Global 'Welding Torch and Wear Parts' Market - Key Trends & Drivers Summarized

Why Are Welding Torches and Their Components Under the Spotlight in Manufacturing?

Welding torches and their associated wear parts are experiencing renewed focus as industries worldwide prioritize operational efficiency, precision, and durability in metal joining processes. From automotive assembly lines to heavy equipment manufacturing and aerospace production, welding remains a foundational operation - and the quality of the welding torch directly influences output, safety, and maintenance overhead. With growing automation in fabrication facilities, torches are now expected to support robotic integration, high-frequency usage, and a wide range of welding techniques including MIG, TIG, plasma arc, and submerged arc welding. The importance of wear parts - nozzles, contact tips, diffusers, insulators, and liners - has also grown exponentially, as they play a critical role in maintaining consistent arc stability, minimizing spatter, and reducing downtime due to part replacement. These components face high thermal and mechanical stress, and their performance impacts both weld quality and operational cost. As demand for high-performance materials and tight weld tolerances increases across industries, the market for advanced welding torch systems and longer-lasting wear parts continues to strengthen.How Are Material Science and Ergonomic Innovation Reshaping Product Design?

Technological innovation in materials and torch design is significantly transforming product capabilities and user experience. Manufacturers are increasingly utilizing heat-resistant alloys, ceramic-coated components, and copper-chrome-zirconium blends in wear parts to extend lifespan and improve conductivity. Torch handles are being redesigned for better grip, reduced weight, and improved balance, all of which minimize operator fatigue and improve safety in manual applications. Some advanced torches now feature integrated cooling systems - both air and water-cooled - allowing them to operate under extreme conditions without overheating. In robotic welding, torches with modular and compact designs are gaining traction as they allow easier integration and toolpath optimization. Wear parts are being engineered for tool-less change-outs and better compatibility across multiple torch models, enabling quicker maintenance and reduced operational interruptions. These advancements are helping welding professionals and automation engineers achieve greater reliability, efficiency, and safety, especially in high-throughput or precision-critical applications such as shipbuilding, railways, and aerospace.Which Industries and Geographies Are Driving Demand for Torch and Wear Part Solutions?

Heavy manufacturing industries continue to be the primary end-users of welding torches and wear parts, but significant uptake is also occurring in newer sectors such as renewable energy, electric vehicle (EV) battery systems, and modular construction. Wind turbine assembly, solar panel mounting structures, and battery enclosures all require consistent, high-strength welds, thus driving the demand for durable, high-performance torches. The automotive industry remains a powerhouse, especially as lightweight metals like aluminum become more prevalent, requiring specialized torches and compatible consumables. Regionally, Asia-Pacific dominates the global market, led by manufacturing giants like China, Japan, and South Korea. These nations are investing heavily in automation and robotics, accelerating the adoption of advanced torch systems. In North America and Europe, stringent worker safety standards and lean manufacturing trends are pushing factories toward ergonomic and high-efficiency torch systems. Meanwhile, the Middle East and Africa are witnessing steady growth as infrastructure and industrial projects expand, bringing welding processes to the forefront of industrial development.What Forces Are Accelerating Growth in the Welding Torch and Wear Parts Market?

The growth in the welding torch and wear parts market is driven by several factors anchored in technological integration, end-user industrial dynamics, and evolving maintenance strategies. On the technology front, the widespread adoption of automated and robotic welding systems is boosting the demand for compatible, high-precision torches and wear components that can endure repetitive cycles without degradation. End-use trends, particularly in the automotive, construction, and energy sectors, are increasing requirements for high-quality welds, pushing the need for torches that deliver better arc control, cooling efficiency, and consumable longevity. There's also a noticeable shift toward preventive and predictive maintenance practices, prompting companies to invest in premium wear parts that reduce unscheduled downtime. Consumer behavior within B2B procurement is evolving as well, with an emphasis on vendor reliability, lifecycle cost, and after-sales service influencing purchasing decisions. Lastly, the push for more sustainable and efficient manufacturing is leading to innovations in reusable and recyclable wear part materials, reinforcing the torch and consumables segment as a critical enabler of future-ready industrial operations.Report Scope

The report analyzes the Welding Torch and Wear Parts market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Wear Part, Torch); Category (MIG / MAG, TIG, Plasma); Cooling Method (Water Cooled, Gas Cooled); End-Use (Automotive, Construction, Demolition & Crap, Heavy Equipment Manufacturing, Oil & Gas, Yellow Goods, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wear Part segment, which is expected to reach US$5 Billion by 2030 with a CAGR of a 3.2%. The Welding Torch segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Welding Torch and Wear Parts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Welding Torch and Wear Parts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Welding Torch and Wear Parts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A&D Weighing, Adam Equipment, Avery Weigh-Tronix, Bizerba SE & Co. KG, BOSCHE GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Welding Torch and Wear Parts market report include:

- ABICOR BINZEL

- Ador Welding Ltd.

- American Torch Tip Co.

- Bernard

- Castolin Eutectic

- Colfax Corporation

- Dinse GmbH

- EWM AG

- ESAB Corporation

- Fronius International GmbH

- Harris Products Group

- Illinois Tool Works Inc. (ITW)

- Lincoln Electric Holdings, Inc.

- Migatronic A/S

- OBARA Corporation

- Panasonic Industry Co., Ltd.

- Parweld Ltd

- SKS Welding Systems

- Thermacut, Inc.

- voestalpine Böhler Welding GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABICOR BINZEL

- Ador Welding Ltd.

- American Torch Tip Co.

- Bernard

- Castolin Eutectic

- Colfax Corporation

- Dinse GmbH

- EWM AG

- ESAB Corporation

- Fronius International GmbH

- Harris Products Group

- Illinois Tool Works Inc. (ITW)

- Lincoln Electric Holdings, Inc.

- Migatronic A/S

- OBARA Corporation

- Panasonic Industry Co., Ltd.

- Parweld Ltd

- SKS Welding Systems

- Thermacut, Inc.

- voestalpine Böhler Welding GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 469 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

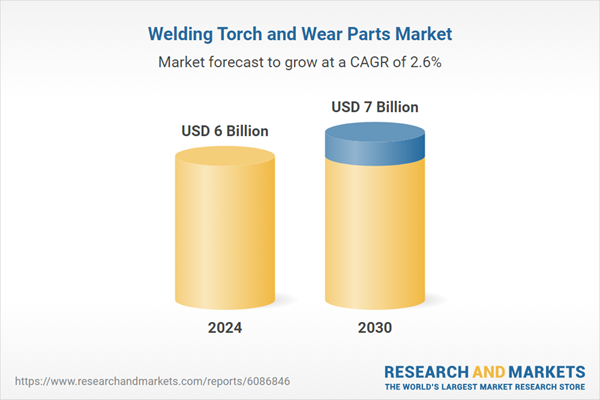

| Estimated Market Value ( USD | $ 6 Billion |

| Forecasted Market Value ( USD | $ 7 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |