Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This not only reduces operational downtime but also lowers overall costs, making it ideal for both onshore and offshore applications. The presence of aging oilfields across the region has further driven the need for routine maintenance and stimulation services, where coiled tubing is extensively used for tasks such as acidizing, well cleaning, and fracturing. With increasing offshore exploration activities, especially in Southeast Asia, the demand for coiled tubing services is anticipated to expand, supported by innovations like real-time monitoring, automated systems, and improved materials that enhance reliability and efficiency.

Key Market Drivers

Offshore Oilfield Expansion Driving Service Demand

The ongoing expansion of offshore oil and gas operations across Asia-Pacific is a significant factor propelling the demand for coiled tubing services. Countries such as India, Indonesia, Vietnam, and Malaysia are ramping up offshore exploration to ensure energy security and cater to rising consumption. These offshore environments, often deepwater or ultra-deepwater, require advanced intervention techniques like coiled tubing for activities such as well stimulation, scale removal, and nitrogen lifting. The industry favors coiled tubing for its flexible, cost-effective nature, especially in complex offshore settings.In 2024, over 30% of new well interventions in Southeast Asia used coiled tubing due to its adaptability in high-pressure and remote environments. The trend toward marginal field development also supports this demand, as coiled tubing reduces rig time and improves project economics. Additionally, the increased use of subsea completions and extended horizontal wells further boosts the preference for coiled tubing in operations demanding swift deployment and maneuverability. Strategic efforts to enhance output from underdeveloped offshore regions like the Indian coast and South China Sea are expected to sustain this growth trajectory.

Key Market Challenges

Skilled Workforce Shortage

One of the prominent challenges in the Asia-Pacific coiled tubing market is the shortage of skilled labor. Operating coiled tubing systems requires experienced professionals capable of handling complex machinery under challenging conditions, especially in offshore settings. Many developing countries in the region face a lack of adequate training facilities and standardized certification programs, resulting in a skills gap.As demand for services such as well intervention and drilling rises in nations like Vietnam, Indonesia, and India, this shortage becomes increasingly evident, affecting both service efficiency and safety standards. The issue is compounded by an aging workforce in regions like Australia and a general lack of interest from younger professionals entering the energy sector. Consequently, companies often rely on importing talent, which escalates operational costs and limits local scalability. The talent gap not only hampers service quality but also restricts the long-term competitiveness of the regional market.

Key Market Trends

Rising Focus on Cost Optimization and Multi-Service Offerings

In response to fluctuating oil prices and cost-sensitive project economics, operators and service providers in the Asia-Pacific coiled tubing market are increasingly adopting cost-optimization strategies. One notable trend is the bundling of coiled tubing services with complementary offerings such as wireline operations, nitrogen pumping, and hydraulic fracturing. These integrated solutions streamline logistics, eliminate redundancy, and improve operational coordination. There is also a growing preference for modular coiled tubing units that are easily deployable and demobilized, particularly in Southeast Asia.These compact setups reduce labor requirements and non-productive time, enhancing overall efficiency. In addition, service companies are embracing standardized, adaptable equipment platforms to reduce customization costs across varied well environments. The use of digital monitoring tools to track fuel use, performance metrics, and resource allocation in real time supports continuous improvements in cost management and service quality. These efforts align with the market’s emphasis on delivering high-value, economically viable well intervention solutions.

Key Players Profiled in this Asia-Pacific Coiled Tubing Market Report

- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Weatherford International plc

- Baker Hughes Company

- General Electric Company

- Nabors Corporate Services, Inc.

- C&J Energy Services Inc

- Trican Well Service Ltd.

- Calfrac Well Services Ltd.

- STEP Energy Services Ltd

Report Scope:

In this report, the Asia-Pacific Coiled Tubing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia-Pacific Coiled Tubing Market, by Service Type:

- Well Intervention

- Drilling

- Others

Asia-Pacific Coiled Tubing Market, by Application:

- Onshore

- Offshore

Asia-Pacific Coiled Tubing Market, by Country:

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Thailand

- Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific Coiled Tubing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Asia-Pacific Coiled Tubing market report include:- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Weatherford International plc

- Baker Hughes Company

- General Electric Company

- Nabors Corporate Services, Inc.

- C&J Energy Services Inc

- Trican Well Service Ltd.

- Calfrac Well Services Ltd.

- STEP Energy Services Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

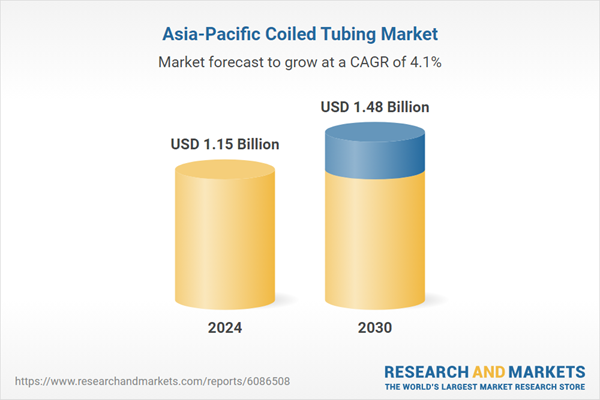

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.15 Billion |

| Forecasted Market Value ( USD | $ 1.48 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 11 |