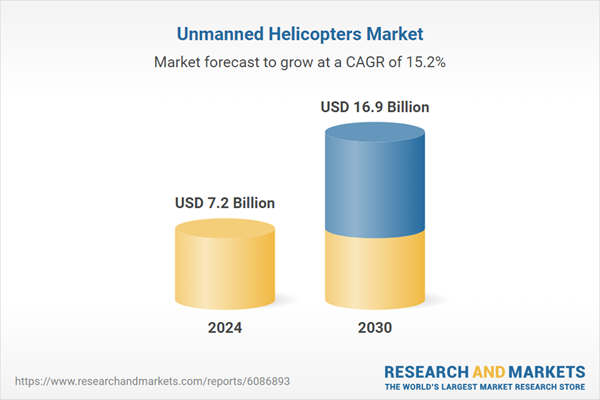

Global Unmanned Helicopters Market - Key Trends & Drivers Summarized

Why Are Unmanned Helicopters Becoming Central to Next-Gen Aerial Systems?

The adoption of unmanned helicopters, also known as rotary-wing UAVs, is reshaping various industries - from defense to logistics and beyond - offering a new dimension of operational flexibility. Unlike fixed-wing drones, unmanned helicopters possess vertical takeoff and landing (VTOL) capabilities, allowing them to operate in constrained spaces such as urban environments, mountainous terrains, and naval vessels. This makes them particularly valuable in military reconnaissance, disaster response, medical delivery, and inspection of infrastructure like power lines and oil rigs. Their ability to hover, maneuver precisely, and maintain steady altitude makes them irreplaceable for tasks that demand a stationary presence or access to hard-to-reach places. Additionally, the transition from traditional piloted systems to autonomous or remotely piloted rotorcraft significantly reduces human risk and operational costs. With increasing regulatory frameworks now being developed across North America, Europe, and Asia-Pacific, the barrier to commercial adoption is gradually lowering, paving the way for exponential market penetration.How Is Technology Transforming Capabilities in the Unmanned Helicopter Space?

Technological advances are rapidly enhancing the performance of unmanned helicopters across multiple fronts. Innovations in lightweight composite materials have enabled manufacturers to extend flight duration while maintaining payload efficiency. Onboard navigation has become more sophisticated with real-time GPS/GLONASS integration, while advanced obstacle avoidance systems now use LiDAR and AI-based visual computing to enable precision movement even in cluttered or dynamic environments. Communication systems have shifted from basic line-of-sight radio controls to advanced satellite and 5G-based networks, allowing for beyond-visual-line-of-sight (BVLOS) operations with low latency and high reliability. Moreover, dual-use sensors capable of both daytime and night-time imaging, along with thermal and multispectral capabilities, have turned these vehicles into indispensable tools for search and rescue missions, border surveillance, and agricultural diagnostics. Autonomy has reached new heights with deep-learning algorithms powering dynamic path planning and real-time decision-making, reducing the burden on human operators and increasing mission success rates.What Applications Are Fueling the Demand Across Industries?

Diverse sectors are increasingly adopting unmanned helicopters due to their unique ability to combine mobility with high-precision operations. In the defense and homeland security space, rotary UAVs are being used for ISR (Intelligence, Surveillance, and Reconnaissance), target designation, and logistics resupply missions in hostile environments. Emergency services are leveraging them for rapid medical delivery in disaster-stricken zones or hard-to-reach rural areas. The energy sector employs these helicopters for asset inspection on offshore platforms, high-voltage transmission lines, and pipelines, where manual inspections are risky or logistically complex. In agriculture, their use in crop health monitoring, pesticide spraying, and yield estimation is gaining momentum. Urban planners and infrastructure developers also use UAVs to survey sites, create 3D models, and monitor construction in real time. Logistics providers have started pilot projects using unmanned helicopters for last-mile delivery, particularly in geographically challenging areas. As industries seek solutions that offer both aerial mobility and operational precision, the application landscape for unmanned helicopters continues to diversify rapidly.What Is Driving the Surge in Market Growth for Unmanned Helicopters?

The growth in the unmanned helicopters market is driven by several factors rooted in advancements in technology, evolving end-user needs, and strategic regulatory shifts. The increasing demand for VTOL-capable drones in urban and industrial zones, especially where fixed-wing UAVs fall short, is a key catalyst. Military modernization programs across countries such as the U.S., China, and India are actively investing in autonomous systems that offer tactical agility and lower operational footprints, boosting defense sector demand. In commercial sectors, the growing need for precision monitoring, time-critical logistics, and cost-effective surveillance is pushing enterprises to integrate rotary UAVs into their workflows. Simultaneously, improvements in lithium-silicon battery chemistry and hybrid propulsion systems are enabling longer flight times, expanding viable mission profiles. The rise of smart cities and automated infrastructure management is also encouraging adoption. Furthermore, regulatory bodies like the FAA and EASA are accelerating certification paths for beyond-line-of-sight operations, opening new commercial channels. As the convergence of hardware, software, and use-case readiness continues, the market is poised for robust, multi-sectoral expansion.Report Scope

The report analyzes the Unmanned Helicopters market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Below 20 lbs, 21 - 55 lbs); Application (Military, Government Agency, Industrial, Other Applications); End-Use (Defense Agencies, Law Enforcement, Emergency Services).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below 20 lbs Helicopters segment, which is expected to reach US$10.5 Billion by 2030 with a CAGR of a 13.8%. The 21 - 55 lbs Helicopters segment is also set to grow at 17.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 14.4% CAGR to reach $2.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Unmanned Helicopters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Unmanned Helicopters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Unmanned Helicopters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AIA Group, Allianz SE, Aviva plc, AXA, China Life Insurance Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Unmanned Helicopters market report include:

- Aeroscout GmbH

- Airbus SE

- Alpha Unmanned Systems SL

- Ascent AeroSystems

- Boeing Company

- CybAero AB

- Elbit Systems Ltd.

- Kaman Air Vehicles

- Laflamme Aero Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters

- Northrop Grumman Corporation

- Robot Aviation

- Rotor Technologies

- Schiebel Corporation

- Steadicopter Ltd.

- SwissDrones Operating AG

- UAVOS Inc.

- Velos Rotors Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aeroscout GmbH

- Airbus SE

- Alpha Unmanned Systems SL

- Ascent AeroSystems

- Boeing Company

- CybAero AB

- Elbit Systems Ltd.

- Kaman Air Vehicles

- Laflamme Aero Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters

- Northrop Grumman Corporation

- Robot Aviation

- Rotor Technologies

- Schiebel Corporation

- Steadicopter Ltd.

- SwissDrones Operating AG

- UAVOS Inc.

- Velos Rotors Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 16.9 Billion |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |