Global Thin Film Chip Resistors Market - Key Trends & Drivers Summarized

Why Are Thin Film Chip Resistors Gaining Prominence in High-Precision Electronics?

Thin film chip resistors are engineered for high-precision applications where stability, low noise, and tight tolerance are paramount. These resistors use a thin layer of resistive material - typically nichrome (nickel-chromium alloy) - deposited on a ceramic substrate through advanced sputtering or photolithographic techniques. This construction provides exceptional accuracy, often with resistance tolerances as tight as ±0.01%, and temperature coefficients as low as ±1 ppm/°C. Their superior electrical performance and thermal stability make them ideal for precision analog circuits, measurement instrumentation, medical electronics, and aerospace systems, where performance fluctuations can lead to costly errors or system failures.The robustness of thin film resistors also lies in their ability to maintain performance across wide temperature ranges and under varying environmental conditions. Compared to thick film resistors, which are more economical but less precise, thin film variants exhibit lower noise levels and better long-term stability. These advantages are crucial in environments where signal integrity, miniaturization, and reliability are essential. Their compact surface-mount packaging, compatibility with automated assembly processes, and high-frequency characteristics make them a staple component in high-end circuit designs and growing applications involving RF and microwave communications.

How Are Emerging Applications and Miniaturization Needs Influencing Demand?

The demand for thin film chip resistors is closely tied to the broader trend of miniaturization and integration in electronics. As devices become smaller and more complex, there is an escalating need for components that deliver high performance without consuming much board space. Thin film resistors, with their ability to achieve high resistance values and stability in small footprints, are ideal for modern PCBs used in smartphones, wearables, tablets, and other compact consumer electronics. The push towards multi-functional, IoT-enabled devices has expanded the need for reliable passive components that can operate across varying power densities and frequency ranges.Beyond consumer electronics, thin film resistors are also being increasingly adopted in automotive electronics, particularly in electric and autonomous vehicle platforms. These systems require a dense network of sensors, control units, and power modules, all demanding precise signal conditioning and thermal management - functions well served by thin film technology. Similarly, industrial automation systems and smart energy grids are leveraging high-precision resistors to enhance feedback loops, safety mechanisms, and sensor calibration. The medical device sector also offers growth potential, especially in wearable health monitors and implantable devices, where tight tolerances and consistent performance are vital to patient safety and accurate diagnostics.

What Technological Innovations Are Refining Thin Film Chip Resistor Performance?

The evolution of thin film chip resistors has been greatly influenced by material innovation and advances in deposition technologies. Manufacturers are experimenting with exotic metal alloys and nanomaterials to achieve even lower thermal drift, improved resistance uniformity, and enhanced long-term reliability. Simultaneously, improved vacuum deposition techniques, such as ion beam sputtering and atomic layer deposition, are enabling ultra-thin films with consistent microstructure and adhesion. These developments have helped push resistance accuracy to new levels and reduce manufacturing variability, making the devices suitable for mission-critical aerospace and defense electronics.Design and simulation tools have also played a pivotal role in optimizing chip resistor layouts for better performance under electrical stress, especially in applications involving high current densities or elevated voltages. High-frequency circuit designers, for example, benefit from the low parasitic inductance and capacitance of modern thin film resistors, which maintain signal fidelity at GHz frequencies. In addition, advanced packaging solutions, such as flip-chip and wafer-level chip-scale packaging (WLCSP), have allowed for greater integration flexibility, especially in space-constrained environments like wearable and implantable devices. With smart manufacturing and Industry 4.0 principles gaining ground, production quality control and traceability of thin film resistors have also improved, contributing to consistent device performance at scale.

The Growth in the Thin Film Chip Resistors Market Is Driven by Several Factors…

The growth in the thin film chip resistors market is driven by several factors tied directly to technology advancements, changing end-use dynamics, and the increasing complexity of electronics. A major driver is the accelerating adoption of high-end consumer electronics and industrial automation systems, where compact, low-noise, and stable resistors are essential. The shift to 5G and high-frequency communication infrastructure has created demand for resistors with superior high-frequency response and minimal parasitic effects. Similarly, advancements in sensor technology - especially in smart meters, precision medical instruments, and aerospace navigation systems - are reinforcing the need for resistors with high linearity and long-term reliability.Electric and autonomous vehicles have emerged as significant end-users, as electronic control units (ECUs), battery management systems (BMS), and advanced driver-assistance systems (ADAS) require thermal stability and signal precision that only thin film resistors can provide. The growing demand for hybrid and digital healthcare equipment - particularly in the wake of telemedicine and home diagnostic tools - has further underscored the value of high-reliability passive components. In parallel, the semiconductor industry's move toward more densely packed and thermally challenging IC environments is pushing designers to prefer components that can maintain performance under stress, driving thin film adoption. Additionally, defense and aerospace applications are contributing to market expansion due to stringent performance and reliability requirements, where only the tightest-tolerance resistors are qualified.

Report Scope

The report analyzes the Thin Film Chip Resistors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (0.05% Tolerance, 0.1% Tolerance, 1% Tolerance, Other Types); Application (Instrumentation, Medical Instruments, Power Supply, Electric Power Equipment, Electronic Digital Products, Other Applications); End-Use (Industrial Equipment, Consumer Electronics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 0.05% Tolerance Resistors segment, which is expected to reach US$352.6 Million by 2030 with a CAGR of a 2.8%. The 0.1% Tolerance Resistors segment is also set to grow at 2.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $201.2 Million in 2024, and China, forecasted to grow at an impressive 6% CAGR to reach $176.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Thin Film Chip Resistors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Thin Film Chip Resistors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Thin Film Chip Resistors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALVC Factory, Boyd Corporation, Celsia Inc., EagleBurgmann, Huhnseal AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Thin Film Chip Resistors market report include:

- ASJ Pte Ltd.

- Bourns, Inc.

- Cal-Chip Electronics, Inc.

- Caddock Electronics, Inc.

- Elektronische Bauelemente GmbH (EBG)

- Ever Ohms Technology Co., Ltd.

- International Manufacturing Services, Inc.

- KOA Speer Electronics, Inc.

- Micro-Ohm Corporation

- Mini-Systems, Inc.

- Ohmite Manufacturing Co.

- Panasonic Corporation

- Ralec Electronics Corporation

- Rohm Co., Ltd.

- Samsung Electro-Mechanics

- Susumu Co., Ltd.

- Ta-I Technology Co., Ltd.

- Tateyama Kagaku Industry Co., Ltd.

- TE Connectivity Ltd.

- Uniohm Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ASJ Pte Ltd.

- Bourns, Inc.

- Cal-Chip Electronics, Inc.

- Caddock Electronics, Inc.

- Elektronische Bauelemente GmbH (EBG)

- Ever Ohms Technology Co., Ltd.

- International Manufacturing Services, Inc.

- KOA Speer Electronics, Inc.

- Micro-Ohm Corporation

- Mini-Systems, Inc.

- Ohmite Manufacturing Co.

- Panasonic Corporation

- Ralec Electronics Corporation

- Rohm Co., Ltd.

- Samsung Electro-Mechanics

- Susumu Co., Ltd.

- Ta-I Technology Co., Ltd.

- Tateyama Kagaku Industry Co., Ltd.

- TE Connectivity Ltd.

- Uniohm Corporation

Table Information

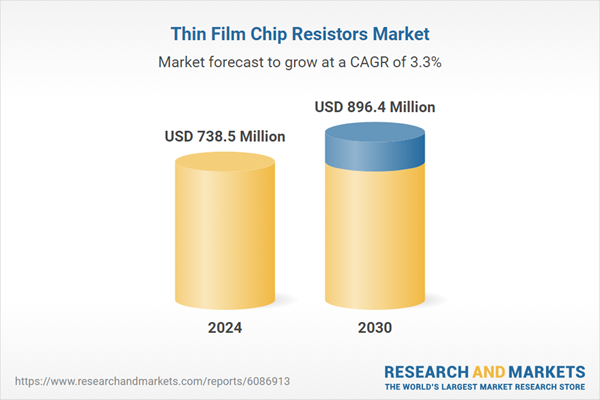

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 738.5 Million |

| Forecasted Market Value ( USD | $ 896.4 Million |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |