Global Flexfuel Market - Key Trends & Drivers Summarized

Why Is Flexfuel Technology Garnering Renewed Global Attention?

Flexfuel technology, which enables internal combustion engines to run on more than one type of fuel - typically gasoline blended with varying concentrations of ethanol - is gaining significant traction as the world searches for cleaner, more sustainable transportation alternatives. Unlike conventional gasoline engines, flexfuel systems offer adaptability, allowing consumers to use E10, E15, E85, or pure ethanol depending on availability and regional policy. With mounting pressure to reduce greenhouse gas emissions and fossil fuel dependence, many governments are promoting flexfuel vehicles (FFVs) as a pragmatic interim solution that complements electric mobility and broader decarbonization goals. Ethanol, particularly when derived from renewable sources like sugarcane or corn, burns cleaner than gasoline and can significantly lower tailpipe CO2 emissions. Countries such as Brazil, the United States, and India are leading advocates of ethanol blending mandates, offering policy incentives and infrastructure support to expand flexfuel adoption. Consumers also benefit from cost savings when ethanol prices are lower than gasoline, and the technology's compatibility with existing engine platforms minimizes barriers to adoption. As climate goals intensify, flexfuel is emerging as a vital bridge technology capable of reducing emissions without requiring a complete overhaul of current vehicle fleets and refueling infrastructure.How Are Regional Policies and Feedstock Economics Reshaping the Landscape?

Government mandates and feedstock availability are two of the most powerful levers shaping the global flexfuel market. In Brazil, flexfuel vehicles dominate the passenger car segment, driven by a well-established ethanol production industry based on sugarcane. The country's long-term ethanol strategy, supported by tax benefits and robust blending mandates, has created a mature market where consumers readily switch between fuels based on price. In the U.S., the Renewable Fuel Standard (RFS) has played a pivotal role in supporting corn-based ethanol, resulting in a widespread network of E85-compatible vehicles and fueling stations. India is also aggressively pursuing its ethanol blending program, aiming to reach 20% blending (E20) in the near future, backed by policy support and investment in second-generation biofuel technologies. In contrast, adoption in Europe remains limited due to lower ethanol blending targets, feedstock constraints, and a stronger policy tilt toward electrification. Nonetheless, rising energy security concerns and inflationary fuel prices are pushing many nations to reconsider ethanol as a locally sourced, low-carbon alternative. The economics of ethanol feedstock - whether corn, sugarcane, or cellulosic biomass - also play a crucial role, with fluctuations in agricultural yields, climate conditions, and commodity prices directly influencing the feasibility and competitiveness of flexfuel programs across regions.Which Automotive Segments and Markets Are Emerging as High-Potential Zones?

Flexfuel vehicles are seeing renewed momentum in both developed and emerging markets, with distinct adoption trends across passenger, commercial, and agricultural vehicle segments. In North America, FFVs have long been integrated into passenger vehicle fleets, though consumer awareness and refueling infrastructure have lagged behind vehicle availability. Automakers such as Ford, GM, and Chrysler have developed numerous models compatible with E85, particularly in pickup trucks and SUVs. Brazil, the world's largest flexfuel vehicle market, continues to expand flex-capable production, with nearly every major automaker offering flex variants as standard. India, currently a fast-rising player, is pushing automakers to launch E20-compliant models as part of its green mobility vision. Flexfuel technology is also gaining ground in agricultural machinery and small commercial vehicles, where diesel alternatives are limited and rural ethanol availability makes FFVs more practical. Markets in Southeast Asia, Africa, and parts of Latin America are also exploring flexfuel options as part of national energy diversification strategies. Additionally, increased interest in sustainable aviation fuels and marine biofuels is prompting innovation in flexfuel engine designs beyond road vehicles, indicating future cross-sectoral growth potential. These shifts underscore the flexibility and scalability of the technology in addressing energy security and carbon neutrality goals across different transport modes and geographies.What Are the Critical Drivers Fueling Market Growth Across the Ecosystem?

The growth in the flexfuel market is driven by several factors deeply embedded in energy policy evolution, consumer economics, and automotive engineering trends. Firstly, global ethanol blending mandates and emission reduction targets are pushing vehicle manufacturers and fuel suppliers to align with flexfuel capabilities as a compliance strategy. Secondly, the relatively low cost of modifying existing internal combustion engines to accept ethanol blends has made flexfuel a cost-effective decarbonization option, particularly in regions where EV adoption remains nascent. Thirdly, ethanol's domestic production potential offers an important strategic advantage for countries aiming to reduce fuel import bills and increase energy independence - making it an attractive policy tool in both emerging and mature economies. Fourth, growing volatility in fossil fuel markets is prompting consumers and fleet operators to seek more stable, locally produced fuel alternatives, with flexfuel offering greater flexibility and resilience. Moreover, automotive OEMs are leveraging flexfuel platforms to extend the viability of ICE technology in a tightening regulatory landscape, especially in markets where charging infrastructure remains a constraint for electric vehicles. Advances in second- and third-generation biofuels, including cellulosic ethanol and algae-based fuels, are also expanding the sustainability profile and long-term viability of the flexfuel ecosystem. Finally, enhanced consumer outreach, increased labeling transparency at fueling stations, and targeted government subsidies for ethanol-compatible vehicles are further accelerating adoption, making flexfuel a critical component in the global transition to low-emission mobility.Report Scope

The report analyzes the Flexfuel market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Blend (E10, E15, E70, E75, E85, ED95, E100); Application (Light Commercial Vehicles, Heavy Commercial Vehicles, Passenger Cars, Other Applications); Feedstock Source (Corn, Sugarcane, Cassava, Molasses, Wheat, Sorghum, Other Feedstock Sources); Fuel Type (Gasoline, Diesel, Methanol, Ethanol, Butanol, Bioethers).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the E10 Blend segment, which is expected to reach US$5.3 Billion by 2030 with a CAGR of a 12.5%. The E15 Blend segment is also set to grow at 8.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.4 Billion in 2024, and China, forecasted to grow at an impressive 9.8% CAGR to reach $2.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flexfuel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flexfuel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flexfuel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Ansell Limited, Ariat International, Bulwark FR, Carhartt Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Flexfuel market report include:

- Audi AG

- BAIC Motor Corporation

- BMW Group

- Changan Automobile

- Daimler AG

- Fiat Chrysler Automobiles

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Nissan Motor Co., Ltd.

- PSA Group

- Renault SA

- Stellantis N.V.

- Subaru Corporation

- Suzuki Motor Corporation

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Cars

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Audi AG

- BAIC Motor Corporation

- BMW Group

- Changan Automobile

- Daimler AG

- Fiat Chrysler Automobiles

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Nissan Motor Co., Ltd.

- PSA Group

- Renault SA

- Stellantis N.V.

- Subaru Corporation

- Suzuki Motor Corporation

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Cars

Table Information

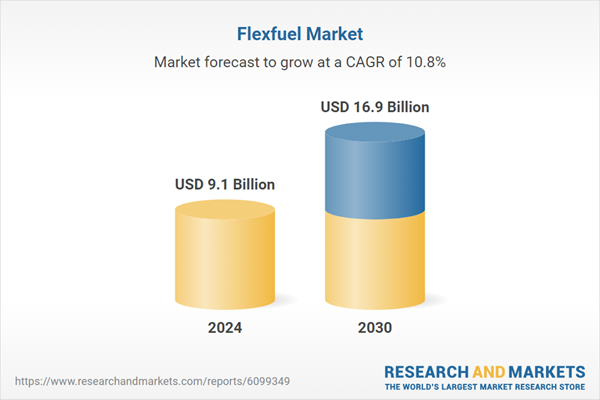

| Report Attribute | Details |

|---|---|

| No. of Pages | 315 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 16.9 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |