Global Wind Turbine Blade Inspection Services Market - Key Trends & Drivers Summarized

Why Is There a Surge in Demand for Blade Inspections Worldwide?

As the global renewable energy sector rapidly evolves, the demand for wind energy continues to expand, positioning wind turbine blade inspection services as a critical component of wind farm operations and maintenance (O&M). Wind turbines are now being installed in increasingly remote and harsh environments - offshore, in deserts, and on mountainous terrains - which heightens the need for reliable, routine blade assessments. These inspections are essential to detect structural fatigue, cracks, lightning strikes, leading-edge erosion, and delamination, which if undetected, can significantly affect turbine efficiency and lifespan. Furthermore, most modern wind farms are designed for a 20-25 year lifecycle, requiring regular maintenance cycles to ensure performance consistency and regulatory compliance. What adds urgency to inspections is the growing trend of deploying longer, composite-material blades that, while improving efficiency, also present unique structural vulnerabilities. The emergence of high-altitude and floating offshore turbines intensifies the demand for advanced inspection methodologies that go beyond traditional manual or rope-access techniques. This has created a thriving niche for service providers offering sophisticated diagnostics such as ultrasonic testing, thermography, and drone-based high-resolution imaging. With climate goals and green transition agendas shaping national energy policies, there's an observable shift toward implementing preventive maintenance regimes rather than reactive repairs, propelling the inspection services market into a new phase of strategic importance.How Are New Technologies Reshaping the Future of Blade Inspections?

The rise of cutting-edge inspection technologies is redefining the operational efficiency and precision of wind turbine blade assessments. A major game-changer has been the widespread integration of unmanned aerial vehicles (UAVs), or drones, equipped with high-definition cameras and sensors, which significantly reduce inspection time while enhancing safety. Coupled with AI-powered analytics, these drones can detect minute defects that might elude human inspectors, classifying damage severity and predicting potential failures before they escalate. Another advancement is the use of digital twin models and machine learning algorithms that simulate real-time blade behavior under varying environmental conditions. These technologies empower operators to move from periodic inspections to condition-based monitoring (CBM), minimizing downtime and extending asset life. In addition, robotic crawlers with embedded sensors now facilitate internal inspections of blades - previously a difficult and hazardous task. The growing application of non-destructive testing (NDT) methods such as acoustic emission testing and laser shearography further reinforces the market's pivot toward precision diagnostics. These innovations not only reduce operational costs but also enhance the credibility and granularity of inspection reports - critical for asset managers, insurers, and regulators alike. As a result, there's a marked shift in stakeholder preferences toward providers who integrate these technologies into end-to-end service solutions, including data management and actionable reporting.What External Forces Are Shaping Inspection Practices and Market Behavior?

The global landscape of energy governance is increasingly influencing how wind turbine blade inspections are conducted and prioritized. Regulatory frameworks in Europe, North America, and parts of Asia-Pacific are becoming stricter, mandating frequent and standardized inspections for onshore and offshore turbines. As safety protocols evolve, so do the expectations of wind farm developers and utility companies, who now demand faster turnaround times, scalable solutions, and minimal disruption to energy output during inspections. This has pushed service providers to innovate their workflows and expand service portfolios to remain competitive. In regions such as the European Union, comprehensive documentation and traceability of blade inspections are prerequisites for subsidy approvals and insurance claims, making digital traceability tools and audit-ready reports indispensable. Furthermore, the increasing adoption of power purchase agreements (PPAs) and investor interest in long-term asset performance has led to a more risk-averse and performance-conscious customer base. Inspection services are now bundled with predictive maintenance, structural health monitoring, and lifecycle assessment modules to meet the holistic expectations of asset owners. The market is also seeing the rise of third-party inspection bodies offering independent assessments to ensure transparency and avoid conflict of interest, especially in large-scale offshore installations involving multiple stakeholders. These changing end-user dynamics, combined with geopolitical trends toward energy security and decarbonization, continue to elevate the profile of blade inspection services from an operational requirement to a strategic necessity.What Is Driving the Rapid Growth of the Blade Inspection Services Market?

The growth in the wind turbine blade inspection services market is driven by several factors rooted in technological advancements, end-use dynamics, and evolving energy strategies. A prominent driver is the surge in offshore wind developments, especially in regions with aggressive renewable energy targets such as the UK, China, and the United States. Offshore blades face extreme weather conditions, making them more susceptible to rapid wear and damage - necessitating frequent inspections using specialized technologies. Additionally, as turbine blades grow longer and more aerodynamically complex, traditional manual inspection methods are proving inefficient, driving demand for robotics, drones, and AI-integrated platforms. Condition-based maintenance models are being widely adopted across both legacy and newly installed wind farms, leading to a surge in continuous monitoring systems that rely on advanced sensor data and predictive algorithms. The aging fleet of wind turbines across Europe and North America is also prompting asset owners to invest in rigorous inspection cycles to support lifetime extension initiatives. On the operational front, digitization trends have made remote, automated inspections more viable, reducing dependence on large field crews and improving scalability. Consumer behavior is also playing a role, with energy buyers and utility customers demanding transparent, green-certified power generation - which places additional scrutiny on the operational reliability of wind farms. Lastly, insurers and financial backers are increasingly tying premium costs and investment decisions to the quality and frequency of structural inspections, further embedding these services into the financial viability of wind energy projects.Report Scope

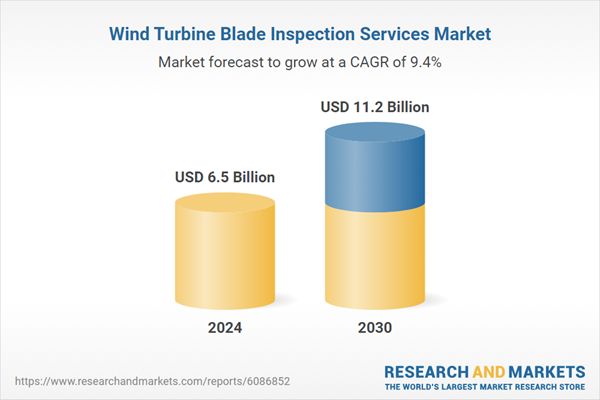

The report analyzes the Wind Turbine Blade Inspection Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Location (On-Shore, Off-Shore); Services (Quality Assurance & Quality Control, Nondestructive Examination, Condition Assessment / Inspection, Process Safety Management, Welding & Corrosion Engineering).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the On-Shore Location segment, which is expected to reach US$6.5 Billion by 2030 with a CAGR of a 7.8%. The Off-Shore Location segment is also set to grow at 12% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Wind Turbine Blade Inspection Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Wind Turbine Blade Inspection Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Wind Turbine Blade Inspection Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acciona Energía, BHEL (Bharat Heavy Electricals Ltd.), Doosan Enerbility, Envision Energy, Enercon GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Wind Turbine Blade Inspection Services market report include:

- Abj Drones

- Aerones Engineering

- AIRPIX

- Altus Wind d.o.o.

- AnyWind

- Applus+ Servicios Tecnologicos, S.L

- Aries Marine and Engineering Services

- BHI Energy

- Blade Wind Services

- Bladestar Renewables Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abj Drones

- Aerones Engineering

- AIRPIX

- Altus Wind d.o.o.

- AnyWind

- Applus+ Servicios Tecnologicos, S.L

- Aries Marine and Engineering Services

- BHI Energy

- Blade Wind Services

- Bladestar Renewables Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 11.2 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |