demand in agricultural, residential, and commercial sectors. A well-developed supply chain and financing frameworks support both new installations and repowering projects for legacy units.Europe, Middle East & Africa present a diverse landscape where established wind markets coexist with emerging economies investing in energy access. In northern and western Europe, stringent emissions targets bolster utility and commercial procurement, whereas select African and Middle Eastern countries leverage off-grid wind solutions to address rural electrification challenges. Across these territories, cross-border partnerships and localized manufacturing partnerships are critical to achieving scale.

Meanwhile, Asia-Pacific is characterized by rapid market expansion fueled by government subsidies, industrial decarbonization goals, and aggressive electrification programs. Manufacturing hubs in East and Southeast Asia benefit from integrated component ecosystems, while rural regions in South Asia and Oceania increasingly adopt off-grid systems to complement solar installations. The result is a multifaceted regional tapestry where small horizontal turbines are forging new pathways to energy resilience and sustainability.

Analyzing Strategic Positioning and Innovation Pathways of Leading Manufacturers Service Providers and Emerging Players in the Small Horizontal Wind Turbine Ecosystem

Key industry participants encompass a spectrum of established turbine manufacturers, specialized component suppliers, digital service providers, and agile start-ups. Leading original equipment manufacturers are deepening their portfolios with smart control solutions and enhanced blade designs, while specialized suppliers are innovating in advanced composites and corrosion-resistant coatings. Digital service firms are expanding predictive maintenance offerings and remote performance analytics, enabling operators to reduce downtime and optimize yield.Emerging players are capitalizing on niche opportunities such as modular tower systems and hybrid microgrid integration, forging collaborations with technology incubators and research institutions. Strategic partnerships between incumbents and newcomers facilitate co-development of low-cost production lines and shared data platforms. These collaborations, along with selective mergers and acquisitions, are reshaping competitive advantages by combining scale efficiencies with innovation agility.

Strategic Roadmap and Tactical Recommendations to Empower Industry Leaders to Capitalize on Emerging Opportunities in Small Horizontal Wind Turbine Markets

Industry leaders should prioritize supply chain resilience by diversifying sourcing strategies and establishing flexible manufacturing partnerships that can absorb tariff volatility. Investment in advanced material research-particularly in carbon fiber composites and high-strength alloys-will yield turbines that balance cost, performance, and durability. Additionally, cultivating relationships with digital platform providers can accelerate adoption of condition-based maintenance and data-driven optimization across asset portfolios.To capture evolving market opportunities, executives are advised to explore novel financing models that reduce customer barriers to entry, such as leasing programs or power-purchase agreements linked to performance metrics. Collaboration with regulatory bodies and local stakeholders can streamline permitting processes and unlock incentives for sustainable infrastructure. Finally, a focus on modularity and ease of installation will differentiate offerings in applications ranging from rural electrification to commercial microgrids, ensuring rapid time to value and stronger competitive positioning.

Transparent Overview of the Comprehensive Methodology Combining Primary Interviews Secondary Research and Data Triangulation Employed in This Study

This study combines insights from extensive primary research, including in-depth interviews with turbine executives, component manufacturers, grid operators, and project developers. Complementary secondary research draws upon technical journals, policy reports, patent filings, and industry white papers to contextualize technological advancements and regulatory frameworks. Data from trade associations and customs records were triangulated with proprietary supply chain information to validate changes in sourcing dynamics.Market segmentation was performed by analyzing performance attributes, material specifications, grid connectivity options, and end-use applications. Regional analysis incorporated macroeconomic indicators, policy incentives, and infrastructure readiness metrics to assess deployment feasibility. Qualitative and quantitative findings were cross-referenced through a multi-tiered validation process, ensuring that conclusions reflect both current market realities and near-term evolution drivers.

Synthesizing Key Findings into a Cohesive Outlook That Highlights the Strategic Imperatives for Small Horizontal Wind Turbine Stakeholders

In conclusion, small horizontal wind turbines stand at the intersection of technological innovation, regulatory momentum, and shifting market demands. The wave of policy incentives and tariff adjustments has underscored the critical importance of supply chain agility, while advancements in blade materials, control systems, and digital monitoring are redefining performance benchmarks. Segmentation analysis reveals that targeted approaches-tailored to component strengths, capacity bands, connectivity requirements, and application contexts-will drive sustainable growth.Regional nuances further highlight the need for adaptive strategies that align with local policy frameworks, infrastructure ecosystems, and customer requirements. As industry participants refine their offerings and strategic partnerships reshape competitive dynamics, the path forward demands a balanced focus on innovation, operational efficiency, and stakeholder collaboration. These imperatives form the foundation for capitalizing on the transformative potential of small horizontal wind turbines.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Components

- Control Systems

- Generator

- Rotor Blades

- Tower

- Grid Connectivity

- Off-Grid

- On-Grid

- Capacity:

- 0-5 kW

- 20-100 kW

- 5-20 kW

- Blade Material

- Aluminum Alloy

- Carbon Fiber Composite

- Fiberglass Reinforced Plastic

- Application

- Agricultural

- Commercial

- Residential

- Utility

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Aeolos Wind Energy Ltd.

- Bergey Windpower Co.

- BORNAY AEROGENERADORES, SL

- ENERCON Global GmbH

- Envision Energy USA Limited

- GE Vernova Group

- Goldwind Science&Technology Co., Ltd.

- Indowind Energy Limited

- Kingspan Group

- Kliux Energies

- LuvSide GmbH

- Mingyang Smart Energy Group

- Mitsubishi Heavy Industries, Ltd.

- New World Wind

- Nordex SE

- Northern Power Systems Inc.

- RRB Energy Limited

- Ryse Energy

- SD Wind Energy Limited

- Senvion S.A.

- Shanghai Electric Wind Power Equipment Co., Ltd.

- Siemens Gamesa Renewable Energy, S.A.

- superwind GmbH

- TUGE Energia

- Vestas Wind Systems A/S

- WEG SA

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Small Horizontal Wind Turbine market report include:- Aeolos Wind Energy Ltd.

- Bergey Windpower Co.

- BORNAY AEROGENERADORES, SL

- ENERCON Global GmbH

- Envision Energy USA Limited

- GE Vernova Group

- Goldwind Science&Technology Co., Ltd.

- Indowind Energy Limited

- Kingspan Group

- Kliux Energies

- LuvSide GmbH

- Mingyang Smart Energy Group

- Mitsubishi Heavy Industries, Ltd.

- New World Wind

- Nordex SE

- Northern Power Systems Inc.

- RRB Energy Limited

- Ryse Energy

- SD Wind Energy Limited

- Senvion S.A.

- Shanghai Electric Wind Power Equipment Co., Ltd.

- Siemens Gamesa Renewable Energy, S.A.

- superwind GmbH

- TUGE Energia

- Vestas Wind Systems A/S

- WEG SA

Table Information

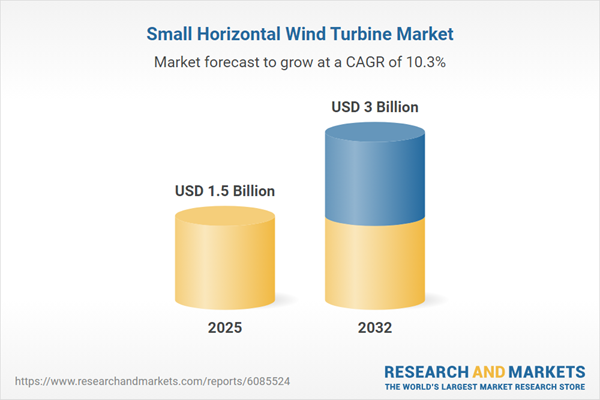

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 3 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |