Global 'Water and Wastewater Valves' Market - Key Trends & Drivers Summarized

Why Are Valves at the Core of Water Infrastructure Efficiency?

Valves are the unsung heroes of water and wastewater management systems, acting as critical control components that regulate flow, pressure, direction, and shutoff across vast and complex pipelines. As global urban populations grow and climate challenges escalate, water infrastructure is under immense pressure to deliver reliable, efficient, and safe services - making valves indispensable to operational resilience. These components are used in every stage of water treatment and distribution - from intake and filtration to chemical dosing, sewage redirection, and discharge. Their ability to isolate sections, mitigate contamination risks, and manage pressure fluctuations plays a crucial role in ensuring system safety and regulatory compliance. Municipal utilities, industrial water users, and desalination plants all depend on robust valve networks to manage varying water qualities and volumes. As governments around the world prioritize water security and infrastructure modernization, valve systems are increasingly being viewed not just as fittings but as high-performance control devices essential to sustainable utility management. The demand for reliable, corrosion-resistant, and long-life valve solutions is only intensifying as water systems face greater demand, aging networks, and stricter environmental standards.How Are Technological Advancements Transforming Valve Performance and Monitoring?

Water and wastewater valves are no longer passive components - they are becoming smart, connected devices through the integration of advanced materials and IoT technologies. Smart valves equipped with sensors, actuators, and remote monitoring capabilities are enabling real-time control over flow rates, leak detection, and system diagnostics. This shift is being driven by the digitalization of water utilities and the emergence of smart water grids aimed at optimizing resources and minimizing energy consumption. Materials science is also advancing the durability of valves, with newer alloys, composite polymers, and ceramic coatings extending operational lifespans in corrosive and abrasive environments. Innovations in design - such as triple-offset, pressure-sealed, and low-torque valves - are improving reliability and reducing maintenance needs. Automation and SCADA (Supervisory Control and Data Acquisition) integration are allowing valves to be controlled remotely, minimizing manual intervention and improving system responsiveness during emergency events or routine adjustments. The rise of predictive maintenance, powered by machine learning algorithms, is enabling utilities to anticipate valve failures before they occur, reducing downtime and repair costs. These advances are turning traditional valve infrastructure into a digitally intelligent asset class within modern water systems.Which End-Use Sectors and Regions Are Driving Valve Demand?

A wide array of end-use sectors and geographies are fueling demand for water and wastewater valves, each influenced by unique infrastructure and regulatory dynamics. The municipal sector remains the largest consumer, with cities upgrading their aging water distribution and sewage systems to accommodate expanding populations and meet stricter discharge norms. In the industrial sector, valves are critical for water-intensive processes in power generation, petrochemicals, food and beverage, and pharmaceuticals - where consistent pressure control and contaminant prevention are operational imperatives. Agriculture, particularly in arid regions, is another significant end-user deploying valves in irrigation systems to optimize water use. Geographically, North America and Western Europe have mature markets focused on upgrading legacy infrastructure with smart and energy-efficient valve systems. In contrast, Asia-Pacific - driven by China, India, and Southeast Asia - is experiencing rapid valve market expansion due to accelerated urbanization, water scarcity issues, and massive government-backed infrastructure investments. The Middle East and Africa are investing in valves for desalination and wastewater reuse plants to address extreme water stress. Latin America is also showing growth in rural water supply and treatment projects. Across these regions, growing awareness of water conservation and infrastructure resilience is steadily boosting the market's breadth and complexity.What's Driving the Growth of the Water and Wastewater Valves Market?

The growth in the water and wastewater valves market is driven by several factors directly linked to changing infrastructure needs, regulatory requirements, and technological advancements. Chief among these is the global push toward water sustainability, compelling utilities to upgrade networks with high-performance valves that minimize leaks, optimize flow, and support water reuse initiatives. The aging infrastructure in developed nations is spurring large-scale replacement projects, while fast-paced urbanization in emerging economies is expanding the need for new water and wastewater facilities. Increasing regulatory scrutiny around effluent discharge, water quality, and system safety is pushing industries and municipalities to invest in precision valve systems that ensure compliance. Another key driver is the transition toward smart water management, where IoT-enabled valves allow for data-driven control, early fault detection, and predictive maintenance. Rising investments in desalination, wastewater recycling, and zero-liquid discharge systems are also boosting demand for valves engineered for harsh, high-salinity environments. Moreover, climate-related challenges such as floods and droughts are necessitating robust flow control mechanisms across infrastructure planning. These combined factors are accelerating innovation and adoption, making valves a pivotal component in the future of global water and wastewater infrastructure.Report Scope

The report analyzes the Water and Wastewater Valves market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Gate, Ball, Butterfly, Globe, Other Types); Material (Cast Iron, Steel, Alloy-based, Other Materials); End-Use (Oil & Gas, Chemical, Power Generation, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gate Valves segment, which is expected to reach US$4.9 Billion by 2030 with a CAGR of a 4.1%. The Ball Valves segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Water and Wastewater Valves Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Water and Wastewater Valves Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Water and Wastewater Valves Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Benson, Bernard Favre, Buben & Zörweg, Chronovision, Designhütte and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Water and Wastewater Valves market report include:

- AVK Holding A/S

- Avcon Controls Pvt. Ltd.

- Böhmer GmbH

- Cameron - Schlumberger

- Crane Co.

- Davis Valve

- EG Valves Manufacturing Co., Ltd.

- Emerson Electric Co.

- Ferguson Enterprises Inc.

- Flomatic Valves

- Flow Control Technology Valve

- Flowserve Corporation

- Fluid Chem Valves (India) Pvt. Ltd.

- IMI plc

- KITZ Corporation

- Mueller Water Products, Inc.

- Red Valve Company, Inc.

- Rotork plc

- Valmet Corporation

- Velan Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AVK Holding A/S

- Avcon Controls Pvt. Ltd.

- Böhmer GmbH

- Cameron – Schlumberger

- Crane Co.

- Davis Valve

- EG Valves Manufacturing Co., Ltd.

- Emerson Electric Co.

- Ferguson Enterprises Inc.

- Flomatic Valves

- Flow Control Technology Valve

- Flowserve Corporation

- Fluid Chem Valves (India) Pvt. Ltd.

- IMI plc

- KITZ Corporation

- Mueller Water Products, Inc.

- Red Valve Company, Inc.

- Rotork plc

- Valmet Corporation

- Velan Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

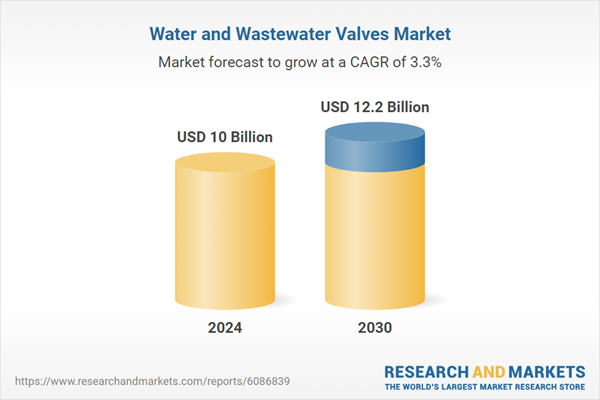

| Estimated Market Value ( USD | $ 10 Billion |

| Forecasted Market Value ( USD | $ 12.2 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |