Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Aggressive advertising and attractive packaging strategies by leading brands have helped retain consumer interest and expand market reach. While the product enjoys widespread usage across demographics, growing health concerns and tighter government regulations - especially concerning tobacco and areca nut content - pose potential limitations to growth. Nevertheless, opportunities continue to emerge in tier-II and tier-III cities, where changing consumption patterns are fostering increased demand.

Key Market Drivers

Rising Disposable Income and Urbanization

The rise in disposable income and accelerating urbanization across India are central to the growth of the pan masala market. As the middle class expands and purchasing power increases, consumers are more inclined to buy lifestyle products, including pan masala. India's per capita disposable income rose from USD 2.11 thousand in 2019 to USD 2.54 thousand in 2023, reflecting improved spending capacity. Urban migration has amplified access to retail formats and modern trade, encouraging consumers to favor packaged alternatives over traditional, loose variants. Urban lifestyles and aspirations also influence consumption, with pan masala often viewed as a status-enhancing indulgence. Brands are leveraging these factors by targeting metro regions and tapping into semi-urban and transitioning rural markets where consumer behavior is evolving toward branded and convenient products.Key Market Challenges

Growing Health Concerns and Regulatory Scrutiny

Health-related concerns around the consumption of pan masala, especially those containing areca nut and tobacco, represent a major challenge to market expansion. Scientific research has increasingly linked pan masala use to serious health conditions, including oral cancers and gastrointestinal disorders. This has spurred public health campaigns and led to greater societal and governmental scrutiny. Regulatory actions, including product bans in several states, mandatory pictorial health warnings, and restrictions on surrogate advertising, are increasingly affecting market visibility and consumer trust. As these measures become more stringent, they are likely to impact how products are marketed, distributed, and consumed - posing challenges for growth and brand positioning in the long term.Key Market Trends

Shift Toward Premium and Non-Tobacco Variants

The pan masala market in India is witnessing a clear shift toward premium and non-tobacco alternatives. As consumer awareness regarding health risks rises, especially among urban and image-conscious buyers, demand is growing for pan masala products that are free from tobacco and contain natural or high-end ingredients. Manufacturers are responding by launching premium variants enriched with saffron, cardamom, silver leaves, and herbal flavors. These products are being promoted as lifestyle accessories or modern mouth fresheners rather than traditional chewing items. Elegant, resealable packaging and wellness-oriented branding are increasingly used to appeal to discerning consumers. This shift aligns with evolving market preferences and is expected to gain traction, particularly as health regulations tighten and non-tobacco offerings become a larger share of the overall product mixKey Players Profiled in this India Pan Masala Market Report

- DS Group

- Manikchand Group

- Godfrey Phillips India (Modi Enterprises)

- Kothari Product Limited

- Dharampal Premchand Limited

- Red Rose Group

- Ashok & Company - Pan Bahar Ltd.

- Shikhar Group

- KP Group

Report Scope:

In this report, the India Pan Masala Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Pan Masala Market, by Product Type:

- Tobacco Pan Masala

- Plain Pan Masala

- Flavored Pan Masala

- Others

India Pan Masala Market, by Packaging:

- Pouches

- Cans

- Others

India Pan Masala Market, by Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Pan Masala Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this India Pan Masala market report include:- DS Group

- Manikchand Group

- Godfrey Phillips India (Modi Enterprises)

- Kothari Product Limited

- Dharampal Premchand Limited

- Red Rose Group

- Ashok & Company - Pan Bahar Ltd.

- Shikhar Group

- KP Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | May 2025 |

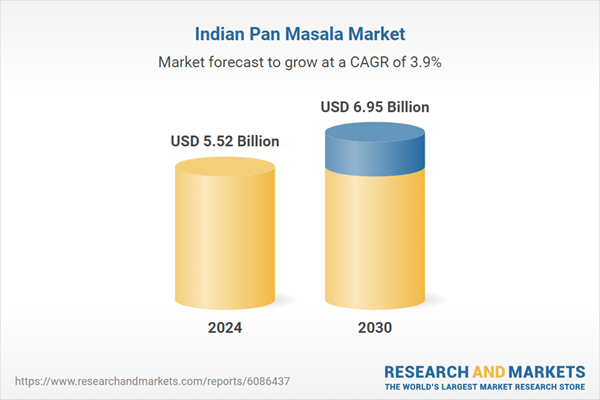

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.52 Billion |

| Forecasted Market Value ( USD | $ 6.95 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |