Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rapid Industrialization and Infrastructure Development

The Asia-Pacific region is experiencing robust industrial growth, particularly in nations such as China, India, Vietnam, and Indonesia, which is driving increased demand for high-efficiency steam generation systems. Water tube chemical boilers, capable of managing high-pressure operations with excellent thermal output, are becoming the preferred choice in large-scale chemical and processing plants.Industrial output growth, such as the 5.8% rise in India's manufacturing sector and China's 4.6% industrial expansion, underscores the growing reliance on steam-based systems in sectors like chemical manufacturing, refineries, and fertilizer plants. Major infrastructure development programs across the region are further amplifying utility requirements. As production processes grow more complex and continuous, water tube boilers offer the scalability and performance needed to support long-duration operations and ensure system integrity.

Key Market Challenges

High Initial Capital Investment and Installation Costs

A major constraint for the Asia-Pacific water tube chemical boiler market is the high upfront cost associated with these systems. Compared to fire-tube boilers, water tube models require advanced design, engineering precision, and robust materials, all of which elevate capital expenditure. For mid-sized chemical plants, the cost of acquiring and installing water tube boilers - including auxiliary components like feedwater systems and economizers - can be nearly double that of fire-tube alternatives.This financial burden is especially challenging for small and medium enterprises in emerging markets such as India, Vietnam, and the Philippines. Additionally, installation demands specialized infrastructure, increasing the total cost of ownership. Securing financing for such upgrades is difficult in regions where banks do not prioritize boiler investments unless supported by government subsidies. These factors collectively slow adoption rates despite the technology’s operational advantages.

Key Market Trends

Integration of Smart Boiler Management Systems

One of the prominent trends in the Asia-Pacific water tube chemical boiler market is the integration of smart control and monitoring systems. Industries are increasingly adopting automation and digital platforms to enhance efficiency, minimize energy waste, and reduce emissions. These smart systems, equipped with sensors and PLCs, provide real-time data on pressure, feedwater quality, and combustion parameters, allowing for dynamic performance optimization. In chemical facilities with variable steam demand, automated systems help stabilize pressure levels, reduce fuel consumption, and enhance system reliability. Advanced monitoring also supports predictive maintenance, reducing downtime and extending equipment lifespan. Countries like Japan, South Korea, and Singapore are at the forefront of IIoT-enabled boiler installations, while markets such as India and Malaysia are quickly adapting as costs decrease and awareness grows.Key Players Profiled in this Asia-Pacific Water Tube Chemical Boiler Market Report

- Babcock & Wilcox Enterprises, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Thermax Limited

- Bosch Industriekessel GmbH

- GE Power

- Wood Group

- Hurst Boiler & Welding Co., Inc.

- Doosan Heavy Industries & Construction

- Zhengzhou Boiler Group Co., Ltd.

- Shanghai Industrial Boiler Co., Ltd.

Report Scope:

In this report, the Asia-Pacific Water Tube Chemical Boiler Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia-Pacific Water Tube Chemical Boiler Market, by Capacity:

- Less than 10 MMBtu/hr

- 10-50 MMBtu/hr

- 50-100 MMBtu/hr

- Above 100 MMBtu/hr

Asia-Pacific Water Tube Chemical Boiler Market, by Fuel Type:

- Natural Gas

- Oil

- Coal

- Biomass

- Others

Asia-Pacific Water Tube Chemical Boiler Market, by Pressure Range:

- Low Pressure

- Medium Pressure

- High Pressure

Asia-Pacific Water Tube Chemical Boiler Market, by Country:

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Thailand

- Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific Water Tube Chemical Boiler Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Asia-Pacific Water Tube Chemical Boiler market report include:- Babcock & Wilcox Enterprises, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Thermax Limited

- Bosch Industriekessel GmbH

- GE Power

- Wood Group

- Hurst Boiler & Welding Co., Inc.

- Doosan Heavy Industries & Construction

- Zhengzhou Boiler Group Co., Ltd.

- Shanghai Industrial Boiler Co., Ltd.

Table Information

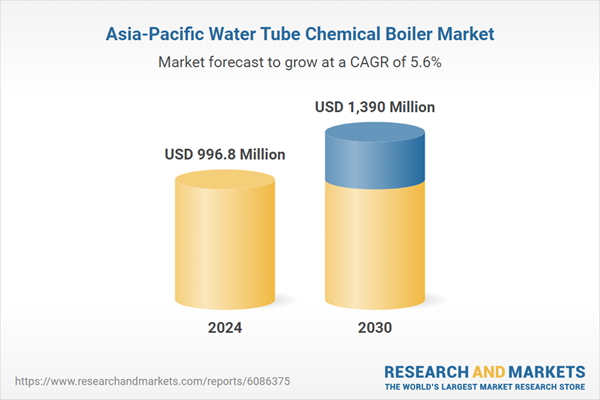

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 996.8 Million |

| Forecasted Market Value ( USD | $ 1390 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |