Alongside this demographic shift, the current healthcare capacity highlights growing pressure on the system. According to the American Hospital Association, as of 2025, the U.S. has 6,093 hospitals, of which 5,112 are classified as community hospitals. A population of around 331 million translates to just 1.84 hospitals per 100,000 people. This relatively low ratio underscores the need for new healthcare facilities, creating strong opportunities for real estate development in the healthcare sector.

Moreover, the rising incidence of acute diseases is compounding the demand. For instance, conditions like acute kidney injury (AKI) are becoming more common, driven in part by the aging population and the increasing prevalence of chronic illnesses such as diabetes and hypertension. According to the 2020 Annual Data Report, these health challenges contribute to rising hospitalization rates.

In 2025, the U.S. is projected to experience about 36.2 million hospitalizations, which is expected to climb to 40.2 million by 2035. This trend reflects the growing demand for inpatient care and highlights the urgency of expanding hospital capacity. As hospitalizations increase and physician shortages persist, the pressure to invest in new medical facilities becomes even more critical.

U.S. Healthcare Real Estate Market Report Highlights

- The senior living and retirement community sector is on a strong growth trajectory and is projected to showcase significant growth from 2024 to 2030. This surge is primarily driven by the aging baby boomer population, which is fueling demand for post-retirement living options that offer comfort and access to specialized healthcare services. Real estate developers and institutional investors are increasingly drawn to this sector, recognizing it as a stable, long-term asset class.

- Medical Outpatient Buildings (MOBs) are capitalizing on changing healthcare preferences, particularly the shift toward more accessible outpatient care. In 2024, MOBs saw a decline in vacancy rates and an increase in asking rents, even in the face of new supply. This reflects robust demand as patients and providers seek care facilities closer to residential areas.

- The lease model dominated the healthcare real estate sector in 2024, holding a market share of 65.10%. Its popularity stems from the financial flexibility it offers healthcare providers, enabling them to invest more in patient care rather than property ownership. Leasing also facilitates scalability, allowing facilities to adjust space usage based on shifting patient volumes and service models. For investors, long-term lease agreements provide stable income and lower risk, making this model especially attractive to REITs and institutional buyers.

- The market is being shaped by industry giants such as Welltower Inc. ($82.34B market cap), Ventas Inc. ($24.94B), and Healthpeak Properties Inc. ($14.44B). These players dominate due to their scale, diversification, and strategic partnerships. Welltower, in particular, maintains the largest and most varied portfolio among healthcare REITs, spanning senior housing, outpatient facilities, and health systems. Their large-scale operations allow them to mitigate risk, secure long-term operator relationships, and maintain consistent performance, even in fluctuating market conditions. Their depth of experience and sector focus give them a significant edge in a growing and increasingly competitive market.

Why Should You Buy This Report?

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this U.S. Healthcare Real Estate market report include:- Welltower Inc.

- Ventas, Inc.

- Healthpeak Properties, Inc.

- Omega Healthcare Investors, Inc

- Healthcare Realty Trust Incorporated

- CareTrust REIT, Inc

- The GEO Group, Inc

- Sabra Health Care REIT, Inc

- National Health Investors, Inc

- Medical Properties Trust, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | April 2025 |

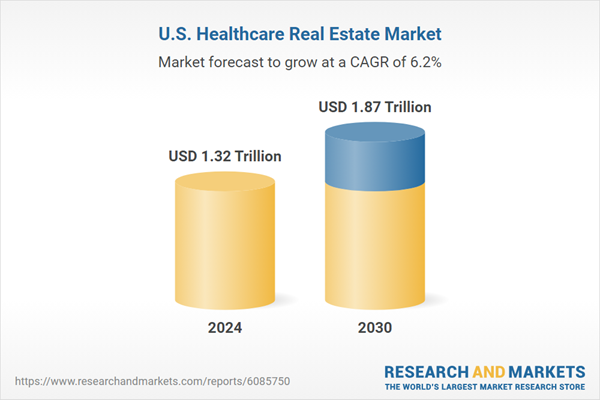

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.32 Trillion |

| Forecasted Market Value ( USD | $ 1.87 Trillion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |